- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Sold My Residence to one buyer and the adjacent land to a different buyer in 2021. Treating it as one sale for capital gains exclusion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold My Residence to one buyer and the adjacent land to a different buyer in 2021. Treating it as one sale for capital gains exclusion.

The IRS treats the sale of the residence to one buyer and the sale of the adjacent land to a different buyer as one sale for the purposes of the $500,000 capital gains exemption. I read where you enter each of the 1099-S separately in Turbo Tax. How do I enter each sale separately and treat it as one sale? If I enter each sale as Sale of Residence, it allows for the $500,000 capital gains exclusion each time, so that can't be right.

How do I combine the sales as one when the sale dates were different, and there are two different 1099-S? This answer is nowhere to be found. Even the CPA I asked doesn't know the answer.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold My Residence to one buyer and the adjacent land to a different buyer in 2021. Treating it as one sale for capital gains exclusion.

Since it appears you are using TurboTax Home & Business, you can use Forms Mode to enter the transaction.

Simply enter Forms Mode, create a second Home Sale Worksheet, and enter the information from the adjacent land sale. Ensure that you answer all of the questions on the worksheet correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold My Residence to one buyer and the adjacent land to a different buyer in 2021. Treating it as one sale for capital gains exclusion.

Since it appears you are using TurboTax Home & Business, you can use Forms Mode to enter the transaction.

Simply enter Forms Mode, create a second Home Sale Worksheet, and enter the information from the adjacent land sale. Ensure that you answer all of the questions on the worksheet correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold My Residence to one buyer and the adjacent land to a different buyer in 2021. Treating it as one sale for capital gains exclusion.

Thank you so much for this answer!!! I wish I had gone to the community sooner. I've asked everybody the question but the mail man and nobody had the answer. Last question. Will it know to not allow me the $500,000 exclusion again? We are only entitled to the portion of what remains of the $500,000 exclusion from the sale of the residence. Please advise.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold My Residence to one buyer and the adjacent land to a different buyer in 2021. Treating it as one sale for capital gains exclusion.

@Mary0111 wrote:

.....Will it know to not allow me the $500,000 exclusion again?

No. If your total gain exceeds the $500,000 exclusion amount, you will have to make an adjustment on one of the Home Sale Worksheets in order for the excludable gain to remain at the maximum allowable total of $500,000 on Form 8949.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold My Residence to one buyer and the adjacent land to a different buyer in 2021. Treating it as one sale for capital gains exclusion.

Note that the adjustment on one of the Home Sale Worksheets will have to be in the form of an override (you will be overriding the amount of the gain excluded).

Fortunately, it appears as if the override will not preclude your ability to e-file since the worksheet is not transmitted with your return and Form 8949 should reflect the correct figure in Column g on Form 8949 (the adjustment column).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold My Residence to one buyer and the adjacent land to a different buyer in 2021. Treating it as one sale for capital gains exclusion.

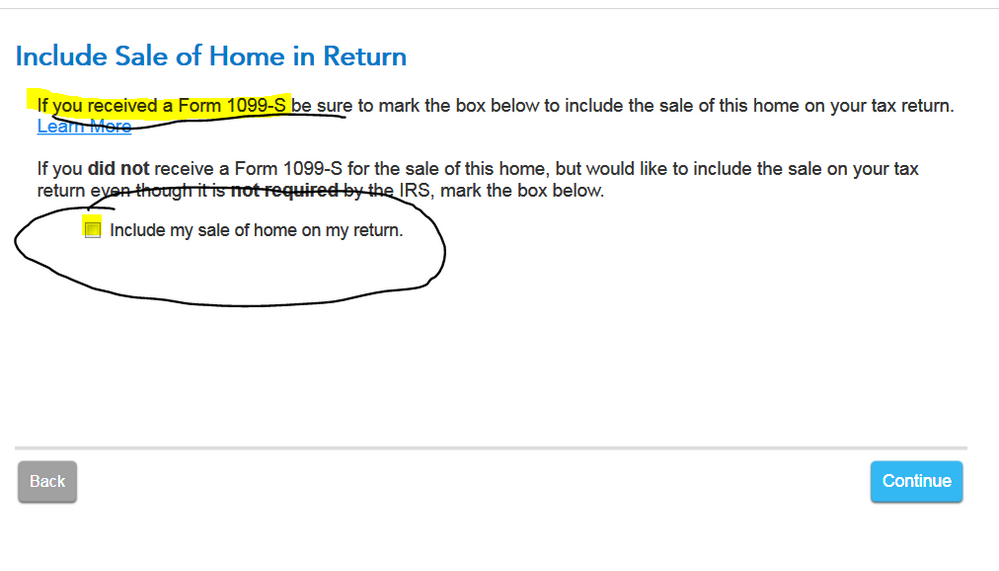

Simplest answer is to report the 2 sales as only one sale in the program ... you do NOT need to make them separate entries for the IRS as the total sale amount will all show up on the Sch D in the end. What you MUST do is click on the 1099-S box to force the sale on to the Sch D correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold My Residence to one buyer and the adjacent land to a different buyer in 2021. Treating it as one sale for capital gains exclusion.

The screen in @Critter-3's post must be from an online version of TurboTax.

TurboTax Home & Business presents the screen shown below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold My Residence to one buyer and the adjacent land to a different buyer in 2021. Treating it as one sale for capital gains exclusion.

I also believe it would acceptable, as stated by @Critter-3, to combine the two sales and report them as one since they occurred in the same taxable year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold My Residence to one buyer and the adjacent land to a different buyer in 2021. Treating it as one sale for capital gains exclusion.

Thank you so much!!! Why didn't I ask the community sooner? So much lost sleep over not having these answers!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold My Residence to one buyer and the adjacent land to a different buyer in 2021. Treating it as one sale for capital gains exclusion.

Thank you for taking time to answer these questions! Thank you!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jays1951-gmail-c

Level 1

noodles8843

New Member

michael_s_peterson

Level 2

dominibopula

New Member

aashish98432

Returning Member