- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

The amount in box 10 of the 1099-MISC is the amount that should be entered in the question, " How much of this is taxable?' Attorney fees are not deductible. Delete forms Schedule C, Schedule C Worksheet , 1099-MISC and 1099-NEC if you have entered it. Follow the steps below.

To delete Forms these steps:

- Open TurboTax.

- In the panel on the left side, select Tax Tools > Tools.

- Delete a form.

- Delete Schedule C.

- Delete Schedule C Worksheet.

- Delete Form 1099-MISC.

- Delete Form 1099-NEC.

- Sign out of TurboTax.

- Open TurboTax > Continue.

To enter forms 1099-Misc and 1099-NEC.

- Open TurboTax.

- "Pick up where I left off."

- Federal > Wages & Income.

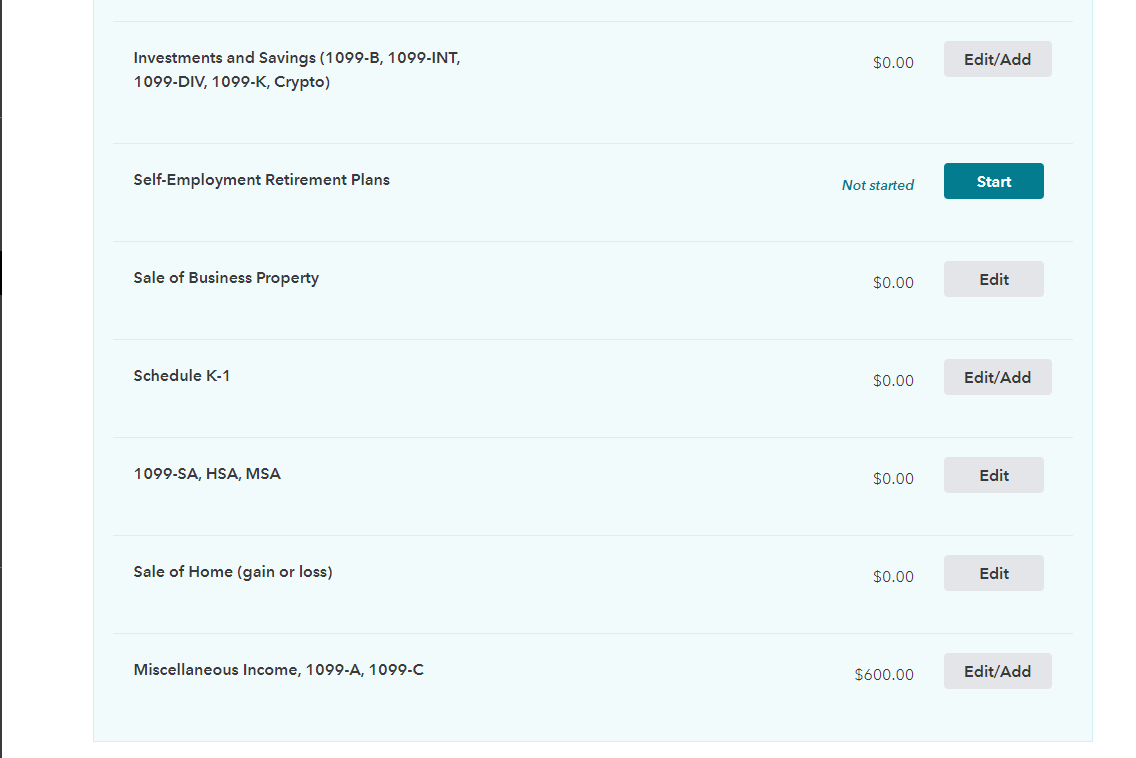

- Scroll to Miscellaneous Income, 1099-A, 1099-C > Edit or Add.

