- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Can I remove miscellaneous income after entering?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove miscellaneous income after entering?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove miscellaneous income after entering?

Yes, you can.

To remove this income in TurboTax Online:

- If you don’t see 2022 TAXES in the left pane, select the dropdown to the right of Income & Expenses on the Hi, let’s keep working on your taxes! page and then select Let’s get started, Pick up where you left off, or Review/Edit.

- Otherwise, in the left pane, select Wages & Income

- Scroll down and select the Show more dropdown to the right of Less Common Income

- Select Edit, Edit/Add or Revisit to the right of Miscellaneous Income, 1099-A, 1099-C

- Select Edit, Edit/Add or Revisit to the right of Other income not already reported on a Form W-2 or Form 1099

From here, you can edit or remove any information necessary.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove miscellaneous income after entering?

Hi, I am having this same problem, but I am on the desktop version of turbo tax, not online version. I can not seem to get this "miscellaneous income not reported on a W2 or 1099" removed. I do not know if I entered this in the right place.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove miscellaneous income after entering?

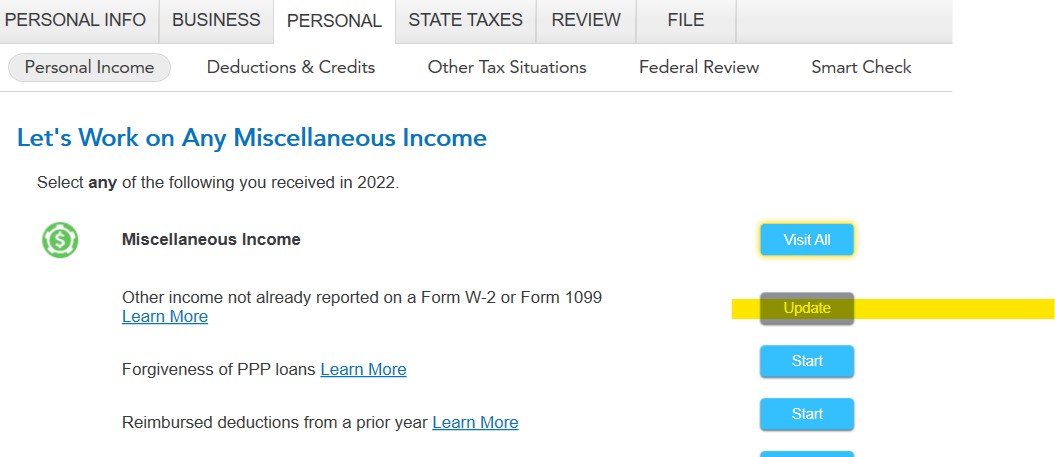

In the desktop software, click on Federal - Personal Income. Scroll down to the bottom of the page to Less Common Income, then click Update next to Miscellaneous Income, 1099-A or 1099-C.

The first item in that section is Other income not already reported on a W-2 or Form 1099. Click Update there and you can remove any amounts you previously entered. If you are asking about something else, please let us know. @clareb

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove miscellaneous income after entering?

Thanks-- I have been going back through the update button, but I still can not get it to take out the $1200 I had entered. [It just keeps going through the same string of questions--any other earned income-yes-enter source- employee comp not on W2- then lots of blank boxes to reenter the wage income]

I should also back up and explain what I am trying to do...

This is for my daughter, a full time college student. She received $1200 for an internship she did during the semester as a sort of work study grant. She actually got a 1099-MISC for this, with no tax withheld. When I entered it under 1099-MISC, it seemed to think this was her business, which did not seem right.

Last year, I had requested help on this, and I entered it under some "other income" section, but there seem to be a few options for this. [Under "Miscellaneous Income", there is one section called "other income not reported on a W2 or 1099" and another section called "other reportable income"]

Since her total income for the year was $9385, I think she should not owe any taxes on her earnings. But wherever I seem to enter this other income, it gets taxed. Any hints on where I should enter this extra income?

Hope this makes sense, and thank you for any advice.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove miscellaneous income after entering?

Likely, your entry as income not reported on a W2 went to a form 8919. So the first step is to find/delete the current entry and then you will add the income in the "Other Common Income" topic.

1. Go to "Forms Mode" (top right quadrant of your screen)

2. Find a form 8919 in the list of forms on the left hand side

3. Select it

4. Delete form at the bottom of your screen.

5. Go back to "Step-by-step" (top right quadrant of your screen)

6. "Wages and Income"

7. "I'll choose what I work on"

8. Scroll to the 1099-Misc and Other Common Income section and "Update" the 1099-Misc topic

9. "Yes" or "add another 1099" and enter your form information

10. Student work study

11. None of these apply

12. No it didn't involve work like my main job

13. I got it in 2022

14. It didn't involve intent to earn money. (it was financial aid for education)

This will put the income on schedule 1, line 8. According to the IRS here, payment for services to access grant money are taxable and if not reported on a form W2 then it needs to go to schedule 1, line 8.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove miscellaneous income after entering?

Great! Thank you so much-- I was able to remove the 8919 form.

I do have a follow up question, though. I entered the 1099-MISC in the area you suggested, and it did take out taxes on those earnings. But I am still thinking since her total income is still low enough, that she shouldn't have to pay taxes on it at all.

Also, I saw a box on the Schedule 1 Line 8r that seemed to be specifically for scholarship or grants not reported on a W2. That seems to be an accurate category. But I'm not sure how to find that back in the step-by-step part of turbo tax to see if I could have it entered in the form there... And if that would make a difference in whether tax is taken out or not.

Again, thanks for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove miscellaneous income after entering?

Scholarships income is reported under Education expenses.

- Click on Federal

- Click on Deductions & Credits.

- Scroll down to Education. Click Show more.

- Select Start / Revisit to the right of Expenses and Scholarships.

- Under Your Education Expenses Summary, click Edit/Add.

- You may have to cycle through several questions about the student, the school and the student's IRS form 1098-T.

- You will arrive at the screen Scholarships and Financial aid. Click Continue.

- At the screen Did you Receive a Scholarship or Grant in 2022?, select Yes.

- There will be several other questions about your educational expenses.

The entry will be reported:

- on line 8r of Schedule 1 of the Federal 1040 tax return, and

- on line 8 of the Federal 1040 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can I remove miscellaneous income after entering?

Thank you for your answer-- I did try that, but thought we better check with her college, and they said we are not allowed to count it as a scholarship. So I went back and entered it again under "other income". That seemed to work the best.

Again, thank you for the help!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

johanna-jauernig

New Member

kellymurphy88

New Member

elin-TLCpm

New Member

WyomingClimber

Level 1

livingst

New Member