- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

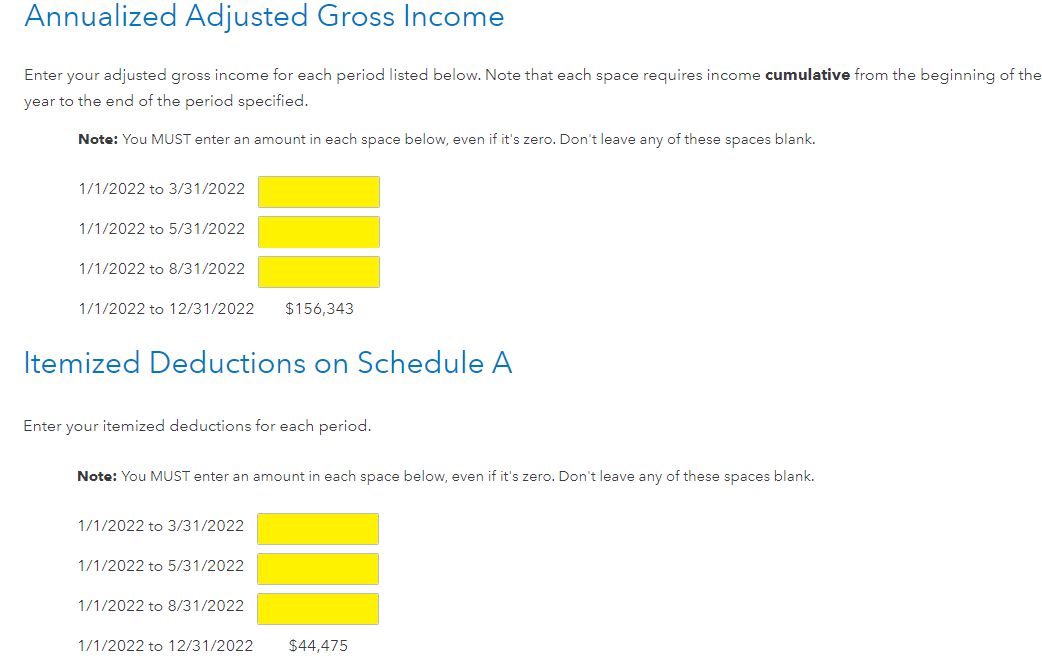

Yes, you should use the 7.5% to compute your medical expense portion of the itemized deductions for each period. Only that excess is being added to the rest of your itemized deductions to calculate the amount for each period. The tax system is 'pay as you go' rule. When you make money they want the tax on that money quarterly. If you made more money at the end of the year or had itemized deductions that were greater towards the last half of the year, then the annualized method will help you reduce the penalty.

Although a total is there from your 2022 itemized deductions you should enter the amount you believe was paid in each period.

- The key is to show you paid more expenses later in the year to reduce the penalty for underpayment.

This is how the annualized income method is supposed to work and to help you, if for example, most expenses were paid at the end of the year, then the penalty would be less because the tax due is based on the amount of taxable income in each period. The annualized method allows you to show your income was earned unevenly and your expenses were paid at different periods and not an average throughout the year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"