- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-MISC and 1099-NEC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC and 1099-NEC

I was in a car accident last year and filed a claim to get the car fixed and some medical bills covered. I received a 1099-MISC from my insurance company but I also received a 1099-NEC for the same amount but its a negative amount. Do I skip both when filing my taxes as it seems like an error?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC and 1099-NEC

It would not be advisable to not enter the 1099's on your return. Without entry and inclusion the IRS would in all probability send out a notice requesting an explanation.

Without knowing what your insurance coverage is, I am going to make a couple of assumptions here and make a suggestion. The first is that the receipt of the 1099-MISC may be for reimbursement of medical expenses. If that is the case you should consider making a negative entry in other income to preclude the possibility of it coming back on to you as taxable income.

Similar for the 1099-NEC as possible for lost wages that may have been reimbursed.

To enter these items, the following steps may be of assistance if I am on the right path. The steps are for TurboTax online but are very similar in TurboTax desktop but not exactly the same.

- On the left side of your screen in the Federal section click on Wages & income.

- Scroll down to "Other Common Income" and click on "Show More"

- Click on 1099-MISC and enter the information from the 1099.

- Answer the questions that follow. I suggest "Reimbursement" for the reason for the 1099.

- Once that is entered, and you are back to the income summary page, scroll down to the bottom area captioned "Less common income" and click on "Show More", then click on the bottom link for Miscellaneous income.

- Click at the bottom for "Other reportable income"

- Enter as a reimbursement with a negative amount equal to what you entered above in the "Other Common Income" area. This will negate the showing of the 1099-MISC as income on your return.

The steps are the same for the 1099-NEC but instead of other common income, enter as a negative at the link for "Income from Form 1099-NEC" In this case you do not have to enter anything as a positive.

I believe the above will assist you in entering the above forms but if not please request additional assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC and 1099-NEC

@JosephS1 thanks for your reply. On the 1099-MISC I received they listed the number in field 10 (Gross Proceeds to an attorney). Then the next question is how much of this is taxable; I entered $0. When I run the smart check it wants me to link the 1099-MISC to a Schedule C? I am not an attorney nor was any attorney involved in this matter. On the 1099-NEC the number is listed in field 1.

Thanks again for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC and 1099-NEC

The amount in box 10 of the 1099-MISC is the amount that should be entered in the question, " How much of this is taxable?' Attorney fees are not deductible. Delete forms Schedule C, Schedule C Worksheet , 1099-MISC and 1099-NEC if you have entered it. Follow the steps below.

To delete Forms these steps:

- Open TurboTax.

- In the panel on the left side, select Tax Tools > Tools.

- Delete a form.

- Delete Schedule C.

- Delete Schedule C Worksheet.

- Delete Form 1099-MISC.

- Delete Form 1099-NEC.

- Sign out of TurboTax.

- Open TurboTax > Continue.

To enter forms 1099-Misc and 1099-NEC.

- Open TurboTax.

- "Pick up where I left off."

- Federal > Wages & Income.

