- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Complex Trust Return / Allocation of Long-Term Gain

I am using TurboTax Business 2020 for a return on a Complex Trust. This trust has one Brokerage Account which has a portfolio of mutual funds and stocks. The FI has issued a Form 1099-DIV which reported Dividends and Capital Gains Distributions (using Boxes 1a, 1b, 2a and 5).

The Trust had no distributions to the beneficiary, all dividends & CG's were retained in the account. As I step through the TT interview / questions, I have entered the data for the correct boxes. Then the next step is "allocation of capital gains" see screenshot:

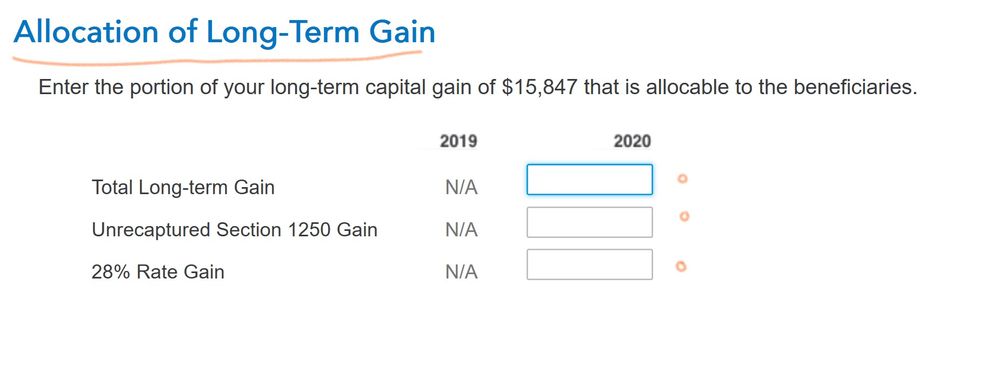

So when I Update this section, I get the following screen to enter the portion of long term CG that is allocable to the beneficiaries as follows:

So I am a bit confused here about the terminology -- if there is no distributions do I enter $0? or do I enter the full value in the first box for the Total Long-Term Gain? Would appreciate any feedback or explanation, have tried to search various blogs and IRS publications on topic, but the wording seems to be unique to TT.

Thanks!