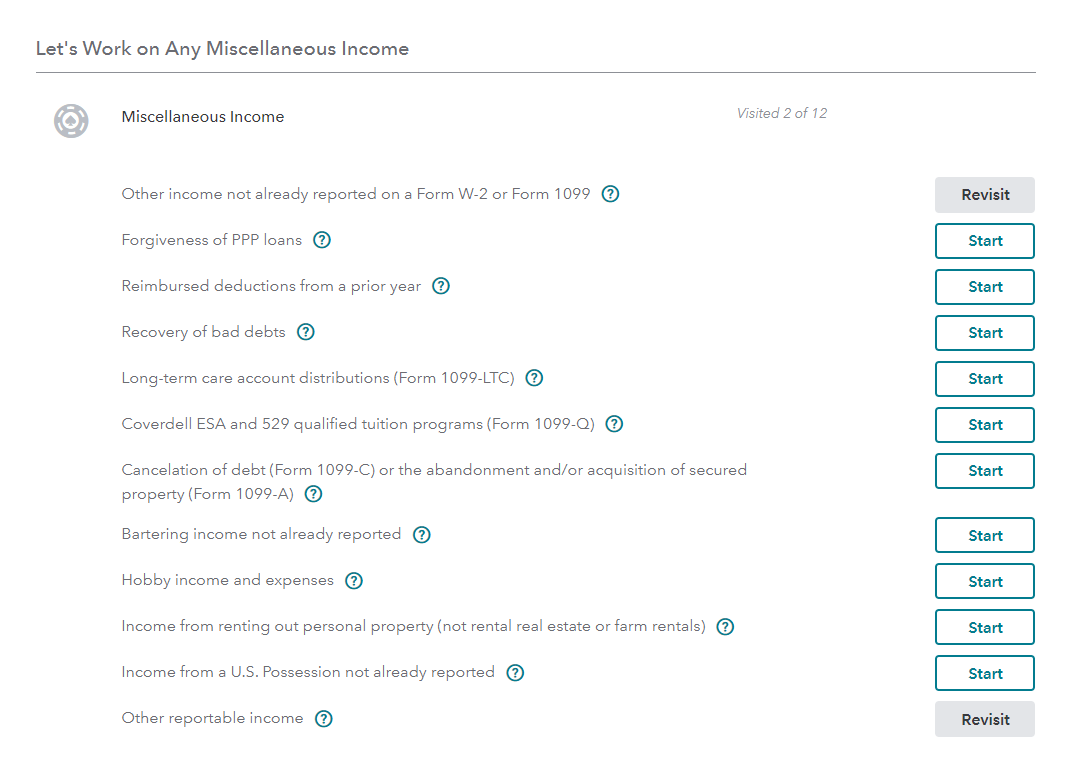

5. "Other income not already reported on W-2 or Form 1099" > Start or Revisit.

