- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Bug with rental property expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

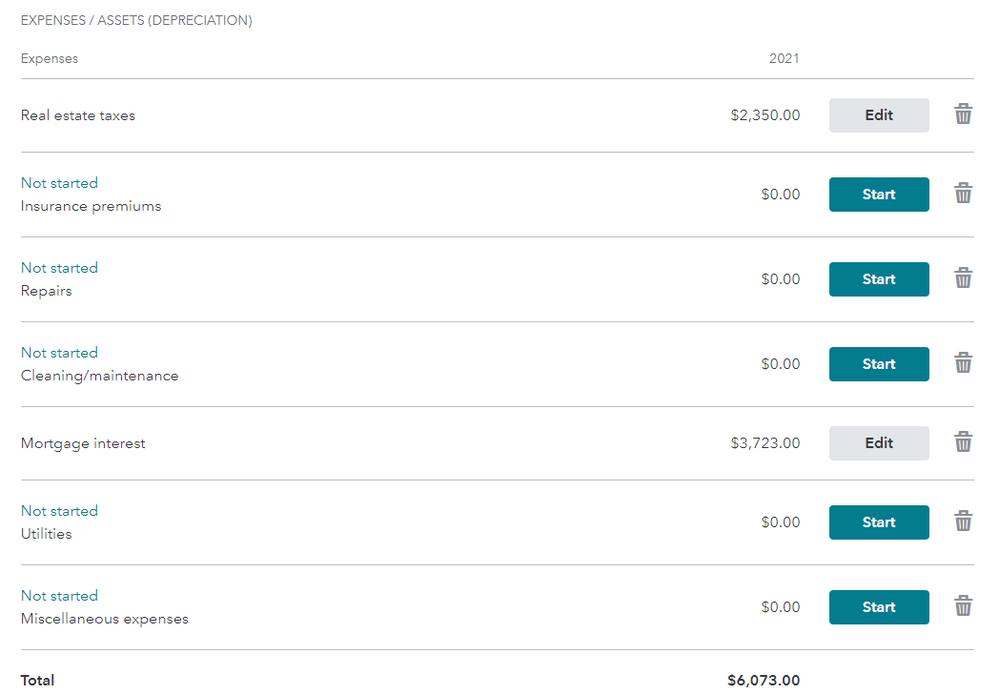

I'm having problem with the "rental property info" using the Turbotax online. Under the expenses, after entering the "Real estate taxes" and "Mortgage interest", all my other expenses entries will turn to zero and shows "Not Started". For example, after entering the information for "Repairs", the website automatically redirected me to the page of "rental property info", where the "Repair" shows 0 and "Not Started" even though I have already entered the data. When I click "start", the dollar amount for "Repair" is still there, but it's not shown on the "rental property info" page where all the expenses are listed.

I have tried to contact the support and use different browsers, clear the caches/cookies/browser history, delete the rental property form and reentered, the issues is still there. Anyone has experienced the same issue before? How did you get around it? Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

We will take a look at your specific return information to try to figure out the problem. Your return will be sanitized for personal information but it will give us an opportunity to actually see your return information to figure out the issue.

Please provide a Token Number to share your file. Here is how to request a Token number:

- Log into TurboTax

- Go to the left side menu

- Go To Tax Tools

- Then Tools

- Share My File With an Agent

- This will produce a six digit number

- Provide that number to us so that we can review your return error.

Come back to this form with the Token Number.

@Anonymous

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

After reviewing your diagnostic file, I found all of the information that you state is missing.

Below are snippets of what I see. All appears accurate. I m seeing the repairs amount and other expenses. Is this different than what you are currently seeing?

I would send pictures but might be PII violation. So here is what I see for the rental

Rental Income is shown ( do not want to show amount)

Repairs $1467

Cleaning $410

Insurance $804

Real Estate $5231

and mortgage interest (2)

You may have not started this yet, but Depreciation $0

If you are not seeing the above, then your computer may be caught in a loop and you may need to clear your cookies, history and reboot. Here is how

Cookies are small files that temporarily store data on your computer. We use them to personalize your experience so you see information you already entered and not items that are irrelevant or repetitive.

On rare occasions, they may make your browser think you already did something that you still need to do. To fix that, you'll need to delete (clear) the cookies from your browser.

Each browser has a slightly different method for deleting cookies. Choose the browser you're using:

- Internet Explorer

- Mozilla Firefox

- Google Chrome

- Safari

- Safari for iOS (mobile devices)

If you are continuing to have issues, come back to this forum so that we may continue to assist you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

Hi @Cynthiad66 , the numbers you see don't show on my end. I have tried using Chrome, IE, and Safari, and cleared cookies, even tried to delete the entire form and renter, the issue remains.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

The page you are looking at is a TurboTax display page only. As long as your numbers are correct on Schedule E and Form 1040, don't be concerned that they don't match on this display page.

