- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Capital Gains Tax Rate on sale of home for low income household 2022?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Tax Rate on sale of home for low income household 2022?

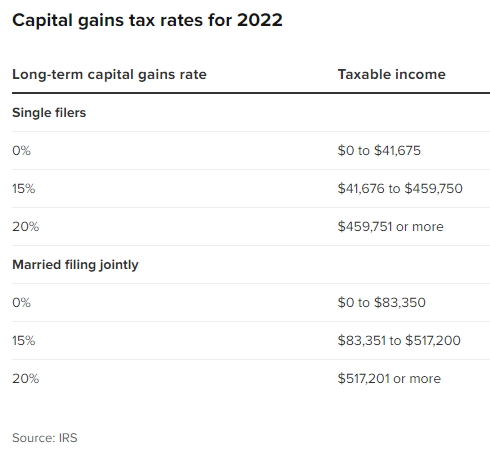

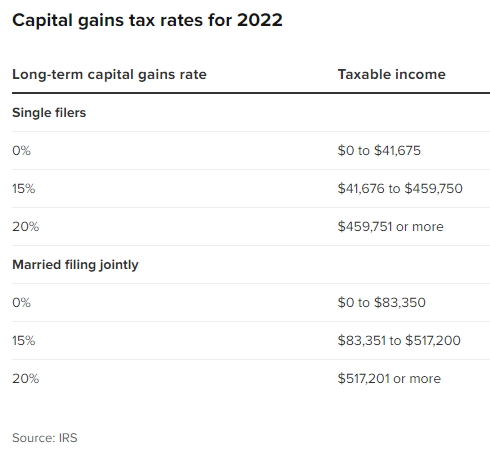

It shows a 0% capital gains rate for people with income below $41k. Parent is on Social Security and a tiny pension, way less than 41K, yet shows taxes owed on sale of home?

Any tips?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Tax Rate on sale of home for low income household 2022?

You are correct. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $41,675 for single and married filing separately, $83,350 for married filing jointly or qualifying surviving spouse or $55,800 for head of household.

Use this link for additional information about rate of capital gains. Capital Gains Tax Rate

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Tax Rate on sale of home for low income household 2022?

You may qualify to exclude your gain on the sale of a personal residence.

If you have a capital gain from the sale of your main home, you may qualify to exclude up to $250,000 of that gain from your income, or up to $500,000 of that gain if you file a joint return with your spouse. Publication 523, Selling Your Home provides rules and worksheets.

You're eligible for the exclusion if you have owned and used your home as your main home for a period aggregating at least two years out of the five years prior to its date of sale. You can meet the ownership and use tests during different 2-year periods. However, you must meet both tests during the 5-year period ending on the date of the sale. Generally, you're not eligible for the exclusion if you excluded the gain from the sale of another home during the two-year period prior to the sale of your home.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Tax Rate on sale of home for low income household 2022?

Yes, the home qualifies for the $250k exclusion, but that leaves 200k as a taxable Capital Gain? I guess I mis-read some tables. I thought if your income was less that 41k, you paid zero capital gains.

I think on re-reading, the tax is zero for the first 0 to 41k in capital gains, then 15% on higher amounts, maxing out at 20%.

Does that sound correct?

Oh, and thank you for the reply!

GL

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Tax Rate on sale of home for low income household 2022?

you didn't mention the amount of the gain

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Tax Rate on sale of home for low income household 2022?

@glark1 wrote:

I think on re-reading, the tax is zero for the first 0 to 41k in capital gains, then 15% on higher amounts, maxing out at 20%.

Does that sound correct?

That's almost correct. The range of taxable income up to $41,675 applies to total taxable income, not just the capital gain. That includes the taxable portion of Social Security, the pension, and the taxable portion of the gain on the sale of the home. The pension and Social Security use up part or all of the 0% bracket, so most or all of the capital gain will be taxed at 15%. If your parent's AGI is over $200,000 he or she may also have to pay some Net Investment Income Tax in addition to the regular income tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Tax Rate on sale of home for low income household 2022?

You are correct. Some or all net capital gain may be taxed at 0% if your taxable income is less than or equal to $41,675 for single and married filing separately, $83,350 for married filing jointly or qualifying surviving spouse or $55,800 for head of household.

Use this link for additional information about rate of capital gains. Capital Gains Tax Rate

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Tax Rate on sale of home for low income household 2022?

Thank you to all who took the time to answer! I can't believe I misread that chart last year. Sheesh.

Looks like I have some work to do to find all the improvements since the home was purchased to help raise the cost basis and lower the tax hit. Dang!

Again, my sincere thanks to all of you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Capital Gains Tax Rate on sale of home for low income household 2022?

Thank you. Note sure how this thread handles replies, so this is what I posted on the final entry:

<<Thank you to all who took the time to answer! I can't believe I misread that chart last year. Sheesh.

Looks like I have some work to do to find all the improvements since the home was purchased to help raise the cost basis and lower the tax hit. Dang!

Again, my sincere thanks to all of you.>>

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

oreillyjames1

New Member

Cindy10

Level 1

cm-jagow

New Member

dpa500

Level 2

RicN

Level 2