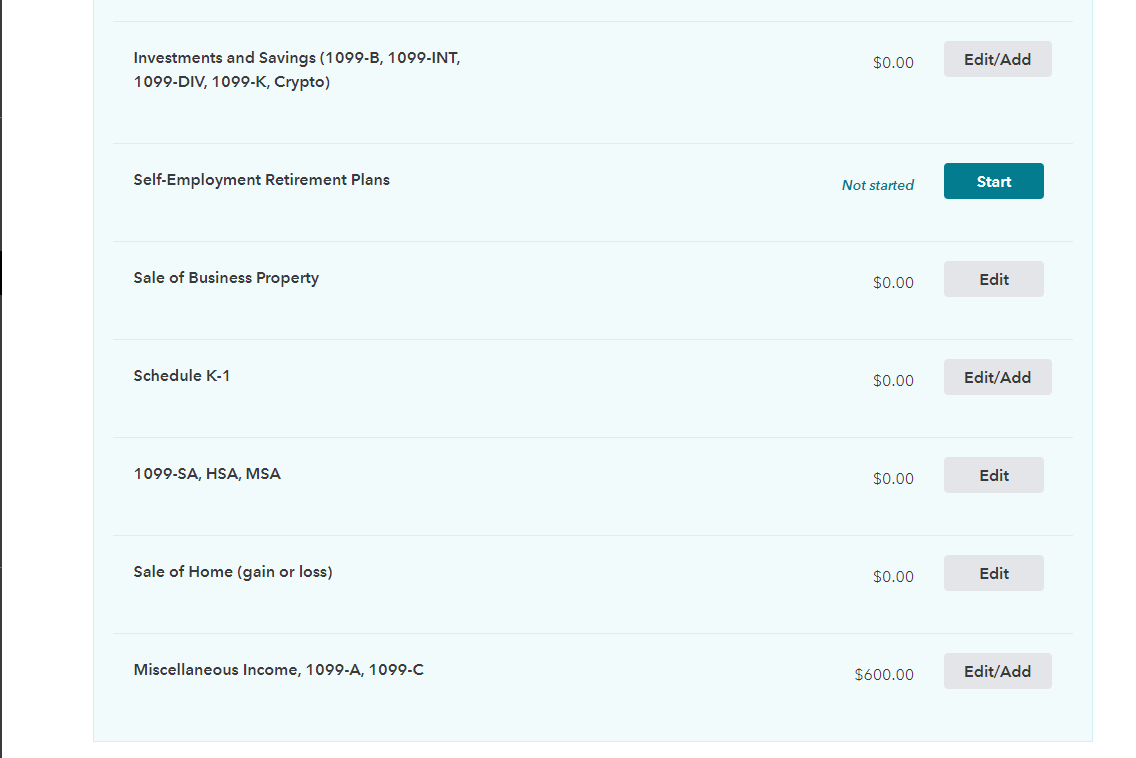

- Scroll to Miscellaneous Income, 1099-A, 1099-C > Edit or Add.

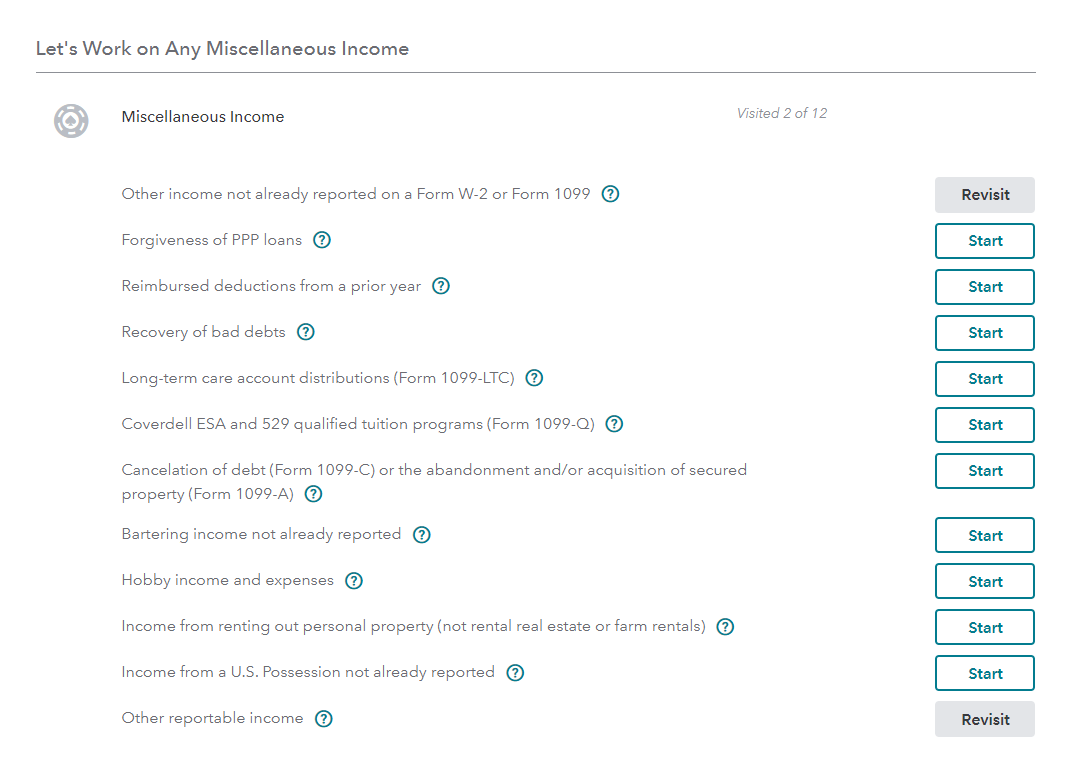

5. "Other income not already reported on W-2 or Form 1099" > Start or Revisit.

