- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Why is "Other taxes" so high? Can I get more detail?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is "Other taxes" so high? Can I get more detail?

There is no breakdown, so I'm confused. This increased hundreds of dollars after I manually entered Roth and traditional IRA excess contribution corrective distributions. I expected no tax. No time passed between the contributions and the corrections, nothing had been invested, so there were no earnings.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is "Other taxes" so high? Can I get more detail?

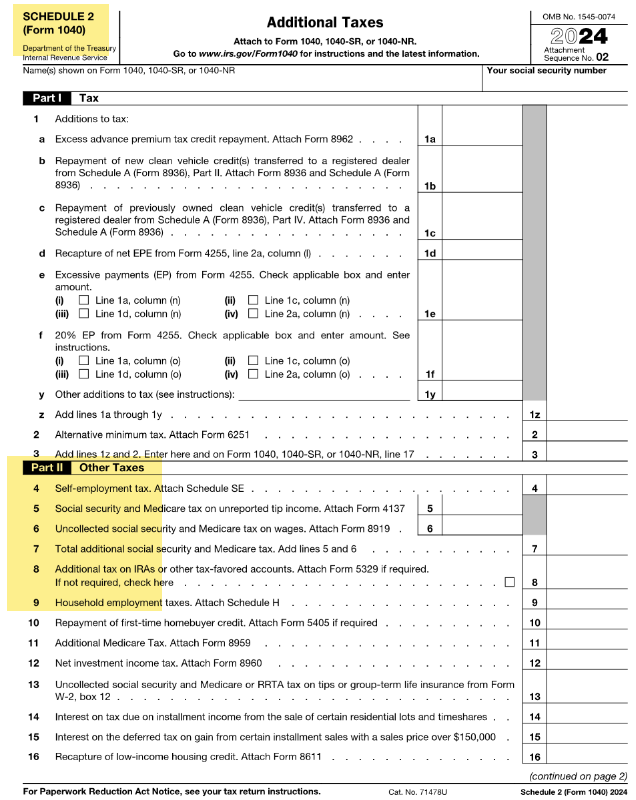

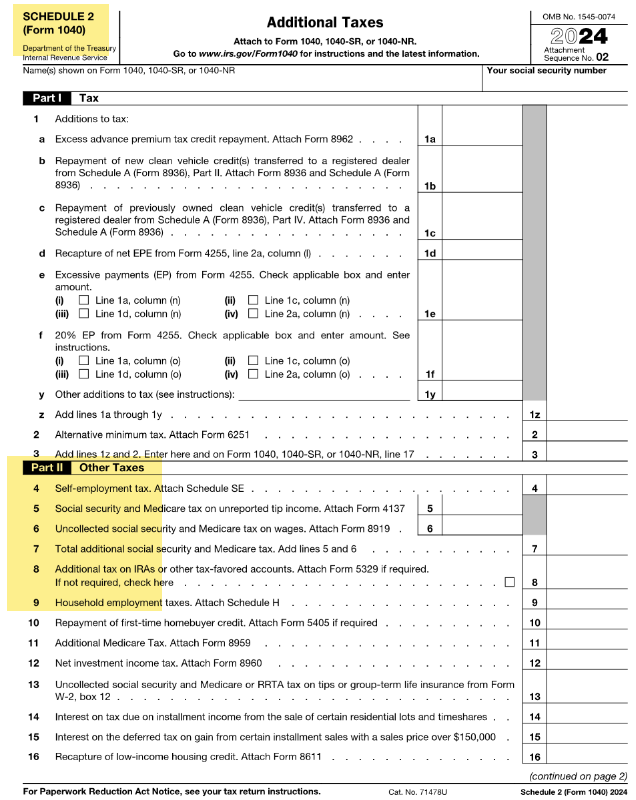

Yes, you can. You may need to revisit your corrective contribution entries. Form 5329 will show you the Additional tax on your IRAs.

To see what the ''other taxes'' are, preview Form 1040 and look at Schedule 2, Part ll. When you preview Form 1040, Schedules 1, 2, and 3 will also be visible; just scroll down past Form 1040.

How to Preview Form 1040 in TurboTax Online.

Use Forms Mode if you are using the desktop software.

Here is a snapshot of a blank Schedule 2. See Lines 4 and/or 8; those two are the most common.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why is "Other taxes" so high? Can I get more detail?

Yes, you can. You may need to revisit your corrective contribution entries. Form 5329 will show you the Additional tax on your IRAs.

To see what the ''other taxes'' are, preview Form 1040 and look at Schedule 2, Part ll. When you preview Form 1040, Schedules 1, 2, and 3 will also be visible; just scroll down past Form 1040.

How to Preview Form 1040 in TurboTax Online.

Use Forms Mode if you are using the desktop software.

Here is a snapshot of a blank Schedule 2. See Lines 4 and/or 8; those two are the most common.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

sudiptobala05

New Member

alex162

New Member

odunham

New Member

h_resat

Level 1

skinnynic

Level 1