- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Brokerage 1099 b statement help please

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

Friends,

Never done this before and my brokerage statement is driving me crazy. Please treat me as Dummy and help me explain how I rad the statement for brokerage account. I have my 1099 B from J P Morgan bank they summaries the interest and dividend on page one page but for brokerage I am confused, I needed the summary not 100 sales to enter for gain/loss so brokerage shows on first page as:

Box A (basis report to IRS) Proceeds cost basis market discount wash sale loss disallowed realized gain/loss loss

Box A ordinary (report to IRS)

Box B ( reported to IRS)

Box B (not reported to IRS) for short term

And same info is repeated for long term

My question is where do I enter this in turbo tax deluxe I am not finding that page or screen and If I enter this on a separate paper form 8949 then how will it calculate my taxes, very confuse here.

on page 2 of statement: Covered short term Gains or losses on Gross proceeds (it show on statement to enter on form 8949 part 1 with box A checked). So do I not enter any info in turbotax and just fill the paper forms, then how my Tax will calculate? same confusion

For this 2nd page info I did find the screen to input data, as I search the 1099B then I choose I will type myself and enter data for box 1 d, box 1e and gain/loss amount (all summary)

So please guide me in detail how to do it right.

Thank you, thank you so much.

Casey

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

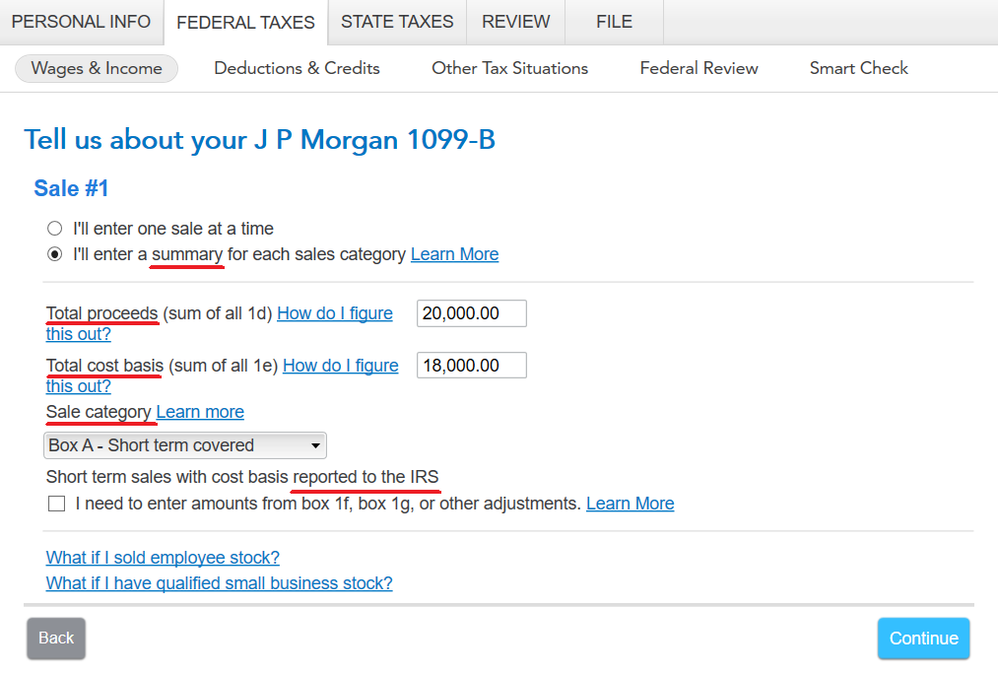

It's not clear whether you are making summary entries or entering every individual transaction. If you are making summary entries you have to enter Total proceeds, which is the sum of the box 1d column, and Total cost basis, which is the sum of the box 1e column. See the screen shot below. Your brokerage statement probably shows the totals at the bottom of each section. You also have to select the sale category from the drop-down list. If you are making summary entries, that's all you have to enter.

Your brokerage statement has more than one category, so you have to make a separate summary entry for each category, with the appropriate sale category selected for each one.

For the categories that are not reported to the IRS you have to attach to your amended return a copy of the part of the brokerage statement showing the details of all the transactions. You have to file your amended return by mail anyway, so just include the necessary sections of the brokerage statement. Send a photocopy, not the original.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

@Casey007 wrote:

Please treat me as Dummy

OK, Dummy.

@Casey007 wrote:

If I enter this on a separate paper form 8949 then how will it calculate my taxes, very confuse here.

You do not use any paper forms. TurboTax will fill out all the necessary forms for you electronically.

@Casey007 wrote:

it show on statement to enter on form 8949 part 1 with box A checked.

Ignore that. Those instructions are for someone who is doing their entire tax return by hand on paper forms, and is not using tax software. When you look at your completed tax return in TurboTax you should see that TurboTax made the appropriate entries on Form 8949.