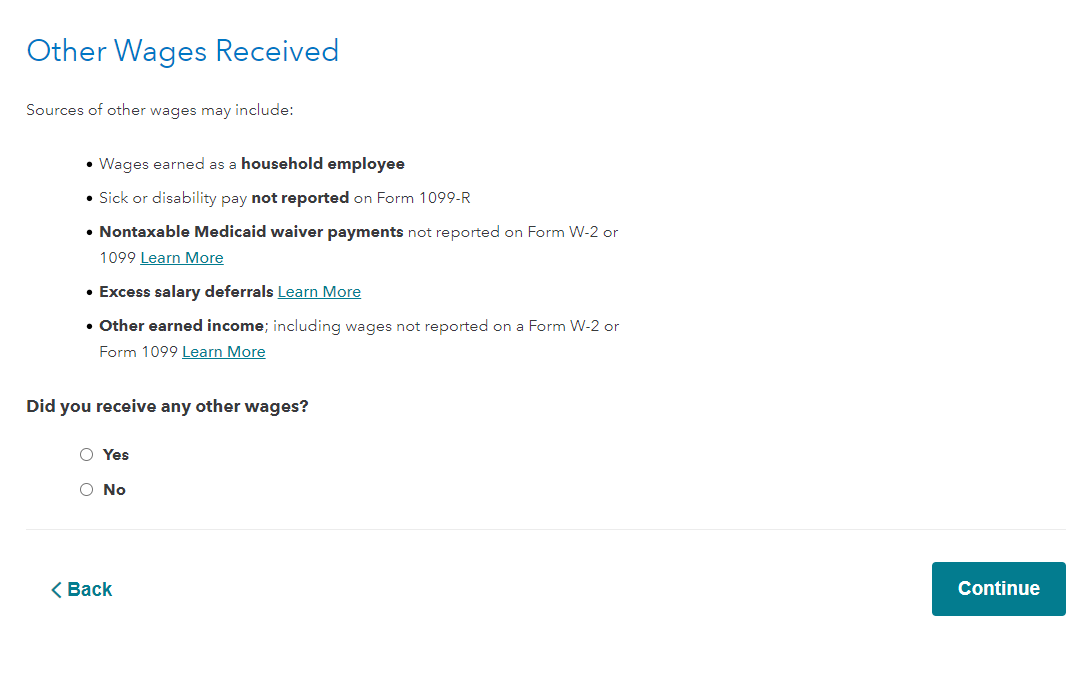

6. On the screen "Other Wages Received" select "Yes" > Continue.

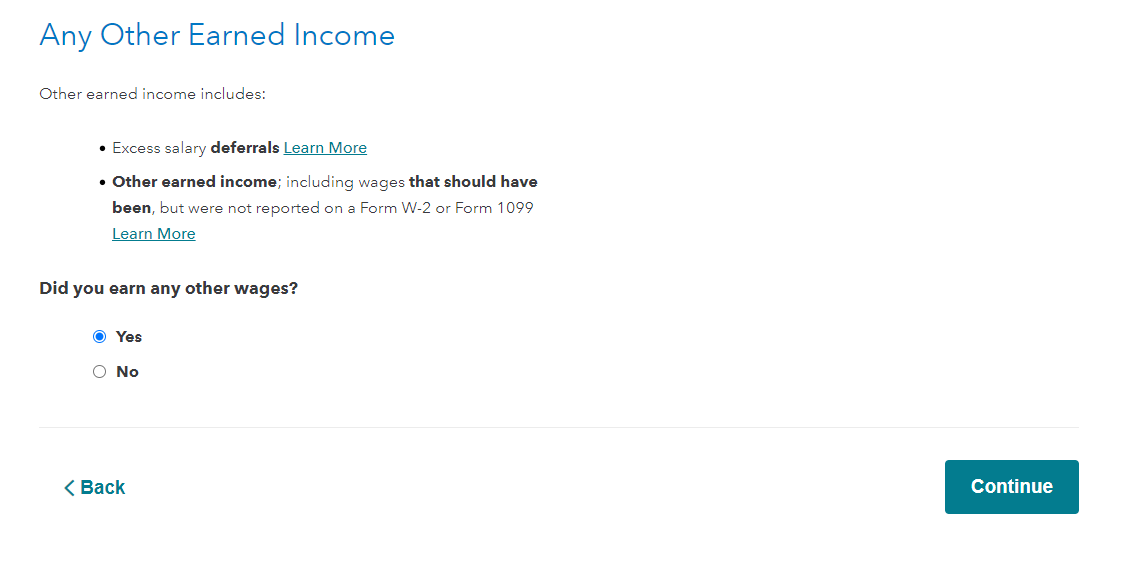

7. On the screen, "Any Other Earned Income" select "Yes" > Continue.

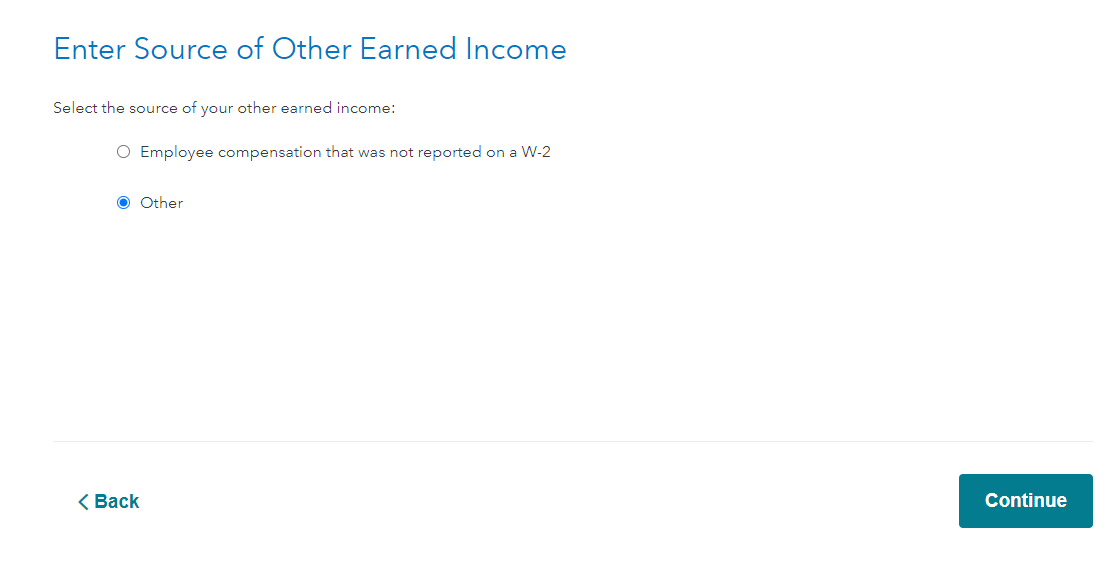

8. In the next screen, select "Other" > Continue

