- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Underpayment Penalty - Annualized Method

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment Penalty - Annualized Method

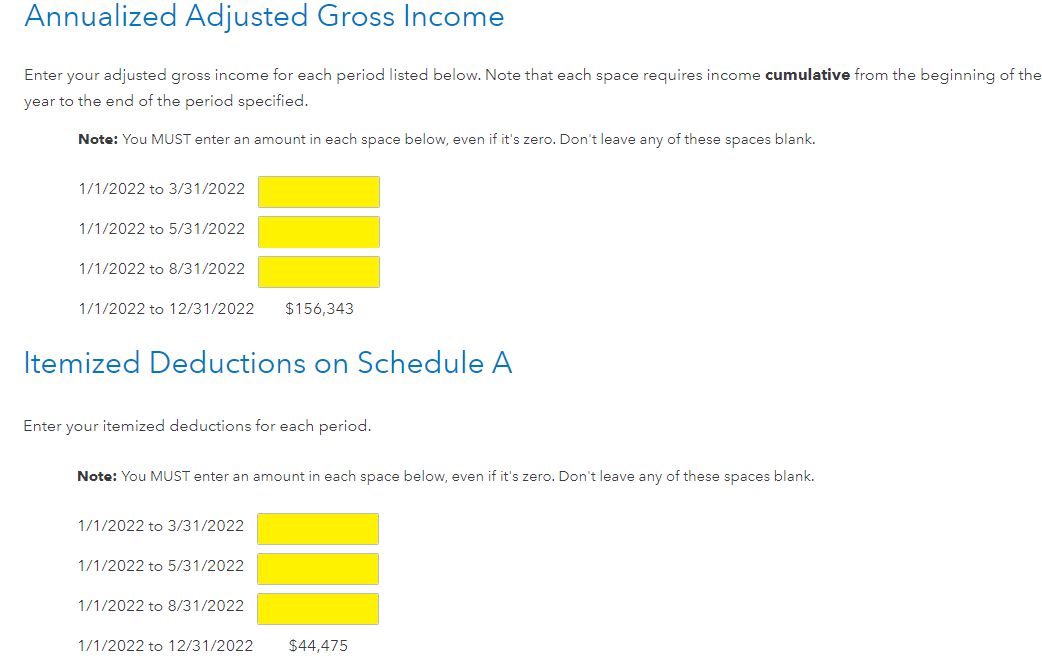

We had medical expenses every month in 2022 which exceeded 7.5% of our Adjusted Gross Income (AGI) for the month. In using the Annualized Method to esimate the underpayment penalty, TurboTax asked for our accumulated AGI and accumulated temized Deduction in the first three quarters as it had already computed our anual AGI and Itemzied Deduction totals from the data entered and gave them in the interview process (dialog boxes) used for the Annualized Method.

How did TurboTax compute the accumulated Annual AGI and Anuual Itemized Deduction which appear to be different from the numbers from our own spread sheet. The Annual AGI value should be stright forward as tehy are not affected by any numbers from the Itemized Deductions. On the other hand, the accumulated vlaues of the Itemized Deduction for each of the three quare are giving me trouble.

Should we use the 7.5% criteria in computing the Itemized medical dedcution every month and accumulated the values for each quarter to enter into the dialog boxes?

Thanks very much for the help. Bye.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Underpayment Penalty - Annualized Method

Yes, you should use the 7.5% to compute your medical expense portion of the itemized deductions for each period. Only that excess is being added to the rest of your itemized deductions to calculate the amount for each period. The tax system is 'pay as you go' rule. When you make money they want the tax on that money quarterly. If you made more money at the end of the year or had itemized deductions that were greater towards the last half of the year, then the annualized method will help you reduce the penalty.

Although a total is there from your 2022 itemized deductions you should enter the amount you believe was paid in each period.

- The key is to show you paid more expenses later in the year to reduce the penalty for underpayment.

This is how the annualized income method is supposed to work and to help you, if for example, most expenses were paid at the end of the year, then the penalty would be less because the tax due is based on the amount of taxable income in each period. The annualized method allows you to show your income was earned unevenly and your expenses were paid at different periods and not an average throughout the year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dewdew

Level 1

gomes_f

New Member

jim-krzeminski

New Member

Frank nKansas

Level 3

rjeffreys

New Member