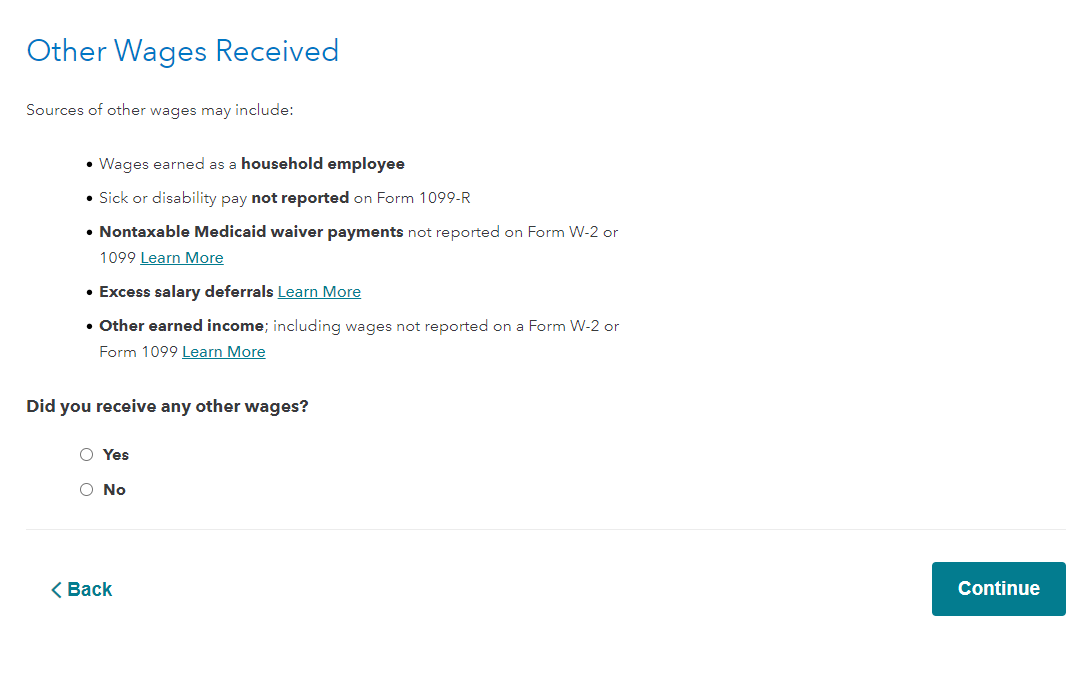

6. On the screen "Other Wages Received" select "Yes" > Continue.

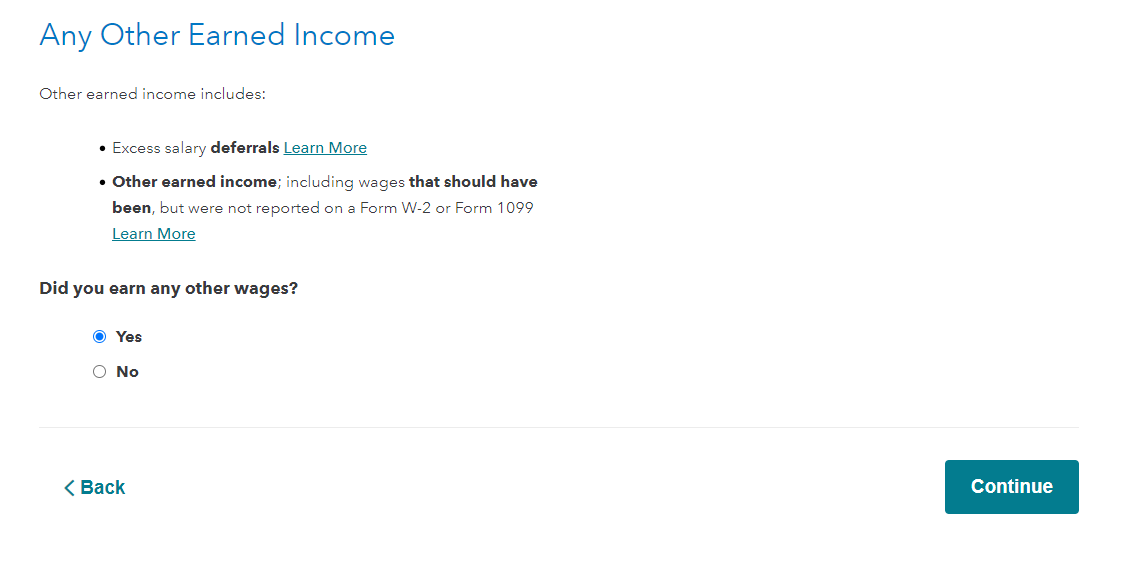

7. On the screen, "Any Other Earned Income" select "Yes" > Continue.

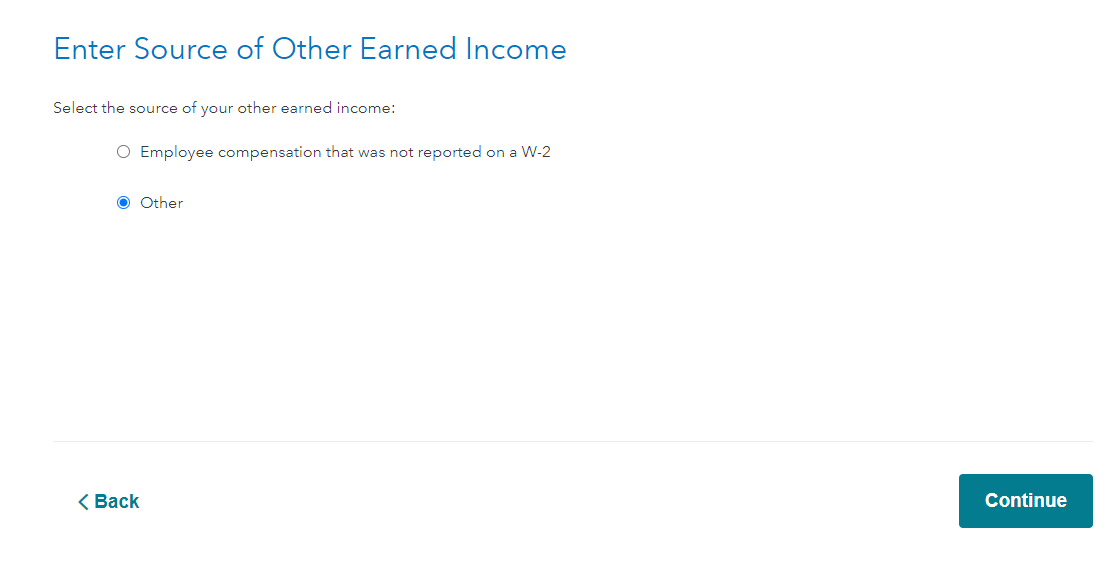

