- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Stimulus for Baby born in 2020

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus for Baby born in 2020

My Baby was born in July of 2020, as far as I can tell that should make him eligible for BOTH stimulus payments. The Turbo Tax software says I have received the full amount, which cannot be correct, since children born in 2020 could not have received the payments. (And i have not received these payments) is this an error in the turbotax software?

Is there any way to manually add the form for stimulus payments?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus for Baby born in 2020

So if i understand you correctly the 17 year age limit is NOT based on 2019 but on 2020! and based on the entire year. ie. Becoming 17 on the last day of 2020 would define a child as No longer eligible.

**update **

As @Opus 17 has correctly stated, the child must be 17 at the END of 2020 to receive the stimulus.

Which explains my situation. See below.

**Under the eligibility rules by the IRS, the child must be under the age of 17 at the end of the year for the tax return on which the IRS bases the payment in order to receive the additional payment. Any dependent who is over age 17 and claimed on someone else’s tax return is not be eligible for the additional stimulus check.**

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus for Baby born in 2020

If you did not receive your first and/or second stimulus payment or if the amount received is not correct, you can claim it on your 2020 tax return as the Recovery Rebate Credit. You can e-file your return even if you have no taxable income.

In TurboTax Online, to claim the Recovery Rebate credit please do the following:

- Sign into your account and continue from where you left off

- Click on Federal in the left-hand column, then on Federal Review on the top of the screen

- On the next page titled Let's make sure you got the right stimulus amount, click on Continue

- Follow the interview

- TurboTax will determine whether you are entitled to any additional stimulus

- Any stimulus amount remaining due to you will show as a credit on line 30 of your form 1040.

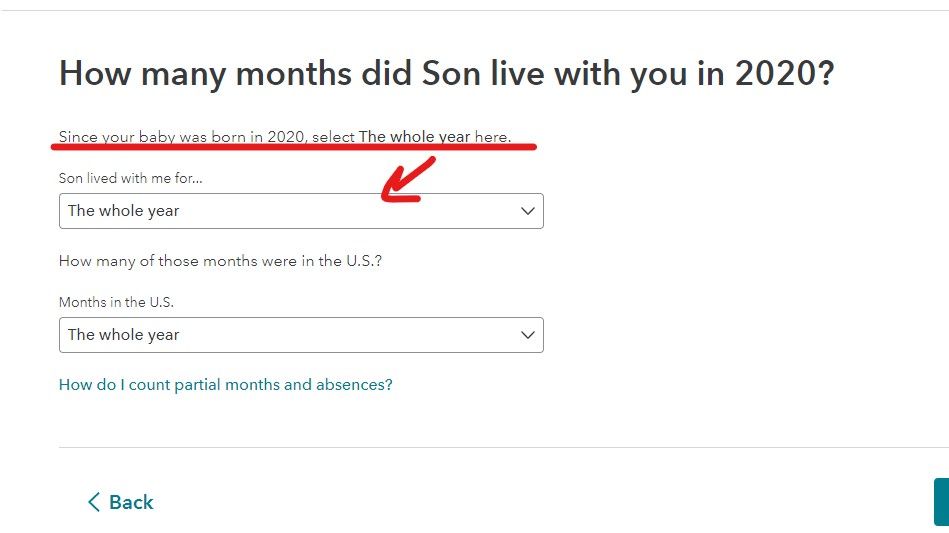

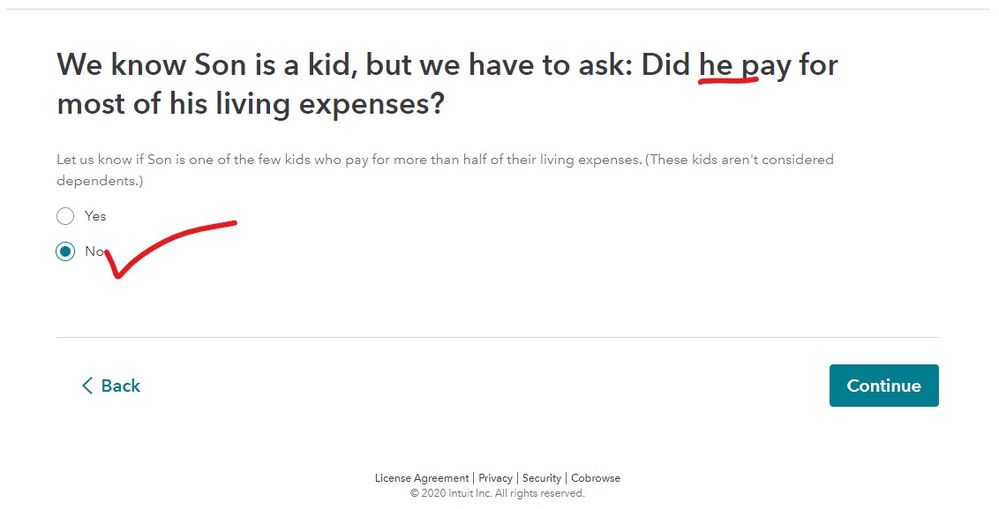

NOW also make sure you added the child correctly ... make sure you choose ALL YEAR for the time they lived with you AND make sure you entered NO when ask if the KID provided more than 1/2 of their OWN support ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus for Baby born in 2020

