- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Where exactly in schedule c do I enter business mileage?? Can't find it. I only find w-2 mileage, but not self employed mileage?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where exactly in schedule c do I enter business mileage?? Can't find it. I only find w-2 mileage, but not self employed mileage?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where exactly in schedule c do I enter business mileage?? Can't find it. I only find w-2 mileage, but not self employed mileage?

No, you need to add the Vehicle category of expenses.

To do this in TurboTax Online you can follow these steps:

- Within your tax return use the magnifying glass icon to search for Schedule C

- Click the Jump to link

- Click Edit for the line of work

- Scroll down to Expenses and click Start or Edit if the category you want is shown

- If you don't see the category you want listed click Add expenses for this work

- Scroll to and mark the box for the category of expense you want to add - if you don't see it on the list, scroll down to the Less Common section and click the down arrow and show more until you do

- Click Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where exactly in schedule c do I enter business mileage?? Can't find it. I only find w-2 mileage, but not self employed mileage?

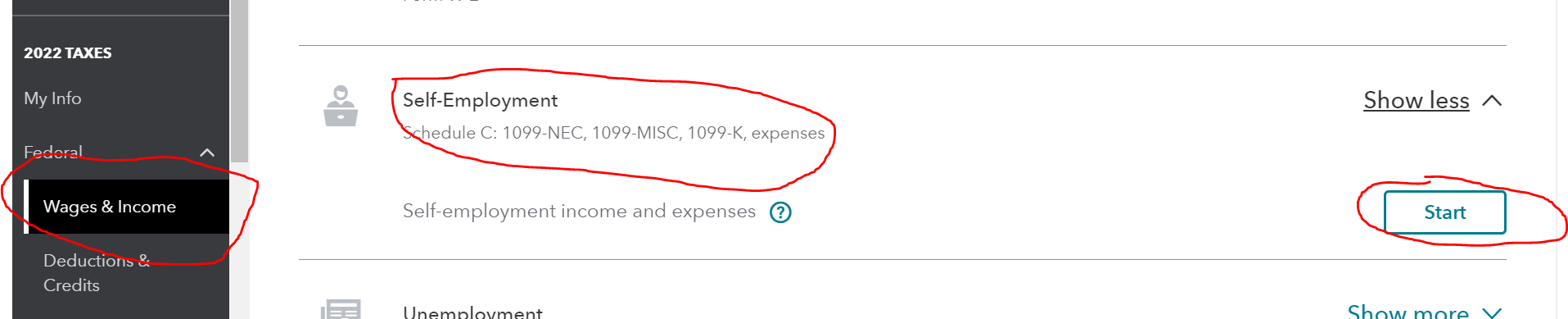

You have to be in the Self-employment income section. As you are going through that section, it will ask if you used your vehicle for business, answer "yes" and TurboTax will guide you through to enter the information about your vehicle.

To get back to that section,

- click "Wages and Income" on the left panel,

- then "Self-employment Income"

- Click "start"

Please note, you will have to upgrade to our Self-employment package in order to deduct business expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where exactly in schedule c do I enter business mileage?? Can't find it. I only find w-2 mileage, but not self employed mileage?

When I click on the self-employment tab that you circled, it takes me to the page that has all the expenses/deductions I already entered: from top to bottom Assets, Supplies, Advertising, Meals, Legal and Prifessional fees, Office Expenses, Business Insurance and Other Misc expenses. It never asked me about using a vehicle and there is no where to enter it as a deduction. Do I need to delete everything I entered and start all over?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where exactly in schedule c do I enter business mileage?? Can't find it. I only find w-2 mileage, but not self employed mileage?

No, you need to add the Vehicle category of expenses.

To do this in TurboTax Online you can follow these steps:

- Within your tax return use the magnifying glass icon to search for Schedule C

- Click the Jump to link

- Click Edit for the line of work

- Scroll down to Expenses and click Start or Edit if the category you want is shown

- If you don't see the category you want listed click Add expenses for this work

- Scroll to and mark the box for the category of expense you want to add - if you don't see it on the list, scroll down to the Less Common section and click the down arrow and show more until you do

- Click Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where exactly in schedule c do I enter business mileage?? Can't find it. I only find w-2 mileage, but not self employed mileage?

This worked! Thank you so much!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17549282037

New Member

tbduvall

Level 4

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

ripepi

New Member

fkinnard

New Member

user17525224124

New Member