- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Why does having HDHP lower my refund after entering HSA information? If I select "no coverage" then my refund dramatically increases!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does having HDHP lower my refund after entering HSA information? If I select "no coverage" then my refund dramatically increases!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does having HDHP lower my refund after entering HSA information? If I select "no coverage" then my refund dramatically increases!

The person that has the HSA plan needs to enter info about their HDHP coverage. If you had an HSA, and then indicate that you had no HDHP, your refund should go down, as you got a tax break for HSA contributions reported on your W-2.

If your spouse has the HDHP plan, for example, you would correctly indicate 'No coverage' for yourself, even if their plan was a Family Plan that covered you also.

This section can be somewhat confusing, so you may want to re-check your entries there.

Here's more info on HDHP Coverage.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does having HDHP lower my refund after entering HSA information? If I select "no coverage" then my refund dramatically increases!

Well, that isn't what's happening with TT. If I select that I did have an HDHP, my federal refund drops from $700+ to just $54! If I select that I didn't have coverage, then my federal refund jumps back up to $700. So this suggests that I am being taxed (very heavily) for having a health care plan. All this AFTER entering my HSA information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does having HDHP lower my refund after entering HSA information? If I select "no coverage" then my refund dramatically increases!

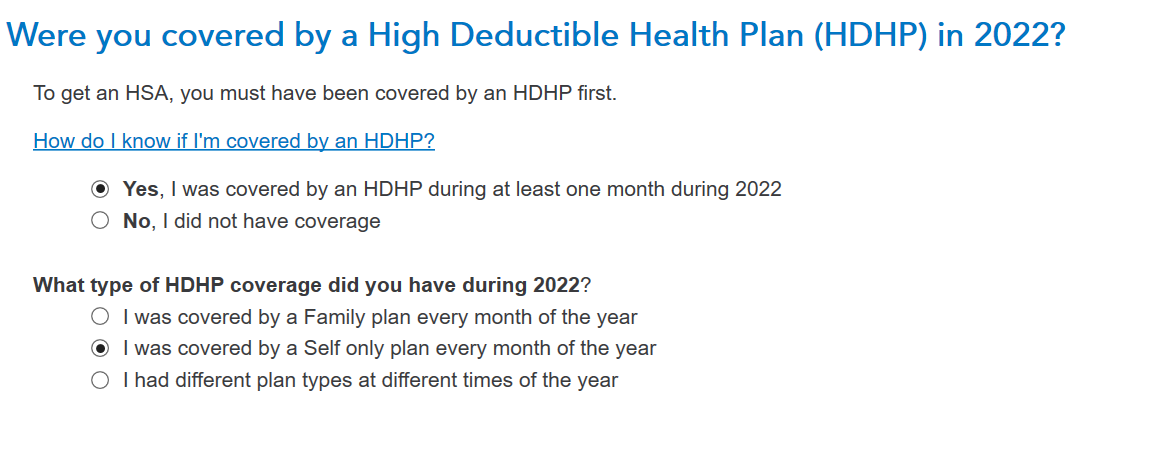

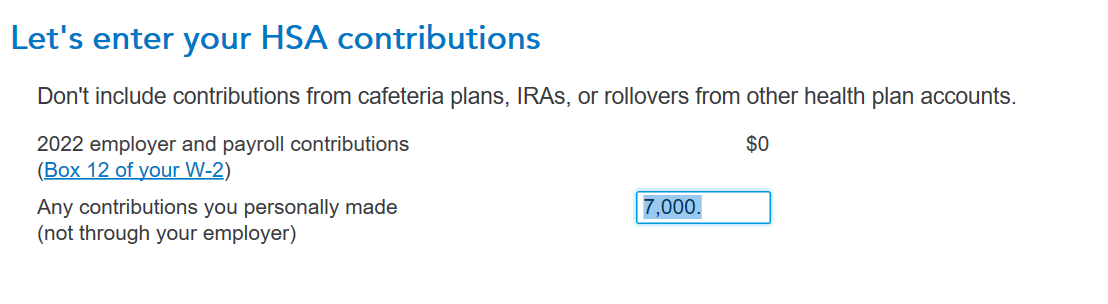

It is possible that you are being penalized for over-contributing to your HSA plan. This can happen if you choose the wrong type of coverage on the page in TurboTax that says Were you covered by a High Deductible Health Plan (HDHP) in 2022? You need to make sure you answered that question properly.

Also, on the page where you are asked about your contributions, you need to make sure you don't enter contributions that are already entered on your W-2 form, from your employer:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does having HDHP lower my refund after entering HSA information? If I select "no coverage" then my refund dramatically increases!

Hello,

Your screenshot confirms that I answered those questions correctly. Also, I made sure NOT to add anything in for additional contributions. My total contributions were only $2800. If I say yes to having an HDHP, I lose $700. If I say I had no coverage, my federal refund jumps back up.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does having HDHP lower my refund after entering HSA information? If I select "no coverage" then my refund dramatically increases!

This may be a matter of timing. If you say that you have HSA contributions through your employer, then the contributions are considered taxable until you demonstrate adequate HDHP coverage. Since HSA contributions through your employer are removed from Wages before your W-2 is printed, the contributions have to be added back to income (making your taxes go up temporarily) until you go through the HSA interview.

I see that you said that your refund goes down when you say that you have HDHP coverage. This, of course, is not right. We encourage taxpayers not to watch the Refund Meter too closely because there are things happening in the background that are out-of-sync with your return.

Since you believe that you have entered everything correctly, tell us step by step (in excruciating detail) what you entered vis-à-vis your HSA, and when the Refund Meter changed either up or down.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does having HDHP lower my refund after entering HSA information? If I select "no coverage" then my refund dramatically increases!

the HSA rules say that if either spouse has family coverage, both spouses are treated as having family coverage so yo must check family coverage in the HSA section regardless of who had the HSA. checking no HDHP coverage for the taxpayer having the HSA would mean no HSA contribution is allowed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why does having HDHP lower my refund after entering HSA information? If I select "no coverage" then my refund dramatically increases!

"If your spouse has the HDHP plan, for example, you would correctly indicate 'No coverage' for yourself, even if their plan was a Family Plan that covered you also."

Wrong. The name on the policy is irrelevant. All that matters is who the policy covers.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

RyanK

Level 2

alicia-bmgl-herrick

New Member

user17545162733

New Member

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

rolfarber

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

timulltim

Level 1

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill