- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

Yes, you can edit any of the entries in the 1099-B.

Review the underlying stock for the Wash Sale. The Wash Sale should close, and the underlying stock should have an increased basis based on previous Wash Sale losses.

To get into the 1099-B so you can edit it.

- Start at Federal

- Wages and Income

- Scroll to Investments & Savings

- Select Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B) [Start or Revisit]

- Did you have investment income in 2022? - Yes

- Get ready to be impressed Continue.

- Select Enter a different way.

- Choose the Box Stocks, Bonds, Mutual Funds Continue

- You will see a listing by broker.

- Select the area you want to edit.

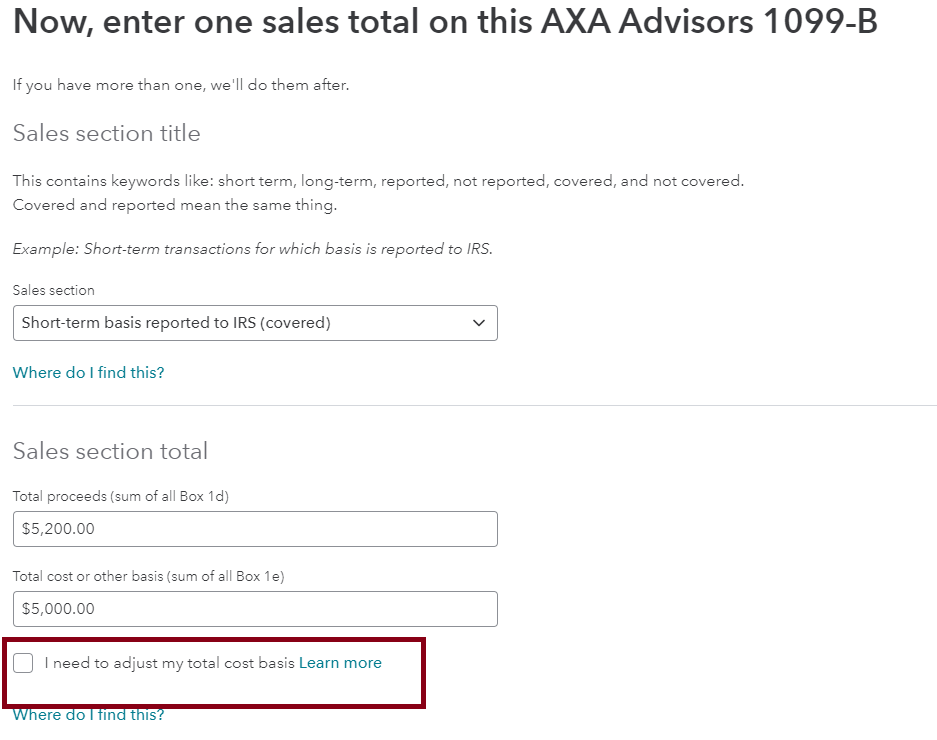

- As you enter the dates and proceeds, there is a check box for The cost basis is incorrect or missing on my 1099‑B

- Use this option to correct any errors on a cost basis.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 8, 2023

11:03 AM