- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Stimulus on taxes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus on taxes

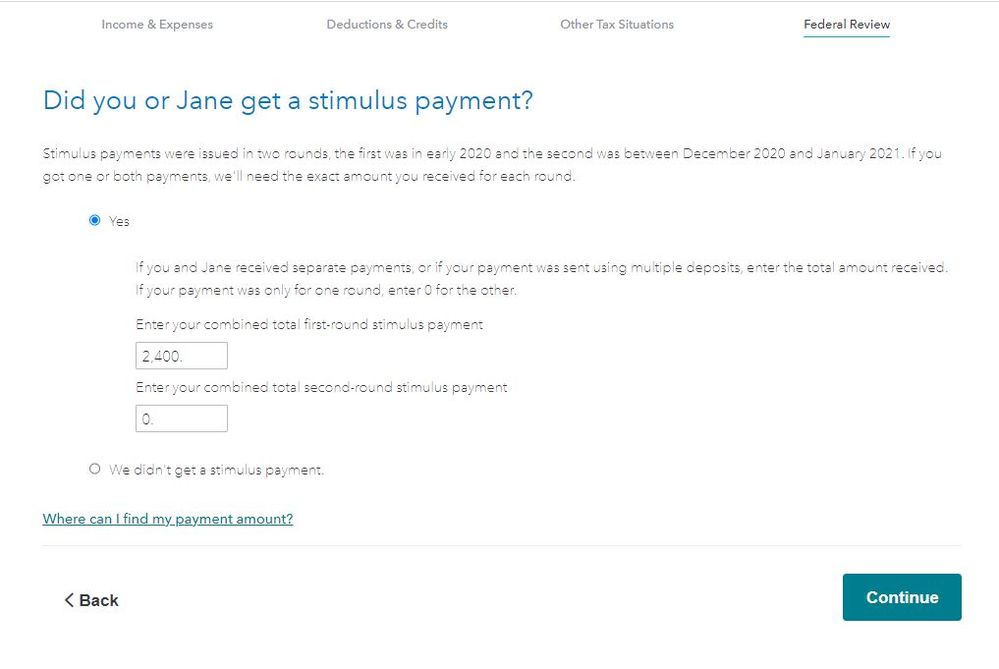

I stated on my taxes that I received my first stimulus when they first sent them out. My refund increased even though I already got it. Is this supposed to happen?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus on taxes

Did you report receiving the second stimulus payment? If not your refund would increase by $600 if you are filing as Single.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus on taxes

I did report I got that as well. That’s why I’m confused on why the amount increased. Will this result on me having to amend my taxes?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus on taxes

@Jessica1108 wrote:

I did report I got that as well. That’s why I’m confused on why the amount increased. Will this result on me having to amend my taxes?

Look at your tax return, Form 1040 on Line 30 to see if there is an amount entered. IF there is then the calculation for your tax credit from the stimulus payment is more than you have entered on the Stimulus question page.

You can view your Form 1040 at any time. Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

Is there an amount entered and if so what is the amount?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus on taxes

Yes, if you did not get the second payment.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus on taxes

I checked and it says 1200. I’m just concerned I will have to amend my taxes. Where the information is incorrect will they just take out the 1200? I don’t understand what I did wrong 🤦🏼♀️ I’m bad at taxes lol

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus on taxes

@Jessica1108 wrote:

I checked and it says 1200. I’m just concerned I will have to amend my taxes. Where the information is incorrect will they just take out the 1200? I don’t understand what I did wrong 🤦🏼♀️ I’m bad at taxes lol

If the 2020 tax return that you filed is incorrect for the amount of stimulus you should have received, the IRS will adjust your tax return by removing the tax credit on the Form 1040 Line 30 that is incorrect. This will reduce your federal tax refund.

The IRS starts accepting or rejecting 2020 tax returns on February 12, 2021.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus on taxes

Thank you so much! I’m glad it won’t have to be redone. 👍🏻

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

K-REALTOR

New Member

Arieshilan321

Returning Member

tigerxducky

New Member

bakkeluke236

New Member

julianknndy87

New Member