- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

I have two Form 1116s defined in TurboTax for a foreign tax credit carryover from a prior year:

Copy 1: General Category Income

Copy 2: Passive Category Income

For Copy 2 (passive category income), the foreign tax credit carryover is AMT only (the regular tax credit carryover is zero). For some reason, TurboTax ignores it and neither the Form 1116 nor the carryover statement are present in the final generated tax return PDF.

If it helps, the specific values in the Copy 2 carryover worksheets are:

Foreign Tax Credit Carryovers

None

AMT Foreign Tax Credit Carryovers

Year: 2014

AMT Foreign Taxes: $614

AMT Amount Used: $453

Can Intuit fix this bug so the 1116 and carryover statements for passive income generate correctly?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

To enter your Foreign Tax Carryover from 2018 you should:

- Click on Federal Taxes > Deductions & Credits [In TT Home & Biz: Personal > Deductions & Credits > I'll choose what I work on].

- Scroll down to the Estimates and Other Taxes Paid section.

- Click on the box next to Foreign Taxes.

- On the Foreign Tax Credit screen, click on the Yes box.

- Continue through the interview, entering the requested information.

- You will come to the Carryovers screen. Click the Yes box.

- Enter your carryover amounts on the next screen -- Foreign Tax Credit Carryovers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

@KurtL1 - I'm not sure if you read my original message, but I'm not looking for instructions on how to enter a tax credit carryover - I know how to do that. There seems to be a problem in TurboTax where one of my carryovers is being ignored by the software and not appearing in the final generated return.

Can you address the problem that I described in my original post?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

We have not had any other questions posted on this error on the Foreign Tax Carryover Statements which usually indicates that there is a problem with the software. That itself does not mean there is not a problem with the software.

To be able to see what is causing your problem we would need to see the forms and schedules on your return to determine why the program is not generating the carryover statement correctly. However, we are unable to view your return here in the Community.

To have an Agent look at your return with an Offline Review to answer your question or to schedule a time to talk to an Agent with a Live Review see What is TurboTax Live? - Community

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

I had a similar issue. It worked for my 2016 return but didn’t for 2017 and 2018. Can I use the carryover from 2016 to 2019 return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

I have the same problem. I have a foreign tax credit carryover that also applies to AMT. The AMT amount is different so I need an AMT copy of Form 1116 in the return in order to carry over the AMT credit.

I have no AMT this year and I can't get Turbotax to include an AMT copy of Form 1116 even if I force Turbotax to include Form 6251.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

