- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Wash Sale Loss

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash Sale Loss

From 1099B for 2022 shows wash sale loss disallowed (Box 1g) for stock sold in 2022. All of this stock was sold by August of 2022. When Form 1099B is imported, Turbo Tax excludes the wash sale loss. Is there a way to manually adjust the loss to properly include the wash loss for 2022 when the Form 1099B has been imported?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash Sale Loss

Yes, you can edit any of the entries in the 1099-B.

Review the underlying stock for the Wash Sale. The Wash Sale should close, and the underlying stock should have an increased basis based on previous Wash Sale losses.

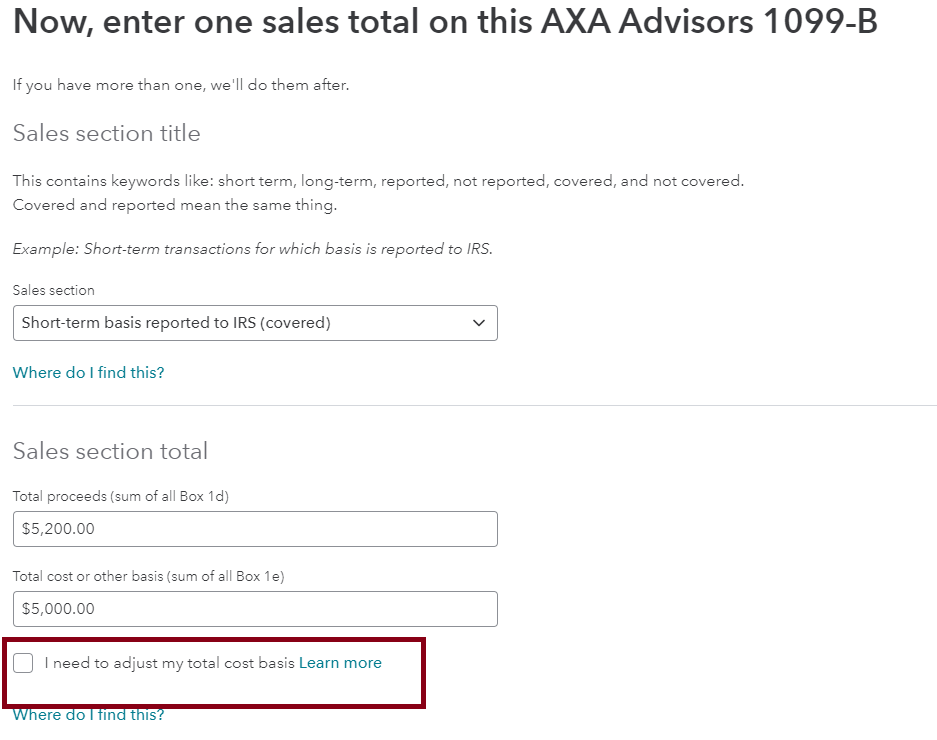

To get into the 1099-B so you can edit it.

- Start at Federal

- Wages and Income

- Scroll to Investments & Savings

- Select Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B) [Start or Revisit]

- Did you have investment income in 2022? - Yes

- Get ready to be impressed Continue.

- Select Enter a different way.

- Choose the Box Stocks, Bonds, Mutual Funds Continue

- You will see a listing by broker.

- Select the area you want to edit.

- As you enter the dates and proceeds, there is a check box for The cost basis is incorrect or missing on my 1099‑B

- Use this option to correct any errors on a cost basis.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash Sale Loss

not sure what's happening in Turbotax. if there was a wash sale in 2022 and you imported that should have been part of the imported info. the disallowed loss is supposed to be added by the broker to the shares bought that created the wash sale. if those shares are sold before year end then the added basis reduces gain or increase loss so in effect it's like the wash sale never occurred.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash Sale Loss

Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Wash Sale Loss

Yes Mike, you are correct. I was not ready the Form 1099B. The import is correct. Thanks!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

20bill-mca

New Member

VJR-M

Level 1

trust812

Level 4

starkyfubbs

Level 4

CaPattie4

Level 1