- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Complex Trust Return / Allocation of Long-Term Gain

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Complex Trust Return / Allocation of Long-Term Gain

I am using TurboTax Business 2020 for a return on a Complex Trust. This trust has one Brokerage Account which has a portfolio of mutual funds and stocks. The FI has issued a Form 1099-DIV which reported Dividends and Capital Gains Distributions (using Boxes 1a, 1b, 2a and 5).

The Trust had no distributions to the beneficiary, all dividends & CG's were retained in the account. As I step through the TT interview / questions, I have entered the data for the correct boxes. Then the next step is "allocation of capital gains" see screenshot:

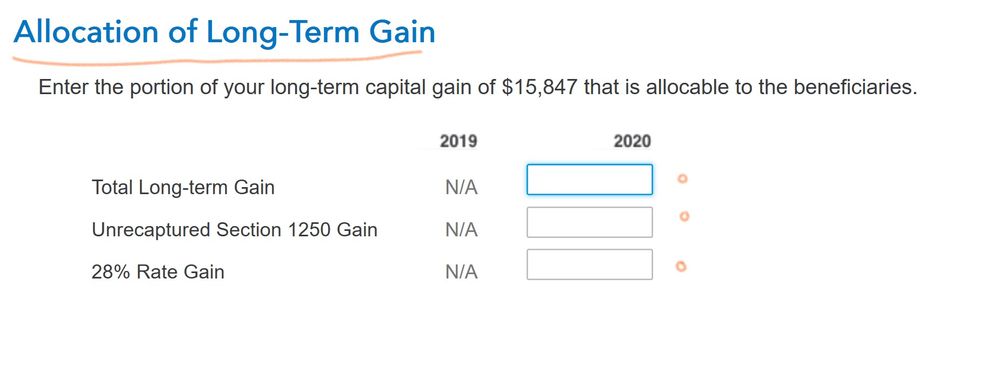

So when I Update this section, I get the following screen to enter the portion of long term CG that is allocable to the beneficiaries as follows:

So I am a bit confused here about the terminology -- if there is no distributions do I enter $0? or do I enter the full value in the first box for the Total Long-Term Gain? Would appreciate any feedback or explanation, have tried to search various blogs and IRS publications on topic, but the wording seems to be unique to TT.

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Complex Trust Return / Allocation of Long-Term Gain

@TaxesConfuseMe2 wrote:

...if there is no distributions do I enter $0?

That is essentially correct; if there are no distributions of capital gains you would leave those fields blank.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

taxbattler

Level 2

OnTheOpenRoad

Returning Member

rkliever

Level 1

jjreynol

Returning Member

Mikey_D

Returning Member