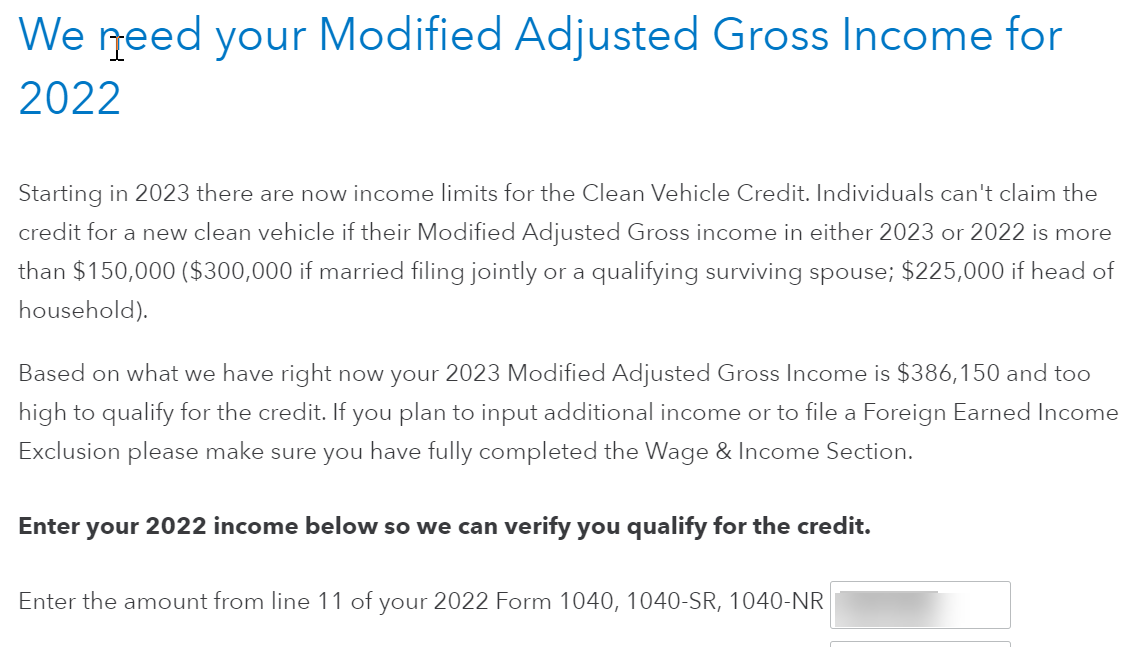

If you go back into the interview for the EV credit in Deductions and Credits, and your current year AGI is over the limit, the next screen after "What kind of Clean Vehicle did you buy in 2023?" will ask (see screenshot):

Enter the prior year amount as indicated. This works for both TurboTax Online and TurboTax Desktop.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"