- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- At risk amount for an LLC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

At risk amount for an LLC

I'm trying to figure out how to determine my at-risk amount for an LLC that I'm non-active partner of (I did not materially participate in). The LLC is also not related to oil and gas. The partnership was formed in 2022. I did received a schedule K-1 for my 2023 return. When I filed my 2023 taxes other than the loss shown on line 14A I didn't showed any at-risk amount on form 6198 when I filed my 2023 return. I have two questions:

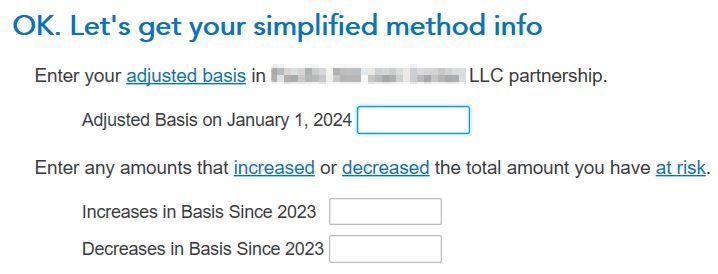

1. How do I determine my at risk amount when filing my 2024 return. The schedule K1 I received for 2024 has beginning and ending values in line item K1 under the qualified non-recourse financing. It also has values in section L with the beginning and ending capital account. I am not sure which values to use in the screen below - I'm assuming I need to use the simplified method - I did file form 6198 but I didn't declare any at-risk amount other than the loss.

2. Do I need to amend my 2023 return since I didn't use the simplified or detailed method and didn't declare my at-risk amount?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

At risk amount for an LLC

You can use the beginning capital account as listed on section L on the k-1 schedule as your beginning basis at January 1, 2024, unless there are any items you know of that affect your basis that are not included in the amount. For instance, if you personally guaranteed partnership loans that would increase your basis but wouldn't be reflected in your capital account.

Increases in 2024 would be things like your share of partnership income and monies you contributed to the partnership. Decreases would be things like your share of partnership losses and money you withdrew from the partnership. For the most part, you could work off the capital account entries as listed in section L on the K-2 schedule, unless there were things that affected your basis that would not be reflected there.

You don't need to amend the 2023 return unless your tax would change because you assumed a wrong basis. For instance, if you deducted more in losses than was your basis, you would need to amend the return to correct that.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

At risk amount for an LLC

@ThomasM125 thank you for your reply. Is it necessary for me to declare the increases and decreases. I added them to TT based on your suggestion but didn't see any changes to my federal return in terms of the $ amount. If I don't declare the increase/decrease or my original contribution would it affect my taxes when I liquidate my shares in the LLC?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

At risk amount for an LLC

You should enter the increases and decreases as they will affect your ending basis. The basis is used to determine whether you can deduct losses if they occur, as you can't deduct losses once your basis is reduced to $0. Also, when you dispose of your interest in the business you will use your basis to determine your gain or loss on your investment. It will not necessarily impact your current year recognition of income or losses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jeannieb82

New Member

CShell85

Level 1

NancyWolfe

Level 1

blueysbe23

Returning Member

kfsj

Returning Member