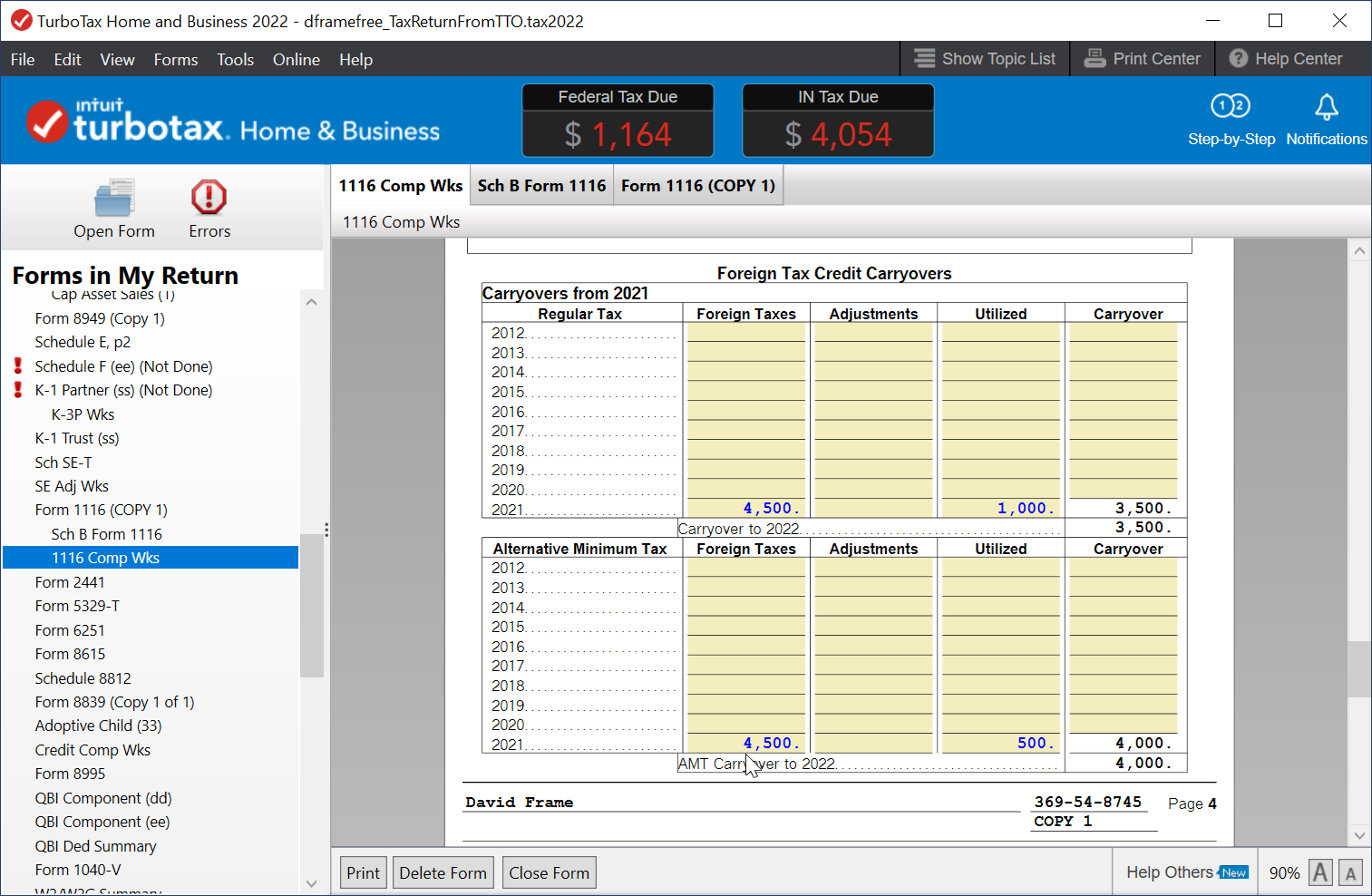

it depends. First of all, if y0u entered the amt carryover from the previous years, all carryover amounts appear on the 1116 Comp Worksheet, which gets filed with your return. It is under a heading called line 21 Section 960 (c) Adjustment Smart Worksheet. Here is an example on what this looks like.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

Hi,

I have that information in the worksheet. There's regular foreign tax credit carryover and AMT foreign tax credit carryover from past years (see Form 1116 Worksheet screenshot).

The problem that while Turbotax correctly created and filled out both "Form 1116 (Copy 1)" and "Form 1116 AMT (Copy 1)", it won't put "Form 1116 AMT (Copy 1) into the return so I can e-file it. It's there and filled out but I can't get it into the return. (Note the "Form 1116 AMT (Copy 1)" screenshot where you can see the data in the form but the form doesn't appear where it should on the list of forms in the return on the lefthand sidebar.)

If it's not in the return I lose the (small) amount of additional AMT foreign tax carryover but more importantly, the carryover has already been filed this way in prior years so the 2022 return will be inconsistent with returns from prior years.

I don't know if this matters but those prior returns were filed by a tax accountant so there's no data about this to import. I entered it by hand.

Ray

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

One more addition: I'm paying no AMT this year. Form 6251 is in the return because I checked the "include Form 6251 even it's not necessary" box. I think you need it to also file the information on the AMT Foreign tax credit carryover.

