- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Check this entry

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check this entry

I keep getting an error that I need to enter State Tax Refund Worksheet: tIme B must be entered. I don't know where to find this and whether it's for this year or last year or what. Help!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check this entry

Which state are you filing in?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check this entry

Wisconsin

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check this entry

Post a screenprint of the error or a diagnostic token

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check this entry

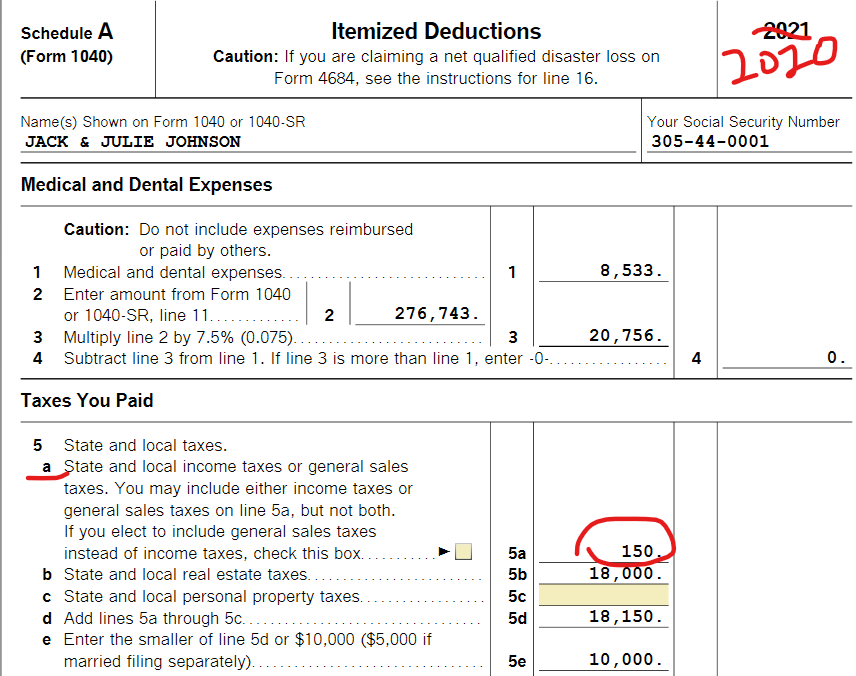

Did you enter your WI state refund or go through that section yet? TurboTax is asking for the amount from your 2020 Schedule A, line 5a. If you receive a tax benefit from your state refund, it may be taxable. Go through the state refund section again and you will be able to provide the necessary info to clear the error.

Report last year’s state or local tax refund, and we’ll figure out if it’s taxable or not.

If all three of the following are true, your refund counts as taxable income:

- You itemized deductions last year, instead of taking the standard deduction

- You claimed state and local income taxes (not general sales taxes)

- Claiming the deduction helped you increase your federal refund or lower your tax bill

Even when your refund is taxable, it may not be the entire amount. It depends on how much the deduction affected your refund or tax bill. Just answer a few simple questions about last year’s refund, and we’ll calculate the taxable amount for you. This is what is causing your error - TurboTax doesn't have all of this information, yet....Even if you did not get a 1099-G last year (because you itemized), use the link below to go through that section.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check this entry

I have gone through the state section again and it doesn't look like anything is missing. And I don't have a Schedule A line 5a. I don't have a line 5a anywhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check this entry

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check this entry

If you took itemized deductions on your 2020 tax return, Schedule A is filed with your 2020 Form 1040.

You need to locate your Schedule A form in your federal return.

@Jstrangfeld23

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check this entry

I don't have a 5a. Which line am I supposed to use?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check this entry

If you didn't have a Schedule A in your 2020 Federal Return, you probably chose the Standard Deduction. You can verify this by looking at Line 12a on Form 1040 in your 2020 Federal tax return.

Just enter the amount of your State Tax Refund in your 2021 Federal return. It will not be taxable.

Click this link for steps on How to Enter 1099-G for State Tax Refund.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check this entry

Now it is asking me to enter Item Q on my State Tax Refund Worksheet? Wisconsin has numbers not letters. Please help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Check this entry

What does the screen say Line Q is? I cannot seem to recreate the screen you are seeing.

@jstrangeld23

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

deven92991

New Member

Randy15

Level 3

Obrian1221

New Member

davidmcbrayer18

New Member

moses0020

Level 2