@Casey007 wrote:

For this 2nd page info I did find the screen to input data, as I search the 1099B then I choose I will type myself and enter data for box 1 d, box 1e and gain/loss amount (all summary)

So please guide me in detail how to do it right.

So it sounds like you found the place to enter the information in TurboTax. That's the right way to do it.

You do not enter the gain or loss. You enter the proceeds and basis. TurboTax calculates the gain or loss.

If you have further questions please tell us what year's tax return you are working on, and whether you are using TurboTax Online or the CD/Download TurboTax software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

Thank you,

I will work on this tonight, after work. I use Turdo deluxe CD for 2022 return, because I did not know that there was another summary of brokerage acc. Well, dumb as you can say I only enter interest/dividend data and file my tax electronically. Now I will send an amended return.

So, this is what I will input data. After your explanation.

box 1d box 1e (brokerage statement)

proceeds cost or Other basis.

just these two-box info and turbo will calculate gain/loss.

will this be good?

Thank again,

Casey

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

It's not clear whether you are making summary entries or entering every individual transaction. If you are making summary entries you have to enter Total proceeds, which is the sum of the box 1d column, and Total cost basis, which is the sum of the box 1e column. See the screen shot below. Your brokerage statement probably shows the totals at the bottom of each section. You also have to select the sale category from the drop-down list. If you are making summary entries, that's all you have to enter.

Your brokerage statement has more than one category, so you have to make a separate summary entry for each category, with the appropriate sale category selected for each one.

For the categories that are not reported to the IRS you have to attach to your amended return a copy of the part of the brokerage statement showing the details of all the transactions. You have to file your amended return by mail anyway, so just include the necessary sections of the brokerage statement. Send a photocopy, not the original.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

Thanks, Rjs sir,

I enter data exactly as per your screen shot, I enter as summary, not individually. Like you mentioned there may be more than one sales category(s), I will double check the entire statement 44 pages, to enter another summary if there is any. Thank you for your great help, If I will bring to your attention if I run into another obstacle.

Thank you and Happy Thanksgiving to you sir.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

rjs sir,

I ran into another obstacle. Please help.

Ok, I input all data as summary from the brokerage statement as per your previous post that includes screen shot. There are two categories: short term covered, and long term covered, and I entered the summary total for box 1d and box 1e for each. Under the sales category box it says " a check box, I need to enter amounts from box 1f, 1g, or other adjustments, do I fill this data? if yes then what adjustment code I use. My brokerage statement shows 0 amount for box 1f, but there is amount for box 1g. (I just entered data to see what difference it makes; federal tax return amount did not change but it did change the "capital loss carryover forward amount to 2023") for now I deleted this data box f and box g, until I hear from you.

Appreciate your great help.

Thank you,

Casey007

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

If the broker statement did not have any adjustments to report you simply skip that section. But if there are wash sales to report you must report them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

Ok ... first look at the forms 8949 before messing with the adjustments ... do the numbers match the 1099-B without making any more entries. If so you are done.

If not then then you will need to make the adjustment entries in the program ... if following the screen instructions are confusing then call TT support for assistance :

Contact TurboTax support and speak directly with a TurboTax support agent concerning this situation.

See this TurboTax support FAQ for a contact link and hours of operation -https://ttlc.intuit.com/questions/1899263-what-is-the-turbotax-phone-number

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

Enter the total wash sale amount (the box 1g amount) in the "Total adjustments" box. The adjustment code for wash sales is W, so enter W in the box for adjustment codes. On Form 8949 TurboTax will put the adjustment code in column (f) and the adjustment amount in column (g). There will also be an adjustment code M, which indicates that you are summarizing multiple sales.

It's very unlikely that there would be any other adjustments on the brokerage statement. If there were any, you would see them somewhere in the transaction information. But if you're worried, call J.P. Morgan and ask them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

I appreciate your valuable help, I believe, Critter and rjs explanation solve my problem. I will put the codes for wash sales.

Thanks again. Have a great day. Hope I don't have further issues.

casey007

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

Oe more thing I forgot to mention is that Turbo tax is saying that I don't have to mail in brokerage statement since I use proceeds and cost basis summary.

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

You don't have to mail a copy of the brokerage statement to the IRS because, if I understand you correctly, all of the sales were covered securities, with basis reported to the IRS. So the IRS already has all of the details of the sales.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Brokerage 1099 b statement help please

Dear rjs,

Yes, they are short and long term covered. Thank you for being so supportive. So far, I am done now, just print and mail return. Whoo-hoo I am getting $$$ back.

thank you,

Casey007

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Pattiwagen

Returning Member

dale-heard

New Member

tompell

New Member

mjmahoney223

Level 1

wmpyoungx

Level 4