If I were paying AMT this year, I suspect Turbotax would include the AMT version of Form 1116.

But I'm not and it's not.

Ray

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

The AMT foreign tax credit is similar to the foreign tax credit for regular income tax purposes, except that it is limited to the foreign tax on foreign source alternative minimum taxable income (AMTI) instead of foreign tax on regular taxable income.

To ensure the AMT Form 1116 is entered correctly, you can preview your return and worksheets before e-filing:

You can view your entire return or just your 1040 form before you e-file:

- Sign in to your TurboTax account

- Open or continue your return

- Select Tax Tools from the menu (if you don't see this, select the menu icon in the upper-left corner)

- With the Tax Tools menu open, you can then:

- Preview your entire return: Select Print Center and then Print, save, or preview this year's return (you may be asked to register or pay first)

- View only your 1040 form: Select Tools. Next, select View Tax Summary in the pop-up, then Preview my 1040 in the left menu

To enter the Foreign Tax Credit Carryover you can revisit these steps:

- Click on Federal Taxes > Deductions & Credits [In TT Home & Biz: Personal > Deductions & Credits > I'll choose what I work on].

- Scroll down to the Estimates and Other Taxes Paid section.

- Click on the box next to Foreign Taxes.

- On the Foreign Tax Credit screen, click on the Yes box.

- Continue through the interview, entering the requested information.

- You will come to the Carryovers screen. Click the Yes box.

- Enter your carryover amounts on the next screen -- Foreign Tax Credit Carryovers.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

Hope,

Thanks for the answer. But please look at the screenshots I posted. The problem is that my return is missing forms that were created and correctly filled out.

I already did the steps you suggested and entered the data. The data populated correctly to all the right forms and the calculations look right.

The data populated to four forms: Form 1116 (Copy 1), Schedule B Form 1116, Form 1116 AMT (Copy 1) and Schedule B Form 1116 AMT.

But I can't get Form 1116 AMT (Copy 1) and its accompanying Schedule B Form 1116 AMT to appear in the return for printing or e-filing because they don't appear in the "Forms in My Return" sidebar on the left.

The only way I can print those forms is to manually save them as PDF's and print the PDF files.

So the only way to file a correct return is to print the return for filing, print out the two missing forms, add them to the return, and mail it all in. E-filing is out because Turbotax won't send the IRS the two missing forms.

Sadly, this looks like a software bug. I've talked to both customer support and the kind folks at Turbotax Live and no one could find another answer that would result in a correctly filed return.

The case number is [phone number removed].

I hope the dev team can fix this. It's an embarrassing bug.

Ray

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

The posting software removed the case number. Let's see if I can get it by this time.

The case number is 15 <ignore this> 1730 <ignore this> 0403.

I also sent in a diagnostic file. Token number is 111 <ignore this> 06 <ignore this> 27.

Hopefully you can get someone on the software side to look at this.

Thanks!

Ray

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

You only gave us three digits for the token number. This is normally a six-digit number. To resubmit.

At the top menu in the black line at the top of the page go to Online.

- From the menu, select Send Tax File to Agent.

- You will see a message explaining what the diagnostic copy is. Click Send and then you will get a Token number.

- Reply to this thread with your Token number. This will allow us to open a copy of your return without seeing any personal information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

DaveF,

As far as I know, the diagnostic file went through. I don't even remember how to send it. The first woman I talked to walked me through sending it.

It's a 7-digit number: 1110627. I split it up in the prior message because the forum posting filters removed the case number because it thought it was a phone number.

Let's see if the posting filter leaves the token id number alone.

Ray

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TurboTax bug: Foreign tax credit carryover ignored when carryover is AMT only

I just another protected copy to you all.

Token number - 1110810

Ray

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

dinesh_grad

New Member

HNKDZ

Returning Member

ssolfest

Level 2

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

DallasHoosFan

New Member

garne2t2

Level 1