- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Yes, you can use TurboTax to prepare your return as a own...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I became a lease purchase/owner operator truck driver. Is turbotax set up to where I can put in all deductions that pertains to the trucking/transportation industry?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I became a lease purchase/owner operator truck driver. Is turbotax set up to where I can put in all deductions that pertains to the trucking/transportation industry?

[Edited 11/15/2019] Removed old answer that doesn't apply to 2018 taxes.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I became a lease purchase/owner operator truck driver. Is turbotax set up to where I can put in all deductions that pertains to the trucking/transportation industry?

Do you obtain and upload 1099 from each and every broker/customer you run a load for?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I became a lease purchase/owner operator truck driver. Is turbotax set up to where I can put in all deductions that pertains to the trucking/transportation industry?

No. You should only get a 1099Misc at the end of the year from anyone who pays you $600 or more during the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I became a lease purchase/owner operator truck driver. Is turbotax set up to where I can put in all deductions that pertains to the trucking/transportation industry?

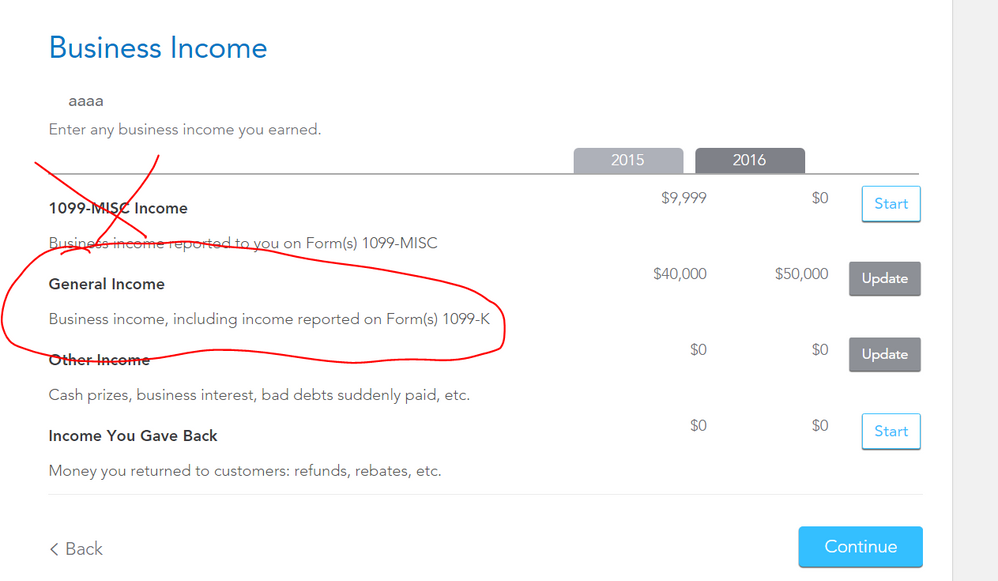

Ok ... a couple of items of note ... in the TT program if you are filing a Sch C you can skip the 1099 income section and simply enter all your income (from your records) in the general income section. The individual entries of the 1099 forms in the program is for YOUR use only ... the IRS doesn't need or want that info since they get it from the issuers already ... on the Sch C the income total is all they want and get.

Next ... when entering in the truck expenses ... do NOT NOT NOT use the vehicle expenses section... that is ONLY for automobiles not big rigs.

If you have net self employment income of $400 or more you have to file a schedule C in your personal 1040 return for self employment business income. You may get a 1099-Misc for some of your income but you need to report all your income. So you need to keep your own good records. Here is some reading material……

IRS information on Self Employment….

http://www.irs.gov/Businesses/Small-Businesses-&-Self-Employed/Self-Employed-Individuals-Tax-Center

Publication 334, Tax Guide for Small Business

http://www.irs.gov/pub/irs-pdf/p334.pdf

Publication 535 Business Expenses

http://www.irs.gov/pub/irs-pdf/p535.pdf

There is also QuickBooks Self Employment bundle you can check out which includes one Turbo Tax Home & Business return....

http://quickbooks.intuit.com/self-employed

Self Employment tax (Scheduled SE) is generated if a person has $400 or more of net profit from self-employment on Schedule C. You pay 15.3% for 2014 SE tax on 92.35% of your Net Profit greater than $400. The 15.3% self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. So you get social security credit for it when you retire. You do get to take off the 50% ER portion of the SE tax as an adjustment on line 27 of the 1040. The SE tax is already included in your tax due or reduced your refund. It is on the 1040 line 57. The SE tax is in addition to your regular income tax on the net profit.

PAYING ESTIMATES

For SE self employment tax - if you have a net profit (after expenses) of $400 or more you will pay 15.3% for 2015 SE Tax on 92.35% of your net profit in addition to your regular income tax on it. So if you have other income like W2 income your extra business income might put you into a higher tax bracket.

You must make quarterly estimated tax payments for the current tax year (or next year) if both of the following apply:

- 1. You expect to owe at least $1,000 in tax for the current tax year, after subtracting your withholding and credits.

- 2. You expect your withholding and credits to be less than the smaller of:

90% of the tax to be shown on your current year’s tax return, or

100% of the tax shown on your prior year’s tax return. (Your prior year tax return must cover all 12 months.)

To prepare estimates for next year, You can just type W4 in the search box at the top of your return , click on Find. Then Click on Jump To and it will take you to the estimated tax payments section. Say no to changing your W-4 and the next screen will start the estimated taxes section.

OR Go to….

Federal Taxes or Personal (H&B version)

Other Tax Situations

Other Tax Forms

Form W-4 and Estimated Taxes - Click the Start or Update button

You can prepare the estimated payments in the program but you cannot pay them thru the program ... you will either mail them in OR pay directly online at the federal & state web sites.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ahkhan99

New Member

bees_knees254

New Member

user17548719818

Level 1

botin_bo

New Member

dc20222023

Level 3