8. In the next screen, select "Other" > Continue

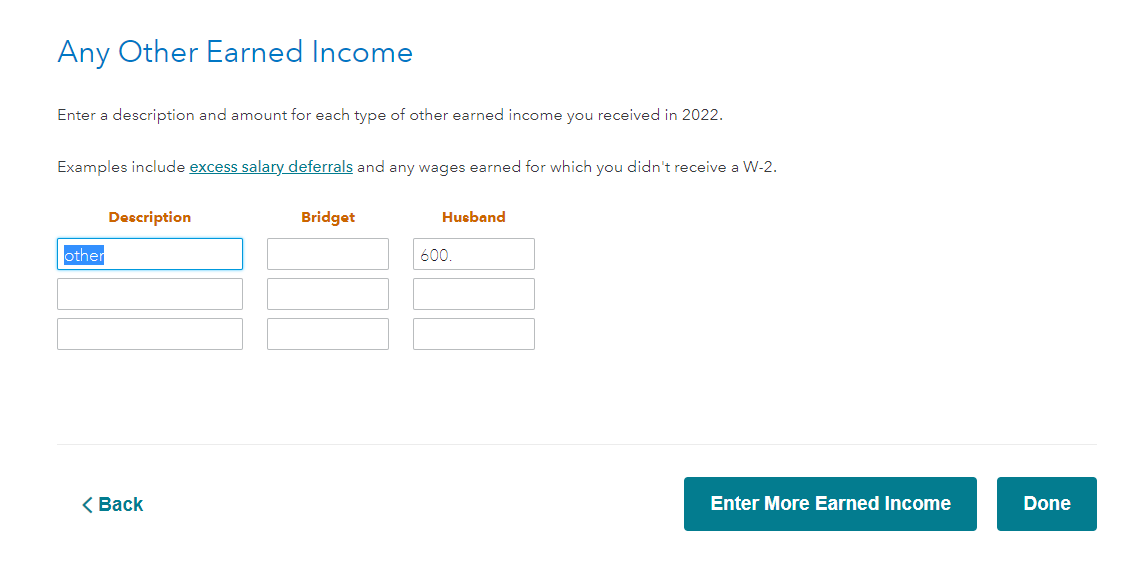

9. On the screen below, enter the description and the amounts of forms 1099-MISC and 1099-NEC.

10. Done.

**Mark the post that answers your question by clicking on "Mark as Best Answer"