- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Business & Personal Tax (K1 & Franchise Tax)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & Personal Tax (K1 & Franchise Tax)

Good afternoon,

I have a couple of questions :

1- I just filed my LLC and Texas Franchise Tax forms and is currently in a "pending status". I realized that

On the Texas Franchise Tax Information Worksheet there was 3 lines where I had to select YES or NO. One of them said the following : "Line1: Majority of revenue is from approved specific activities or SIC related retail or whole sale trade." . I needed to select "Y" for this line but it was accidentally left to "N". Is it possible to change it since its still pending?

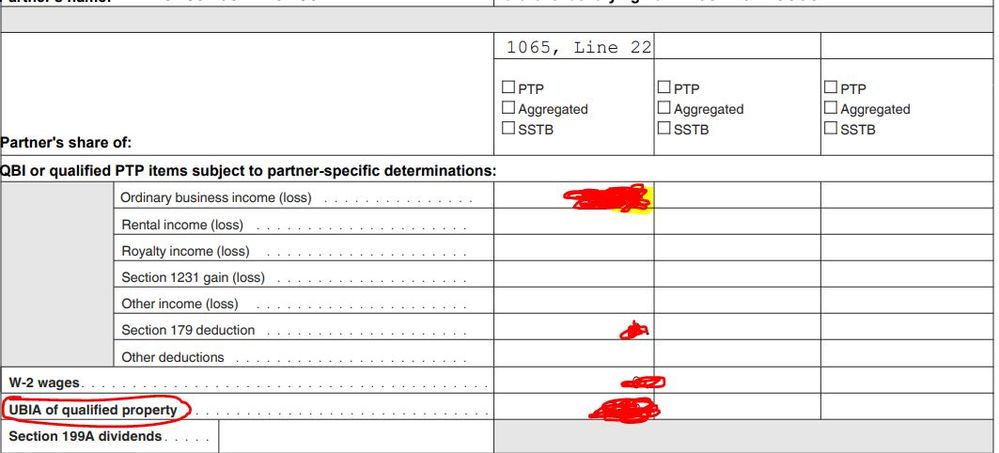

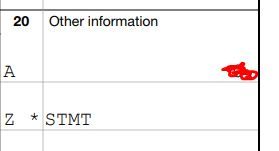

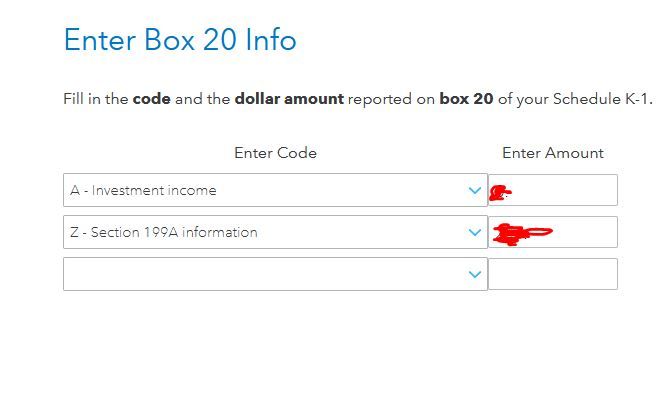

2- When entering K1 information into our personal taxes, Box 20 has code Z (Section 199A information) with an amount that says "STMT". I am looking at the QBI Statement A but I am unsure of which number should I add there. Is it the amount that is listed for UBIA of qualified property?

Thank you,

Alex Mansur

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & Personal Tax (K1 & Franchise Tax)

Hi there,

For your franchise return, you'll need to wait and see if it gets accepted or rejected. There's no way to make changes after you e-filed (even if it's still pending). If Texas accepts the return, you'll need to file an amendment.

As far as your K-1 entries, you can just enter the amount of Ordinary business income (loss) from that statement in the box 20 screen. Once you move on, TurboTax will use that info to ask you more questions about your 199A (QBI) income, and you'll have the opportunity to enter all the amounts from the statement for an accurate calculation.

- Rebecca

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & Personal Tax (K1 & Franchise Tax)

Hi there,

For your franchise return, you'll need to wait and see if it gets accepted or rejected. There's no way to make changes after you e-filed (even if it's still pending). If Texas accepts the return, you'll need to file an amendment.

As far as your K-1 entries, you can just enter the amount of Ordinary business income (loss) from that statement in the box 20 screen. Once you move on, TurboTax will use that info to ask you more questions about your 199A (QBI) income, and you'll have the opportunity to enter all the amounts from the statement for an accurate calculation.

- Rebecca

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & Personal Tax (K1 & Franchise Tax)

Thank you for your reply. The tax franchise makes sense. So even though there is a number in the Ordinary Business Loss line and the QBI line for attachment A on the K1, we just add the ordinary business loss number and then fill out the additional details when Turbo Tax asks in future prompts?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & Personal Tax (K1 & Franchise Tax)

Yes, you will fill out the additional details for QBI when prompted by TurboTax.

Once you enter the ordinary business income from the Statement in box 20 screen, continue on, and you'll eventually find the screen "We need some more information about your 199A income or loss". When you check the box next to a category on that screen, a place will open up to enter the amounts from the Statement or STMT that came with your K-1. The applicable category (or categories) on this screen (and the following "Let's check for some uncommon adjustments" screen, if applicable) must be completed in order for your K-1 QBI information to be correctly input into TurboTax.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

See additional information in the link below:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

gobedoer

New Member

DennisK1986

Level 2

tammy-grady07

New Member

Raph

Community Manager

in Events

justine626

Level 1