- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Bank has not been debited to pay my taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

If your auto debit was setup correctly, no additional actions are needed and sending a check will result in paying twice.

If you set-up a payment for your income tax payment using TurboTax and you did not specify a payment date for the withdrawal, TurboTax's default payment date will be used (the last day of tax season = April 18th this year).

If your payment date has passed, but your tax payment has not been withdrawn yet, payment will not usually be not initiated until the return has been processed. Most states don't begin processing state returns until after the federal return has completed processing (your payment is still considered timely, as long as submitted before April 18).

You can also call IRS e-file Payment Services anytime at 1-888-353-4537 to verify your payment.

Contact your state Department of Revenue: https://ttlc.intuit.com/replies/3302452

OR

To check the IRS or state payment date selected in TurboTax:

1. Sign In to TurboTax

2. Select "Taxes"

3. Click "My Tax Timeline"

4. Choose "Some things You can Do"

5. Select "Download all forms and worksheets"

6. Review Part V of the Federal Information Worksheet for payment and banking information.

7. Review State Information Worksheet for payment and banking information.

** If the election checkboxes are marked "NO" and OR your banking information is not displayed on the Information Worksheet, then the direct debit was not successful. To setup payments for federal and state taxes, use the links in this answer and choose from the payment options available. If you did not set up your payment through TurboTax, visit www.irs.gov/Payments and choose from the payment options.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

Turbo Tax failed to send my state tax due as specified on April 10 for 2019 and I was charged penalty and interest. How do I recover this from Intuit? It was their mistake.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

You can not pay a state tax due from Turbo Tax. How were you suppose to pay it? You probably just paid the Turbo Tax fees for doing the state return. And you can not have a state tax due deducted from a federal refund, only the Turbo Tax fees. Turbo Tax just shows you a screen at the end showing the Net amount of federal and state combined. But it is just for your own info. You do still have to pay the state yourself separately.

Your only proof of payment is your bank statement or credit card showing the payment coming out. Turbo Tax only passes your bank account number to the state for the state to take it out of your account. But most states do not let you pay by Direct Debit so you have to mail in a check or go directly to the state's website to pay.

Check the printout or PDF of your return; look for the state cover sheet with the Turbotax logo. If you owed tax, it will show the payment information and how/when you decided to pay. Read the state payment instructions carefully since most states cannot be paid from within the TT system and requires additional steps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

@Rusa8 wrote:Turbo Tax failed to send my state tax due as specified on April 10 for 2019 and I was charged penalty and interest. How do I recover this from Intuit? It was their mistake.

______________________

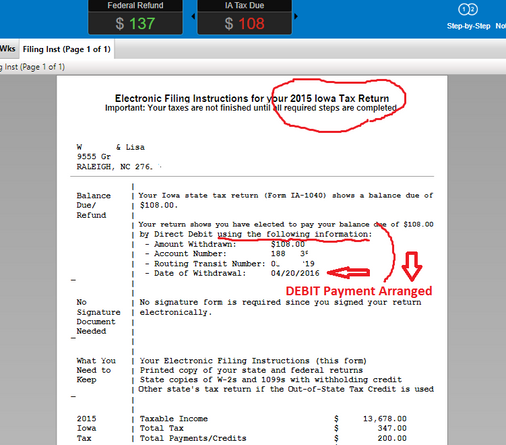

In your PDF of your state tax filing...the state "Electronic Filing Instructions......" should look like the picture below ...IF...if it was possible to arrange the payment with yoru e-file. Check the routing, account numbers and date

(and if BofA...they sometimes require a different routing number than the one on your checks)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

It was set up properly. I'd like to recover penalties and interest from Intuit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

And some banks use different routing numbers for deposits and payments so double check the debit info with your bank.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

Did you ask the state (and bank) why they couldn't withdraw it from your bank account? Did the payment reject?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

No clue. Nothing happened - no notification from anyone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

No clue. Nothing happened - no notification from anyone until a letter from FTB with penalty and interest because of failure to pay. Same instructions worked fine for receiving the federal refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

This also happened to me on a prior year. I am trying to make sure it doesn't happen this year, but the state taxes have still not been withdrawn.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

1) Did you double-check the date and account numbers on your state Electronic Filing Instructions, as shown in the picture above.?

2) Is your bank the BofAmerica? Sometimes their routing number is different form what is on their checks.

3) If it ends up being more than a couple weeks without a withdraw...then find your state's payment website and make your payment separately there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

I did double check the date and account numbers.

My bank is Wells Fargo.

Now that my state return has been accepted (although not paid) I can go directly to the State website and pay through it--however I don't want to pay twice. I also don't want to pay late fees. Although the deadline has been extended to file, according to NC posts, taxes owed are still due the 15th.

It appears my options are:

1) wait a couple weeks and it goes through or I pay late fees and resubmit

2) find a way to cancel the turbotax payment and pay directly through the state website

Any ideas? thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

Yeah...they (NC) allowed the late payment penalty to not be applied until after 17 May, but inters still accrues if paid after 15 April.

___________________________________________

Still, it's still another 8 days until the 15th, so you could sit on it until the 13th, to see what happens.

I didn't have problems with the D.Debit in 2019 for taxes owed for 2018 (NC too), but with all the mid-year changes this year, I was uncomfortable with entering D.Debit for NC with my tax return. I just indicated pay by check, and then used the NC website to pay a couple days after my NC was accepted. I might jsut continue to do it this way every year.

____________________

I thought NC used to have a clear number to call to ask about ACH payments, but I can't find it now.

The is an NC number at the bottom of this page you could try to see if they are delaying debiting for some reason:

https://www.ncdor.gov/file-pay/electronic-funds-transfer

________________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bank has not been debited to pay my taxes

Thanks. I think last year I paid directly at the State website, but I got frustrated this year at the NC site and couldn't figure out how to do it easily.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

vincentr9

New Member

pk222

Level 1

hsuhsiaotung

New Member

cherylnehr

New Member

finellia

New Member