I have correctly added my son as a dependent . Choosing "lived with me the whole year" and "no" on the did he support himself question.

The software still refuses to claim stimulus for him!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus for Baby born in 2020

I guess I'll have to move to some other software, just tested out my info on another website and they give the additional stimulus money. Seems to be an error in the TurboTax software.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus for Baby born in 2020

Did you claim a dependent in 2019 who is not being claimed by you in 2020? The credit is based on the number of dependents you claim, not their identity. Is your income above the start of the phase-out? $75,000 for single and head of household and $150,000 for married filing jointly.

Is this child awarding you the $2000 child tax credit? Then it must also be eligible for a stimulus payment and there must be some other reason that a further amount is not allowed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus for Baby born in 2020

Thanks for taking the time to answer!

1. All previous dependants are claimed with the addition of the the Baby.

2. Income is far below the threshold.

3. Not sure about the Child tax credit.

I'm wondering if perhaps my other dependent turning 17 at the end of 2020. Has anything to do with it. Not sure if that should make any difference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus for Baby born in 2020

Yes, that’s it. A dependent age 17 or older is not eligible, due to the (possibly hasty) way that Congress defined eligibility. You dropped one dependent from eligibility and added another; since the credit is based on the number of eligible dependents rather than their identity, and there is no change in the number of dependents, you aren’t eligible for an additional amount.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus for Baby born in 2020

So if i understand you correctly the 17 year age limit is NOT based on 2019 but on 2020! and based on the entire year. ie. Becoming 17 on the last day of 2020 would define a child as No longer eligible.

**update **

As @Opus 17 has correctly stated, the child must be 17 at the END of 2020 to receive the stimulus.

Which explains my situation. See below.

**Under the eligibility rules by the IRS, the child must be under the age of 17 at the end of the year for the tax return on which the IRS bases the payment in order to receive the additional payment. Any dependent who is over age 17 and claimed on someone else’s tax return is not be eligible for the additional stimulus check.**

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus for Baby born in 2020

BOTH stimulus checks were an ADVANCE of the 2020 credit based off 2018 or 2019 information and is being reconciled on the 2020 return. On the 2020 return you have only one qualifying child and you have already received the credit for one child ... the fact that you have a different child on the 2020 return is irrelevant.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus for Baby born in 2020

I am struggling with whole turbo tax thing too! Our Daughter was born October 2020. She was added as a dependent, but I can not manually enter anything in line 30!!!!!! The software must has some glitch to it! If anyone knows how I can fix this, so I don't have to redo all the info into another program!!!! Please Help

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Stimulus for Baby born in 2020

@emrsmallwood wrote:

I am struggling with whole turbo tax thing too! Our Daughter was born October 2020. She was added as a dependent, but I can not manually enter anything in line 30!!!!!! The software must has some glitch to it! If anyone knows how I can fix this, so I don't have to redo all the info into another program!!!! Please Help

You should not have to add anything manually to line 30, Turbotax will assign the full amount of stimulus you qualify for, and you must reduce that amount if you received any of the advance stimulus payments (round 1 and 2).

Two key points:

1. you get the rebate based on the number of dependents, not their identity. If you received a stimulus payment for 1 dependent who was age 16, they won't be eligible when they turn 17, so if you add a new dependent but a previous dependent turned 17, you won't get any additional funds.

2. for a newborn, you must indicate that the child lived with you all year, or at least more than half the year, even if they were born in the second half of the year (this is the correct answer per the tax regulations.). If you print your return before filing, check the front page and make sure the box for "qualifies for child tax credit" is checked. If that box is checked, then the correct stimulus is also being calculated. If that box is not checked, then you aren't getting the $2000 child tax credit and you also won't get any stimulus rebate. You may need to correct the dependent interview -- check the dependent's age, relationship to you, time lived with you, and make sure they have a social security number.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HW11

Returning Member

e38037725

New Member

soulhotel57

New Member

candyhargrove75

New Member

Jay733

New Member