- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- TT2023: Can't enter sale of capital asset without 1099-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT2023: Can't enter sale of capital asset without 1099-B

In TurboTax 2023, I can't enter my capital asset sale from a small privately held LLC without a 1099-B.

Using TurboTax 2022, when I add a capital asset sale it asks me if I received a 1099-B.

TurboTax 2023 does not ask that question so it won't let me enter the sale without one.

How can I enter the sale in TT2023 without a 1099-B?

TIA!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT2023: Can't enter sale of capital asset without 1099-B

Yes, we are using different versions, but you are in the right place. It doesn't matter what name you use if you're entering your sales manually because there's no broker/bank identification that's included in the income tax return. All security sales show up with the same basic information of:

- Description of what was sold

- Date of sale

- Proceeds

- Date of acquisition

- Basis

The financial institution name is strictly for your use and utility. So, if you facilitated trades through 4 different brokers and needed to edit one trade, you would be able to find the transaction easier.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT2023: Can't enter sale of capital asset without 1099-B

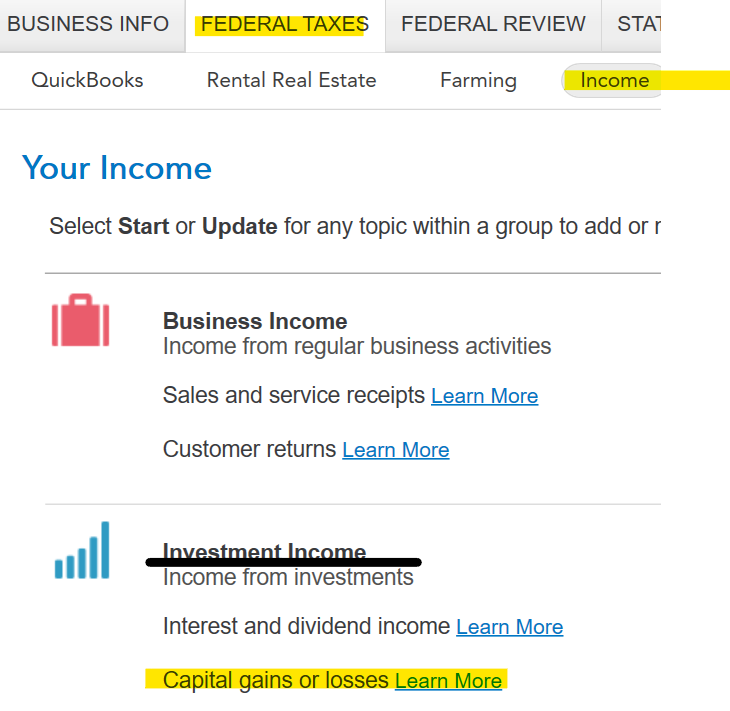

You don't need a 1099-B to enter a sale. In TurboTax Business, go to Federal Taxes >> Income >> Investment Income >> Capital gains or losses - Start.

You will be asked if you have sold any capital assets this year, answer YES.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT2023: Can't enter sale of capital asset without 1099-B

When I do so, it asks me to enter the bank or brokerage that gave me the 1099-b.

It was a private transaction. Should I enter the seller's name?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT2023: Can't enter sale of capital asset without 1099-B

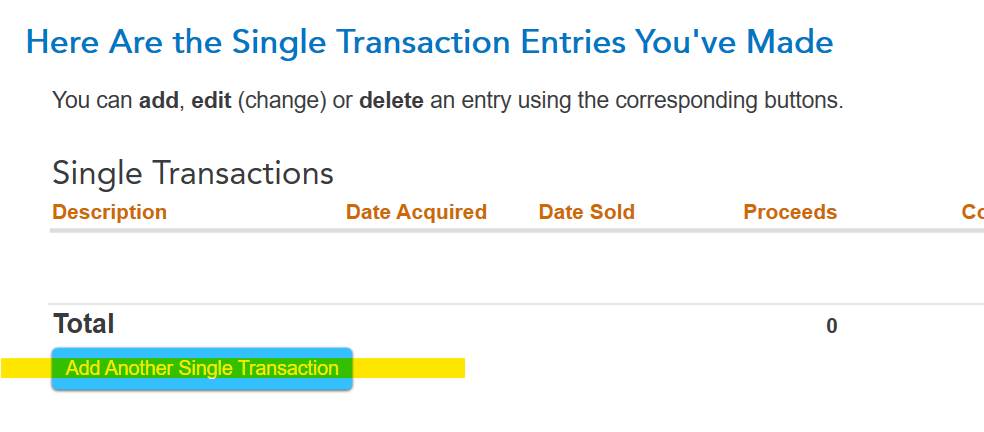

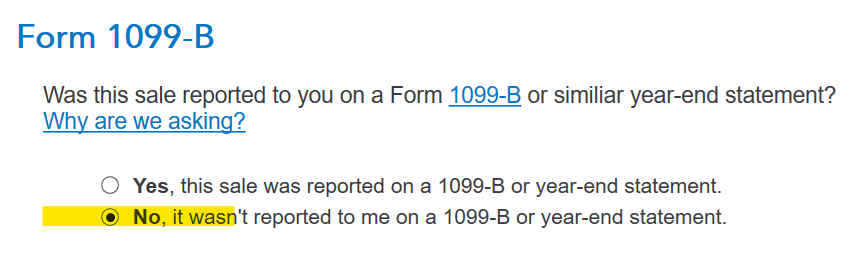

You don't need it. After you answer Yes to selling capital assets, the next screen asks about non-portfolio assets. Answer Yes on that screen. Then click on Add another single transaction. Then answer NO to the 1099-B question.

Now you can enter the details without a 1099-B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT2023: Can't enter sale of capital asset without 1099-B

I'm not seeing that. Do we have different TT versions? I have home & business version.

When I add a capital sale, I see these dialogs:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT2023: Can't enter sale of capital asset without 1099-B

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT2023: Can't enter sale of capital asset without 1099-B

Yes, we are using different versions, but you are in the right place. It doesn't matter what name you use if you're entering your sales manually because there's no broker/bank identification that's included in the income tax return. All security sales show up with the same basic information of:

- Description of what was sold

- Date of sale

- Proceeds

- Date of acquisition

- Basis

The financial institution name is strictly for your use and utility. So, if you facilitated trades through 4 different brokers and needed to edit one trade, you would be able to find the transaction easier.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

TT2023: Can't enter sale of capital asset without 1099-B

Thanks! I should have mentioned the tt version I am using.

Also, turbotax ought to clarify what to do in this case, like your versions does.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

fcp3

Level 3

Moonlight

Level 2

taxgirlmo

Returning Member

gtstiefel

New Member

wphredd

New Member