- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Bailey settlement throwing incorrect error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey settlement throwing incorrect error

Blocked numbers for privacy, but they are the same number. Why isn't TurboTax Home and Business Desktop allowing me to efile this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey settlement throwing incorrect error

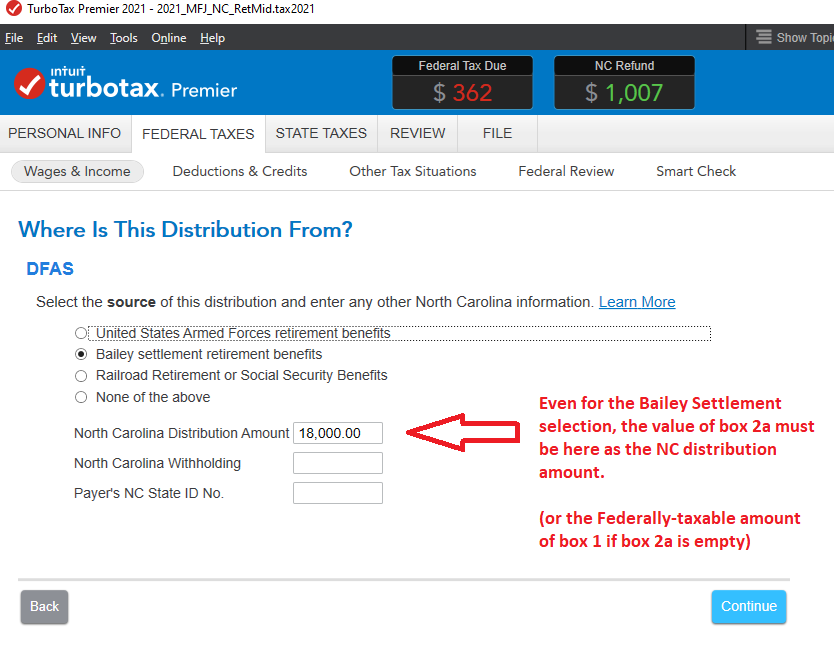

1) If your 1099-R, that is eligible for the Bailey Settlement deduction, if it has a non-zero $$ number in box 2a, make sure that the amount you are claiming is not greater than that 2a value. Also see picture below.

2) IF it is a military pension, make sure you are not claiming it for BOTH, the Bailey settlement, AND Uniformed Services Retirment in the NC Q&A. Once you select the Bailey Settlement on the follow-up page when entered in the Federal section, then that's your claim. Then later during the NC Q&A it ask you to enter some $$ for a Uniformed Services Retirment....you DO NOT enter it there again...that's double-claiming it. One or the other, not both.

___________________________

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey settlement throwing incorrect error

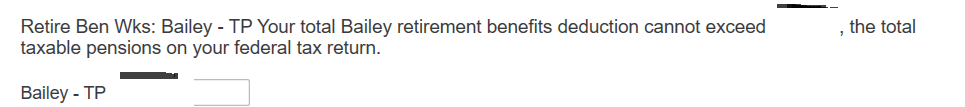

In my case The "Bailey-TP shows exactly the amount that I am claiming as the Baliey deduction. Yet the program does not allow me to E-file. I don't understand what's going on. The amount shown is the sum total of the 2a information on the 1099-Rs.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Bailey settlement throwing incorrect error

Yeah, but was the total of your 2a $$ amounts (apparently you have more than one 1099-R) included in your Federal taxable income?

For instance, if one the 1099-R forms was for a rollover, or partial rollover of $$ into another retirement account, then those rolled $$ are not eligible for Bailey exemptions, since some or all of the $$ are not included in Federal income in the first place.

And if you have a Military pension 1099-R that is Bailey eligible, you can't exempt it both under Bailey, and a second time under the Military Pension retirement selections...one or the other, not both.

Beyond that, you'd need to describe exactly what the source was for every 1099-R you received and how it was used, before we "might" be able to describe what is happening

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ChicagoJ

Level 3

niubi

Level 1

JCBarr23

New Member

viking

Level 2

rosekat21

Returning Member