Since you're using TurboTax Online, try closing the program, clear your Cache and Cookies and see if the display updates.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

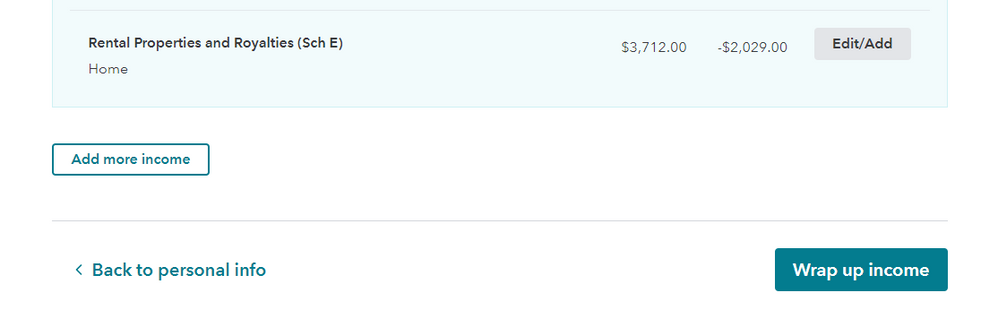

I haven't wrapped up the tax return yet, but the display page shows Sch E matches with the numbers in the page I uploaded previously (income: $4,044; Expense: $6,073; net income:-2029), which doesn't record all the expenses. Do you mean it doesn't matter if the number shown here is incorrect, the form TurboTax generate in the end will be correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

Yes. Verify that amounts are correct on Schedule E.

Since you're using TurboTax Online, try closing the program, clear your Cache and Cookies and revisit the section to see if your display screen amounts have updated.

If you haven't filed yet, you may want to consider using TurboTax Desktop where you have easier access directly to the forms.

You'll be able to transfer your tax file over if you decide to try this option.

How to Transfer from TurboTax Online to TurboTax Desktop.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

Did this ever get resolved. I have followed every diagnostic listed, including starting a new return. The same issue persists with not being able to include rental expenses in my totals (except taxes). This software will be unusable without that ability!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

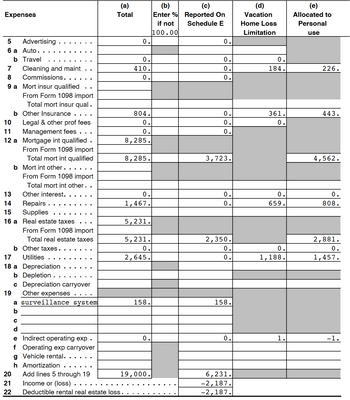

I switched to the TurboTax Desktop as you suggested. But the cleaning and maintenance, insurance, repair and utility are still not reported on Schedule E. They are captured in the "(a) Total", but not in the "(c) Reported on Schedule E". The deduction on my tax only reflects property tax and mortgage interest. I rent a room out in my primary residence (single family house) for 164 days. My questions are: 1) why some of the expenses are not reported on Schedule E; 2) Turbo Desktop doesn't ask me percentage of the square footage of the rental part in the house, it only asks how many days did I rent (I chose rent "part of the house"); when it comes to expenses like utility, should I calculate the portion based on the rental proportion by myself then enter into Turbox?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

Yes, your expenses are being limited, as you can see in 'Cleaning & Maintenance' in your screenshot. Of the $410 amount you entered, $226 is counted as 'personal' and $184 as 'limited. You could enter your Expenses directly on Schedule E, but you are limited to the amount of Rental Income, which is -$2,187 on your screenshot.

You could choose to 'Enter Expenses Myself' and calculate the amounts to enter, for renting a % of your home for 161 days to see if you get the same results.

Because this is your personal residence (in addition to being a rental property); and you use it most of the year (the 14 day or 10% rule), you are precluded from claiming any rental losses. You are only allowed to deduct expenses up to the amount of the income. Almost everybody in your situation comes out with a zero sum for tax purposes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

Thank you! Further questions:

- After selecting "rent part of the house", Turbotax asks about days for personal use vs rental. Since I only rent out a room not the entire house, is it asking for the personal use vs rental of that room or the entire house? That room was never used for "personal use" in 2021, so the day for personal use is 0. However, the personal use of the house is 201 since the room was rented for 164 days.

- Do I need to further reduce the rental portion of mortgage interest and real estate tax by the square footage of rental? For example, my mortgage interest is $8285, rent out a room for 164 days, Turbo calculates the deductible mortgage interest as $8285*165/365=$3723. However, since I rent out one room in a 5-bed house, should I further divide the $3723 by 5?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

Personal use days refer to the room(s) you rented, not the entire home.

By entering the square footage (or percentage) of the home that is rented, you may enter the full amount of COMMON expenses (those shared with the entire home). Check the result, however, in case you need to adjust the final amount allocated to your rental space.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

Thank you!

For anyone who may have the same question as I did, I found it's helpful to read the IRS's guide Publication 527, Residential Rental Property (Including Rental of Vacation Homes)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bug with rental property expenses

Has this ever been resolved? This is an absolute show stopper, Vacation Rental expense reporting is clearly broken and render TT unusable.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ealejandroyepes

New Member

user17708430112

New Member

ericas

New Member

gfaust22

New Member

lucy196949

New Member