- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-NEC?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

Some TurboTax Online customers are getting the error below when attempting to link their Form 1099-NEC. If you are experiencing this issue, please sign up here for email updates as we are working on the issue. You will be notified by email when it has been resolved. @John H3

Check This Entry

Form 1099-NEC Worksheet (XXXXX): A link to Schedule C or another form is something we need to get your info in the right place.

The 1099-NEC is new this year - it replaces the 1099-MISC-Box 7 forms. All of the entries for the 1099-NEC are new in all software.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

That is exactly what mine is doing. Please let me know if you figure anything out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

For the 1099-NEC, since the trouble is linking it to your Schedule C or another form, then please Sign Up here for email updates. TurboTax is working on this issue.

If you would rather enter it as other income for self-employment income and expenses, follow these steps:

- First, use the search for 1099-NEC and click the Jump to link.

- When you see Form 1099-NEC, click the Trash can Icon to delete it

- Next, re-enter the income by searching for schedule c and clicking the Jump to link

- Add income for this work as Other self-employed income and Continue

- Describe the Type of Income as Form 1099-NEC, including the EIN and business name, too.

- Enter the Amount and click Continue

- If there are no other adjustments, scroll down and select Done

- Follow through the rest of the interview and select Done with Income.

Form 1099-NEC is a new form for non-employee compensation that replaces what used to be reported on Form 1099-MISC, Box 7 in the past. For more details, see What is Form 1099-NEC?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

I have received a 1099-NEC which includes payment for work performed, and re-imbursement for travel expenses.

How do I take care of this in my 2020 taxes (in turbotax) ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

That is for self employment. You enter the full 1099NEC as income on Schedule C. Then enter your expenses. You get taxed on the Net Profit.

You can enter Self Employment Income into Online Deluxe or Premier but if you have any expenses you will have to upgrade to the Self Employed version. Or use any of the Desktop CD/Download programs.

How to enter income from Self Employment

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

Enter Form 1099-NEC for work performed and re-imbursement for travel expenses in your self-employment income & expenses section.

To go there in TurboTax, follow these steps:

- From the left menu, select Federal, which will open to Income & Expenses.

- Scroll down to Self-employed income & expenses and Start/Edit/Add

- Add income for this line of work

- Select Form 1099-NEC, new IRS form for nonemployee compensation (replaces 1099-MISC)* and Continue

- Enter the form exactly as you received it

- Enter travel expenses in the expenses section to offset the income.

For an overview to this new form, see What is Form-NEC?

*Alternatively, it is allowable to enter Form 1099-NEC in the Other self-employed income, includes 1099-K, cash, and checks section.

When prompted for Type of income, include Form 1099-NEC, EIN, and Business Name of the Issuer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

Kathryn,

This does not work. When you enter the NEC-1099 information it prompts you to a review that asks you to "double click" in a schedule c line. I've done (along with many others) what you have suggested tens of times, but it's still being flagged. If you're connected with TurboTax employees, please advise when they have an actual solution to their software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

I have already paid you $120 dollars for filing, but I'm unable to file because of this problem on your end. What are the steps at getting reimbursed for my payment? I don't find it ethical to charge customers for a service that didn't work. Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

How long before the 1099-NEC issue is fixed

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

See this FAQ

But actually you can just enter it as Other self employment income or as Cash or General income. You don't need to get a 1099NEC or 1099Misc or 1099K. Even if you did you can enter all your income as Cash. Only the total goes to schedule C.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

That happened to me. What it happened was that I had entered it twice, so the system was asking me to link it to make sure it was the right amount. Please make sure you only entered one.

Now, I have the problem that I cannot e-file my taxes, because one of the forms can't be filed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

We have a similar problem: Apparently, Turbotax no longer remembers the 1099-MISC information that we have used and re-used for many consecutive years. We shouldn't have to waste time and effort by manually re-entering data that TurboTax has maintained and imported year-after-year for nearly 30 years!

We have been using Turbotax, Quicken, and QuickBooks since the 1990s. All three USED TO BE great--both individually and as an ensemble. (BTW, I use BOTH Quicken and QuickBooks because of my wife's business, and our personal and other business/financial needs.) And that is why we HAD BEEN (happily) using all three of them for so long.

But, over the past several years, each of those programs have developed significant and increasing problems. For Quicken, the reason seems to have been that Intuit decided to sell it, so why sink any more money into maintaining, let alone improving it. I get that. Don't like it; but I "get" it. (BTW, Quicken's new owners seem to be doing what they can to maintain and improve it--so I am still using Quicken.) But I swear that for QuickBooks (to a lessor degree) and, especially for Turbotax, Intuit and its minions seem--to me, at least--to have been suffering mess-ups with increasing frequency. For example, when lots of people complained over each of the past half dozen or so years that Turbotax could no longer accurately (if at all) import data from QuickBooks and Quicken, the Turbotax and Intuit support people and other non-employee website monitors insisted that the people complaining of that on their support and community pages--myself being one of many--were doing the task wrong; were lying; that a solution was immanent; or that the problem will be fixed for "the next tax year." But, year after year, in fact, the problem was real and no solutions were forthcoming.

