- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

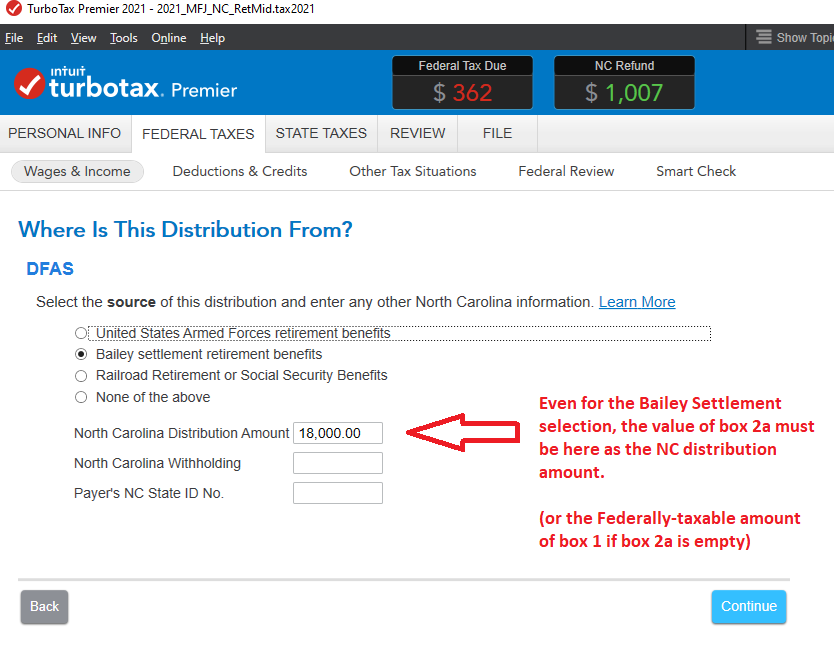

1) If your 1099-R, that is eligible for the Bailey Settlement deduction, if it has a non-zero $$ number in box 2a, make sure that the amount you are claiming is not greater than that 2a value. Also see picture below.

2) IF it is a military pension, make sure you are not claiming it for BOTH, the Bailey settlement, AND Uniformed Services Retirment in the NC Q&A. Once you select the Bailey Settlement on the follow-up page when entered in the Federal section, then that's your claim. Then later during the NC Q&A it ask you to enter some $$ for a Uniformed Services Retirment....you DO NOT enter it there again...that's double-claiming it. One or the other, not both.

___________________________

____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.*

April 14, 2024

7:27 AM