- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- uncorrectable “error" on form 2210 line D

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

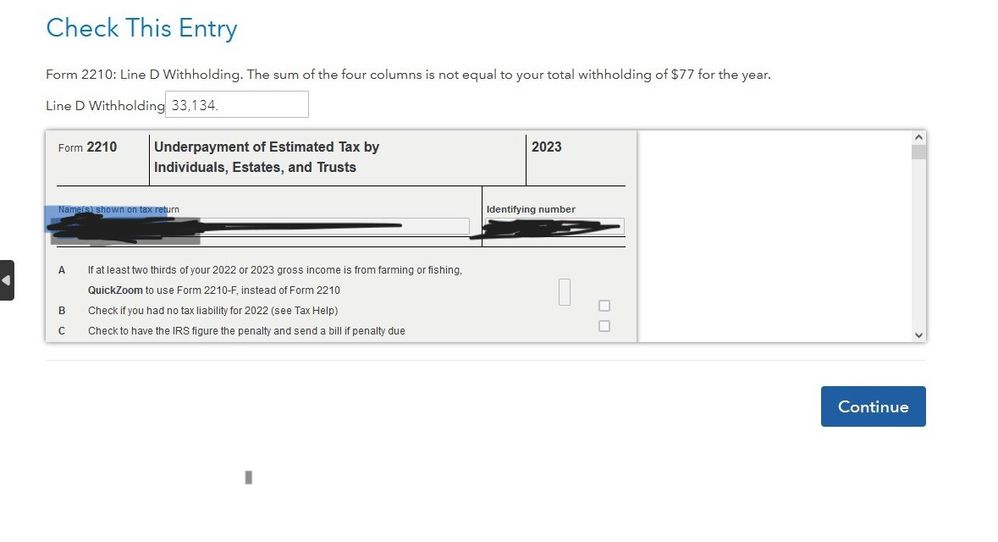

Turbo Tax calculated an underpayment penalty despite a healthy refund. It also asked for us to fix "Form 2210: Line D Withholding. The sum of the four columns is not equal to your total withholding. . . "

The window to the form 2210 only shows 3 possible places to make a correction entry with two columns in the form 2210 sharing one of them. The widow does not allow not allow me to make corrections. It also indicates a very large amount in one of the columns which is a large multiple of the amount we actually had withheld entered during the income part of the tax program.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

same problems. apparently it has been on going for several years and intuit has REFUSED to fix it. we need to some real help people.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

There are two things about the penalty on the underpayment of estimated taxes:

1. You can avoid it if you pay more than a set amount.

2. Even if you pay more than the set minimum, you must pay it out more or less evenly over the course of the year.

This means that getting a refund does not mean you are guaranteed to avoid an underpayment penalty.

Also, can you share with us a screen shot that you are describing (Please ensure that there is no personally identifiable information on it. Thanks!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

Absolutely I appreciate any help I can get to get this resolved. I appreciate it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

Here is the screen shot.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

Thanks to all who reviewed and made suggestions. In the interest of getting my taxes done, I followed the advice I found on this forum from a couple of years back and simply omitted the offending worksheet (and form). When I then ran the online review, everything was good.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

I keep seeing this answer, but I can't figure out for the life of me how to delete Form 2210! I don't see an option to do that anywhere. I accidentally checked D (about amounts withheld or paid) and it was a mistake, and even though I keep going back and marking "no" instead of "yes," it still shows up checked on my final return and won't let me file!!! I'm beyond frustrated. How do you get to a screen where you see an option to delete that form and start over? The only way I can get to it is through the underpayment question, but it just prompts me with questions, I don't see a screen that lists the forms and lets you delete and start over.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

I'm not sure what you checked for "D", but this is a way to delete the 2210.

If you do owe taxes, it will regenerate itself.

On the menu bar on the left.

- Select Tax Tools

- On the drop-down select Tools

- On the Pop-Up menu select Delete a Form

- This will give you all of the forms in your return

- Scroll down to the form you want to delete

- Select the Form 2210

- Click on Delete.

- Always use extreme caution when deleting information from your tax return. There could be unintended consequences.

Please contact us again with any additional questions or to provide some additional details.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

Thank you so much!! That worked. I was afraid I was going to have to sit on the phone with customer service for an hour or delete my entire self-employed income section and start over to get rid of it. Appreciate the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

How can I delete that form??!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

If you are trying to delete Form 2210, in TurboTax Online:

On the menu bar on the left.

- Select Tax Tools

- On the drop-down select Tools

- On the Pop-Up menu select Delete a Form

- This will give you all of the forms in your return

- Scroll down to the form you want to delete

- Select the Form 2210

- Click on Delete.

- Always use extreme caution when deleting information from your tax return. There could be unintended consequences.

If you might owe the underpayment penalty, the form could regenerate.

You could also go through the Underpayment Penalty section in Other Tax Situations and answer the questions. This could result in a change in the penalty calculation.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

Is there a resolution to this error

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

uncorrectable “error" on form 2210 line D

Are you trying to see if you can reduce your underpayment penalty by annualizing your income? The original post was about the Tax withholding, which required you to enter how much of the taxes were paid during each time period. It will also tell the total for what the withholdings need to be.

If you need to delete the under payment penalty form 2210, you can go to Forms mode (if using TurboTax download) by clicking Forms at the far right on the blue banner. Find Form 2110 and click Delete Form, just below the form. In the online version of TurboTax, click on Tax Tools on the left side menu, click Tools, then click Delete a Form. In the listing of forms, find Form 2210 and click the trash can icon to the right of it to delete it.

If these answers don't cover the information you were needing, please provide more detailed information on the question you have, and errors or stumbling blocks that you are having, so that we can better assist you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jtf2

New Member

Michael16

Level 4

bradweitzner

New Member

BPav

New Member

lspenadel32

New Member