Now here I will be careful to clarify that, this year, I have not tried to import data from Quicken or QuickBooks into TurboTax. I decided last year that I would never try that again. For several years now, it has taken too much time and effort, and created too much frustration and anger for me to intend to try that with Turbotax again. It has become faster and simpler to just go with the flow--that is to manually enter the data. So I swore that I will NEVER try importing from Quicken or QuickBooks into TurboTax again. Nor will I waste my time complaining to Support about this problem, either. Given what I have seen and experienced, what is the point?

At least--I told myself--I can trust TurboTax to walk me through preparation of our taxes, and TurboTax still seemed to do that part of the process better than the competition. Plus, TurboTax also made it easier to do my taxes from year-to-year by tracking, remembering, and prompting me for stuff--like 1099-MISCs, for example... Now, even that no longer appears to be true. I don't know if this is due to forgetfulness, poor programing, or bad intent. And I no longer care which might be the case. I am done with TurboTax.

You wanna bet that this comment gets deleted from the database? Perhaps they will say it is "off-topic," a fraudulent post by the competition, not productive, or some other excuse. Or maybe it will simply disappear. Whatever, actually happens, it won't surprise or even bother me. I'll be gone and it won't really matter to me any more. The real question is whether TurboTax and Intuit will resume listening to their customers or not. If they don't, their time is numbered. If they do, then maybe someday I will come back to TurboTax. Who knows?

I bought this program in December. But I only just started using it when I stumbled on this problem. Now, it is too late to start over--"from scratch" as it were--with another program. And that is on me. So this year I expect to finish our taxes using TurboTax. But NEVER AGAIN. H&R Block, get ready, I'll be with you (or some other tax prep program) next year! I don't know whether I will be alone in that migration, and I don't really care. I just want a tax prep program that I can reasonably rely upon.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

Today I worked with a turbo tax specialist who was assisting me in negating a 1099 NEC and replacing it with. 1099 MISC. The income total was doubled on the income listed. How do I fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

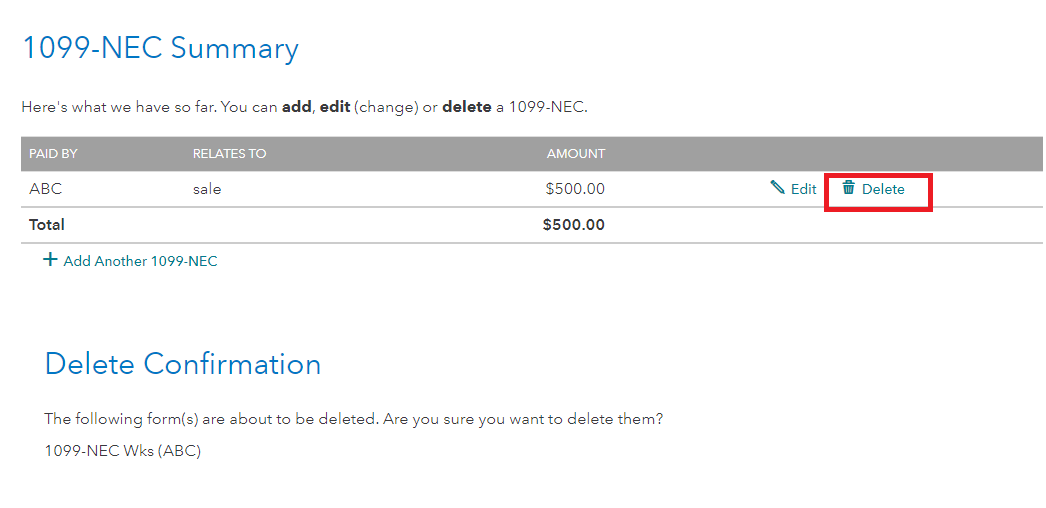

The Form 1099-NEC is used to report self employment, or independent contractor payments. If you did not earn this money, then you can delete the entry by using the following steps.

- Sign into your TurboTax account > Select Search (upper right) > Type 1099-nec > Enter > Click the Jump to ... link

- Click on the Delete button next to the trash can > Your 1099-NEC has been removed from your return

- See image below

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-NEC?

I am using TT Premier and it allows 1099-NECs to be entered but the results do not show up on the step-by-step summary page. The information is loaded in the forms, however. Hope they can fix this.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

leannepetterson

New Member

kochert1985

Level 1

jhughe0205

New Member

magbwill

New Member

ajfreese

New Member