in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- box 14 NYPFL

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

1Q:what category do i pick?

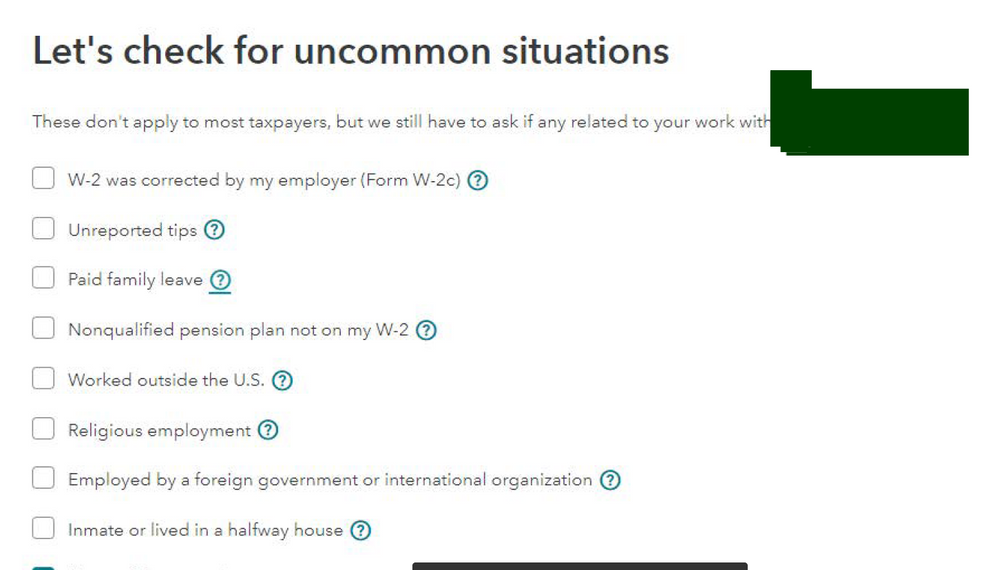

2Q:if i have NYPFL in box 14,should i check paid family leave?

thank you for all help

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

That's right. Still don't check the box. The NYPFL in box 14 is PFL tax that you paid. The check box on the "uncommon situations" screen is for PFL benefits that you received that are included in your W-2. Paying the tax does not mean that you received any benefits. If you did not take paid family leave you did not receive any PFL benefits so you do not check the box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

1Q: Select "Other mandatory deductible state or local tax not on above list." Depending on exactly where in TurboTax you make this selection, you might see slight variations in the wording, but they are all treated the same.

2Q: No, do not check that box. "Paid family leave" in the question about uncommon situations is not related to the NYPFL in box 14. The question about uncommon situations is asking whether part or all of the income on your W-2 is paid family leave that you received.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

but on my w2 on box 14 i did have the NYPFL and some amount there, around $150 bucks. still dont check it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

That's right. Still don't check the box. The NYPFL in box 14 is PFL tax that you paid. The check box on the "uncommon situations" screen is for PFL benefits that you received that are included in your W-2. Paying the tax does not mean that you received any benefits. If you did not take paid family leave you did not receive any PFL benefits so you do not check the box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

The category for the drop down box below 14 NYPL is "Emergency Family Leave Wages". It is between Code U,V,W,X,Y or Z and Railroad Retirement.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

Box 14 is where your employer can include extra info about anything they want to report to the IRS. This box is commonly left blank and, if it is, you don't have to enter anything.

Examples of what an employer might add here include:

- The cost for a vehicle lease if your employer included 100% of your vehicle's annual lease as part of your income

- State disability insurances taxes your employer withheld

- Union dues paid by your employer

- Uniform payments your employer made

- Nontaxable income you earned

- Pretax commuter benefits

- Flex Spending Account (FSA) contributions

- Employee stock benefits (RSUs, ESPPs, etc.)

If none of the categories apply, scroll to the bottom of the list and choose either:

- Other deductible state or local tax

- Other (not classified) or Unknown

Don’t worry. We'll figure out if it impacts your return or not. If we need more information, we'll ask you.

If box 14 is blank, just skip over it. Don't enter a 0 for any blank boxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

Which is the correct turbotax category for Box 14 for NYPFL:

1. Emergency family leave wages,

2. Other deductible state or local tax,

or

3. Other (not classified) ?

Thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

NYPFL would be listed under Other deductible state or local tax in Box 14. If you itemize your deductions, PFL is deductible on Schedule A of your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

How about the categories for NY SDI and NY-FLI for box 14? Should those be "Other deductible state or local tax"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

Yes, those are both state imposed taxes that can be deducted on your federal return, if you itemize. Select "Other Deductible Tax".

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

Would the emergency family leave be for COVID pay, not an insurance that gets paid in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

No. NYPFL (New York Paid Family Leave) was introduced in 2018. It is insurance that is funded by employees through payroll deductions. New York's state's Paid Family Leave (PFL) program provides workers with job-protected, paid leave to bond with a new child, care for a loved one with a serious health condition, or to help relieve family pressures when someone is deployed abroad on active military service.

Each year, the Department of Financial Services sets the employee contribution rate to match the cost of coverage. In 2022, the employee contribution is 0.511% of an employee’s gross wages each pay period. The maximum annual contribution is $423.71. Pursuant to the Department of Tax Notice No. N-17-12 [PDF], Paid Family Leave contributions are deducted from employees’ after-tax wages. Employees earning less than the Statewide Average Weekly Wage (SAWW) of $1,594.57 will contribute less than the annual cap of $423.71, consistent with their actual wages.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

What about NYFL? Is that the same as NYPFL?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

Without seeing your W-2, I would believe what you have listed as NYFL is the same as NYPFL. Some payroll systems limit the number of characters in individual fields. If this is your situation then the payroll service has a maximum of 4 characters per Box 14 field. I suggest you ask your HR department, if you have one, or a manager if you do not, if the item in Box 14 labeled NYFL is the same as NYPFL.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

box 14 NYPFL

Hi, so I uploaded my W2 via pdf but one of the box 14 categories was left blank. Its for NYPFL and last year I picked "Other deductible state or local tax" but this year there is also the option of "New York Paid Family Leave tax". Which category should I pick?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

TKLA

New Member

user17711185613

New Member

LTrinh

New Member

annntx

New Member

Rakeshchru

Level 1