- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Why do I see a positive number ($329) for "Medical Expenses" when I have NOT added any medical expenses?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I see a positive number ($329) for "Medical Expenses" when I have NOT added any medical expenses?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I see a positive number ($329) for "Medical Expenses" when I have NOT added any medical expenses?

Since we cant' see your return in this forum, most likely the $329 for Medical Expenses is being transferred from a W-2, a 1099-R, SSA-1099, 1095-A, or another document, since you didn't enter it yourself.

If you are using TurboTax Online, once you have paid for your return, look at the Medical Expenses Worksheet to see what the expense was.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I see a positive number ($329) for "Medical Expenses" when I have NOT added any medical expenses?

Thank you so much for the response @MarilynG1! I am using TurboTax Self Employed online, and we do have only a Form 1095-A, We do not have W2-s, or any of the other forms you have mentioned. Our self employed income is from K-1s, if that matters.

I also just spent almost an hour on the phone with TT support to no avail - we deleted the medical expenses form, which did not reset that number. By now, I assume it is being added automatically, likely mysteriously related to the 1095-a.

Thank you for the advise that I must pay, so I can see the worksheets. I am not willing to pay $179 for a product that automatically adds numbers without any information whatsoever. Phone support wasted a lot of my time as well. TT is the most expensive product out there, so I am starting to consider other options.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I see a positive number ($329) for "Medical Expenses" when I have NOT added any medical expenses?

Sounds like you had to pay back part of the subsidy. If you went to an exchange for Health Insurance, and had to pay back some of the subsidy, part of the adjustment will flow to Schedule A. I would not worry about any Medical showing up on schedule A. You probably don't have enough Medical to deduct. And most people are taking the Standard Deduction now anyway. So it won't affect anything.

But if you have self employment income you can deduct it directly on the 1040 against your schedule C if you have a Net Profit.

If you enter the 1095-A and select the "Self-employed and bought a Marketplace plan" box, it will automatically include those premiums in the SE Health Insurance section.

You can deduct self employed health insurance directly on 1040 Schedule 1 line 16 without going through schedule A and meeting the 7.5% floor.

Self-employed health insurance deduction goes on Form 1040 schedule 1 line 16, as long as the expense is not greater than your net self-employment income. If it does exceed your net self-employment income it gets split automatically. An amount equal to your net self-employment income goes on Form 1040 Schedule 1 line 16, and the remainder gets added in to medical expenses on Schedule A.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I see a positive number ($329) for "Medical Expenses" when I have NOT added any medical expenses?

Thank you @VolvoGirl! Our self-employment income is from Schedules K-1, so we do not file with schedule C anyway. That said, I do not actually see any forms, schedules and worksheets, as I am using the online product. The medical expenses do not affect my federal return, however they do affect my NJ State return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why do I see a positive number ($329) for "Medical Expenses" when I have NOT added any medical expenses?

Hello @MarilynG1,

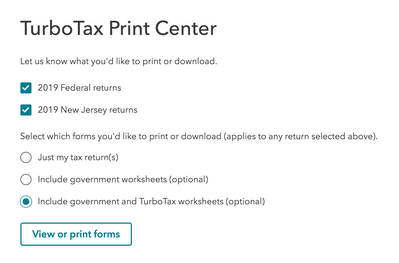

After all, I went trough the online product and submitted payment. I looked trough the documents I can print (the version that is supposed to have all worksheets) and did not find any medical expenses worksheet.

On my printed NJ return forms I see the following line with a large lump sum:

Medical Expenses (Worksheet F and instructions page 22) , but there is NO such worksheet included.

This is EXTREMELY frustrating :(

How can I see the "Medical Expenses Worksheet" as you suggested trough the online product? Is there anything I am missing?

Thank you for your help.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

nex

Level 1

Viking99

Level 2

sam992116

Level 4

user17558084446

New Member

Idealsol

New Member