- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & Personal Tax (K1 & Franchise Tax)

Good afternoon,

I have a couple of questions :

1- I just filed my LLC and Texas Franchise Tax forms and is currently in a "pending status". I realized that

On the Texas Franchise Tax Information Worksheet there was 3 lines where I had to select YES or NO. One of them said the following : "Line1: Majority of revenue is from approved specific activities or SIC related retail or whole sale trade." . I needed to select "Y" for this line but it was accidentally left to "N". Is it possible to change it since its still pending?

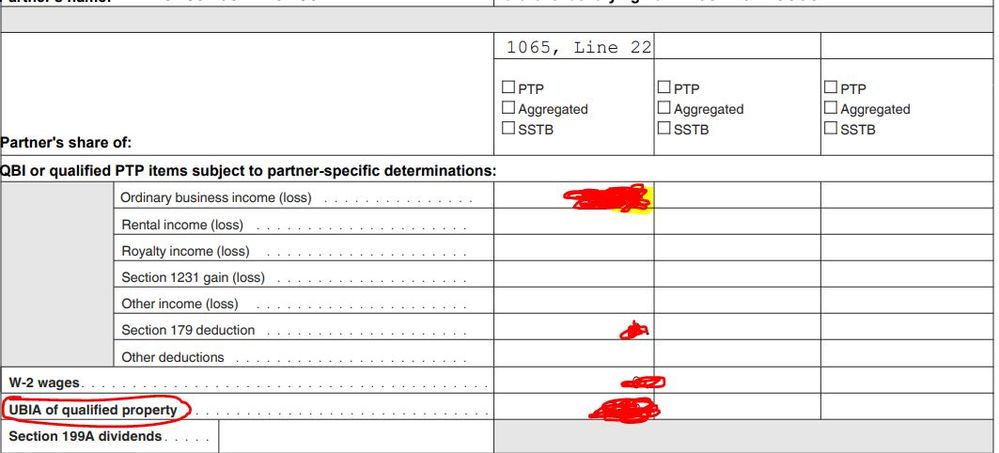

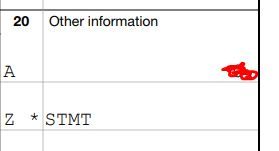

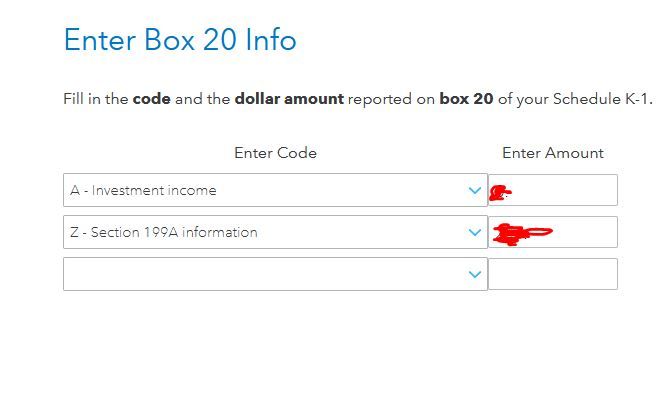

2- When entering K1 information into our personal taxes, Box 20 has code Z (Section 199A information) with an amount that says "STMT". I am looking at the QBI Statement A but I am unsure of which number should I add there. Is it the amount that is listed for UBIA of qualified property?

Thank you,

Alex Mansur