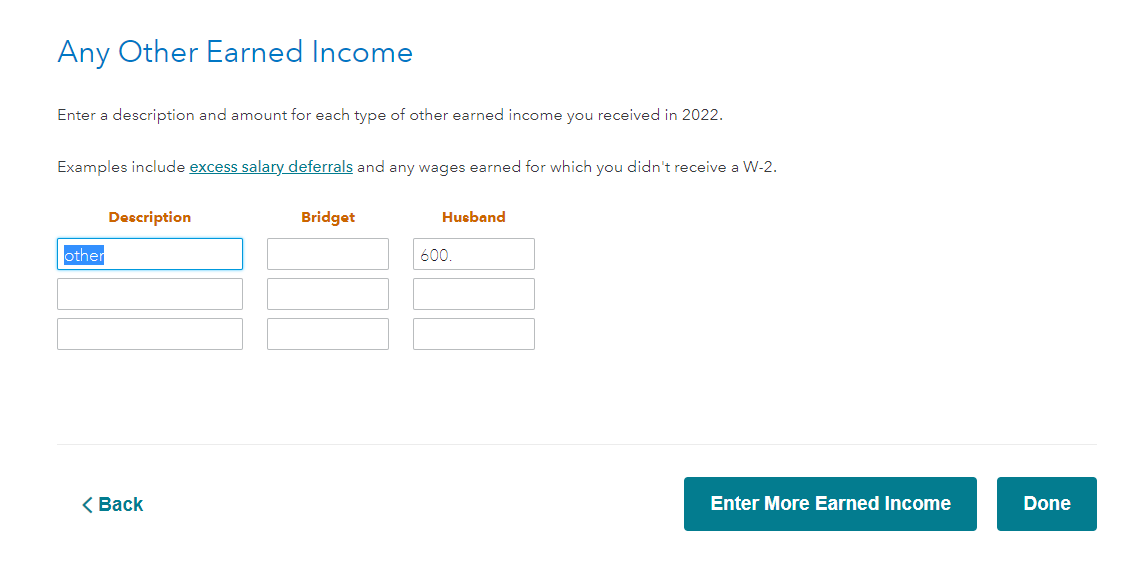

9. On the screen below, enter the description and the amounts of forms 1099-MISC and 1099-NEC.

10. Done.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DeboraWood148

New Member

lauriebrady

New Member

3000NAR

New Member

user17693062481

Returning Member

angelarsanders04

New Member