in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- 1099-K Smart Check Error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

Using Desktop TurboTax Deluxe Federal+State 2024.

I sold 1 personal item at a loss that PayPay reported on 1099-K. I entered it in the 1099-K section and noted that all items were sold at a loss. Smart Check is stopping me indicating Box 1 isn't checked and I need to select Schedule C, D, E, F or Form 4835. None of these apply.

I have seen advice stating to file the personal item as an investment under the 1099-B section, indicating my cost basis (original price paid) and proceeds (the sale amount). However, I still don't know what to check when Smart Check stops me and tells me I need to check one of those boxes:

[ ] Schedule C

[ ] Schedule D

[ ] Schedule E

[ ] Schedule F

[ ] Form 4835

[ ] Hobby Income

[ ] Other Income

[ ] Personal Property Rental

It indicates in bold that one is required, but checking any of them seems to reduce my refund and indicate that I'm getting taxed on the $1000 I sold a $2200 item for, even with an entry under the 1099-B section indicating that. What do I do here? I don't want to leave it blank and have my return get flagged since one of the boxes is apparently required.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

Did you select "Personal items sales" on the "What type of income is your 1099-K for?"

Did you select "All items were sold at a loss or no gain"

If yes, there should be no smart-check errors.

Please review that entry

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

@KrisD15I reviewed many times... however, I just closed and re-opened TurboTax to take a walk out of frustration and SmartCheck is now not giving any errors. I even deleted the 1099-B entry for the item and SmartCheck is again not reporting errors.

I really dislike the desktop version of TurboTax, and this is now another reason why for putting me through this frustration for over an hour... But I save $50 by buying a code from Costco which you apparently can't use in the online version. Sigh. Thank you for your response, even if the problem seemed to be something cached or otherwise needing the program to be restarted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

Hi, I am having the same issue but in the online version. This error won't go away.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

I'm sorry. I am not able to view the .PNG file.

In TurboTax Premium Online, you are entering the IRS form 1099-K and reporting personal item sales. You are receiving a Review error.

The reporting of personal item sales takes two steps:

- The first step is entering the IRS form 1099-K and reporting personal items sales.

- The second step is reporting the sales on Schedule D of the Federal 1040 tax return.

In TurboTax Online, to report Personal item sales, follow these directions.

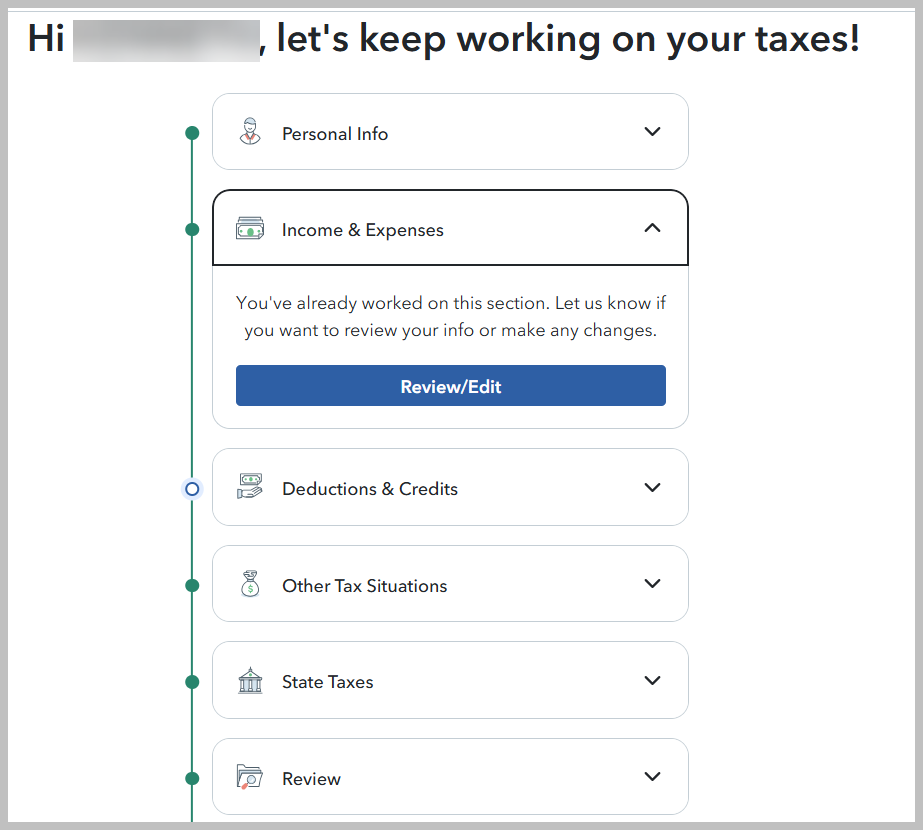

- Down the left side of the screen, click Federal.

- Down the left side of the screen, click Wages & Income.

- Click the down arrow to the right of Other Common Income.

- Click to the right of Form 1099-K.

- At the screen Did you get a 1099-K?, select Yes.

- At the screen How would you like to upload your 1099-K? click Type it in myself.

- At the screen Which type of income is your 1099-K for, select the button for Personal item sales. Click Continue.

- At the screen Let's get the info from your 1099-K, enter the information.

- Click Continue.

- At the screen Personal Item Sales, click Continue.

- At the screen Your 1099-K summary, notice that the income relates to ‘Personal Items’. Click Done.

- At the screen Your income and expenses, scroll down to Investments and Savings (1099-B, 1099-K….). Click the down arrow.

- To the right of Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B), select Start/Revisit.

- At this screen, you will be asked to Review the Personal item sales (1099-K). Click Review.

- At the screen Now, enter one sale…., answer questions about the personal item sale. Click Continue.

- At the screen, Let us know if any of these situations apply to this sale, sales expenses may be recorded.

The entry will be reported:

- on Schedule D of the Federal 1040 tax return, and

- on line 7 of the Federal 1040 tax return.

Capital loss for a personal item sale reports $0 capital gain on line 7 of the Federal 1040 tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

There is no "revisit" option on the online version of turbotax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

Yes, I understand that. What I am saying is that the thing we need to “revisit” isn’t there. There is no option to review personal item sales reported on a 1099K

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

Please clarify if you are not able to work through the entry screens for Form 1099-K again for the entry you have already made by choosing "Edit" next to Income from Form 1099-K?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

@JamesG1 Thanks I was able to resolve this by contacting Turbotax chat support. After escalation, the solution was to first delete the existing 1099-K and then add it back through Other Common Income. It's a software bug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

I tried this and all the other proposed solutions above, and none of them work for me. I still have the error and it tells me I have 1 item to fix.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

Are you reporting an IRS form 1099-K and personal item sales?

If so, the posting of IRS form 1099-K for personal item sales is a two-step process.

- First, you post the IRS form 1099-K amount of box 1a.

- Second, you post the IRS form 1099-B Proceeds From Broker and Barter Exchange Transactions to report the sales proceeds, cost basis and selling costs.

Make sure that the amount reported on the IRS form 1099-K box 1a equals the Proceeds reported for the multiple entries of IRS form 1099-B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

There is no way for me to enter personal item sales in a 1098-B. At least the online version doesn’t allow me to.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

What version of TurboTax are you using? IRS form 1099-B is supported in the Premium Online version. It is not supported in the Free, Basic or Deluxe Online versions.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-K Smart Check Error

There you go! It's not a glitch, it's a feature lol

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jamiemr

New Member

chief120

New Member

lookto0411

New Member

user17697975098

New Member

jimm-wisc

Level 1