- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Schedule H Deferral

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

Just got a letter from the IRS saying I owe $384 due on December 31, 2021 due to taking a deferral on Schedule H. Didn't even know I even did this, as it sounds like TT did it on it's own. Thanks TT!! (not).

Since I am paying Self Employment estimated taxes every quarter, isn't my estimated payments part of paying this back? If not...why didn't TT generate something when I printed out my tax forms saying this was due and payable (like my Estimated Tax Coupons) ??

Very disappointed in how TT has handled this..

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

Not sure what you mean by "deferral" on schedule H. Schedule H is taxes for a household employee that you have.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

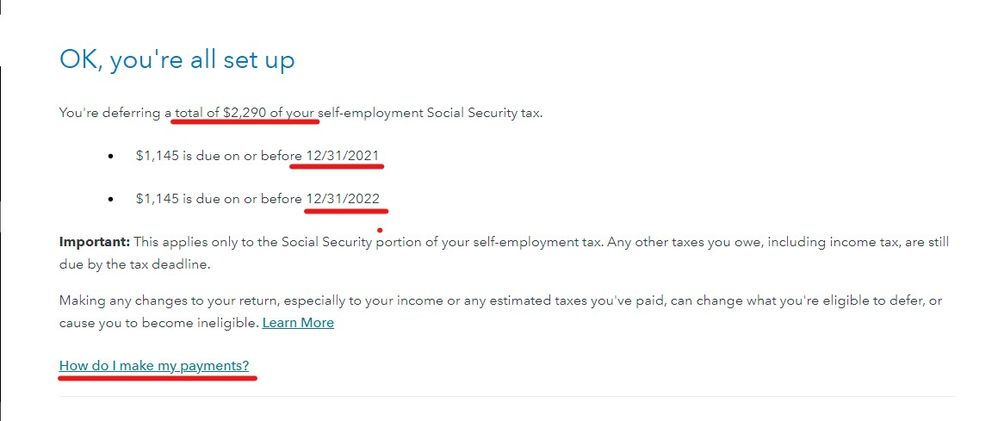

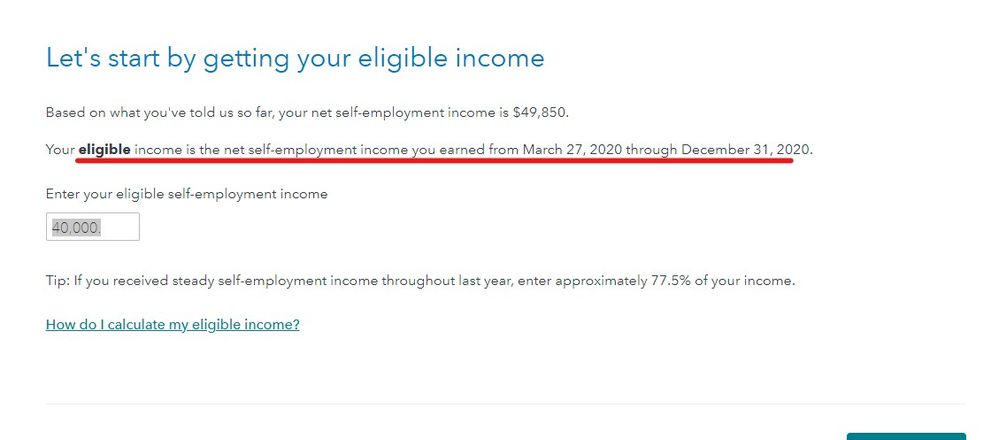

Since I am paying Self Employment estimated taxes every quarter, isn't my estimated payments part of paying this back? no, the payback will be a separate payment. estimated taxes are for 2021. what you'll be paying back is the 2020 deferral. 50% due 12/31/2021 and the other half 12/31/2022. TT did the deferral based on how you answered certain questions. by the way the estimated taxes would have been computed based on the reduced liability due to the deferral. example: 2020 income taxes before deferral $32,000 deferral $8,000 =net taxes of $24,000. estimated tax requirement for 2021 would be $6,000 per quarter instead of $8,000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

Sorry...IRS called it Schedule H in the letter they sent me...it is actually Schedule 3 in Turbo Tax...never heard of it or used it before. Line 12E of Schedule 3 refers to Schedule H... "Deferral for certain Schedule H or SE filers (see instructions)"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

Would have been nice to know Turbo Tax was doing that...no mention at all of any payment due in the future other than the estimated taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

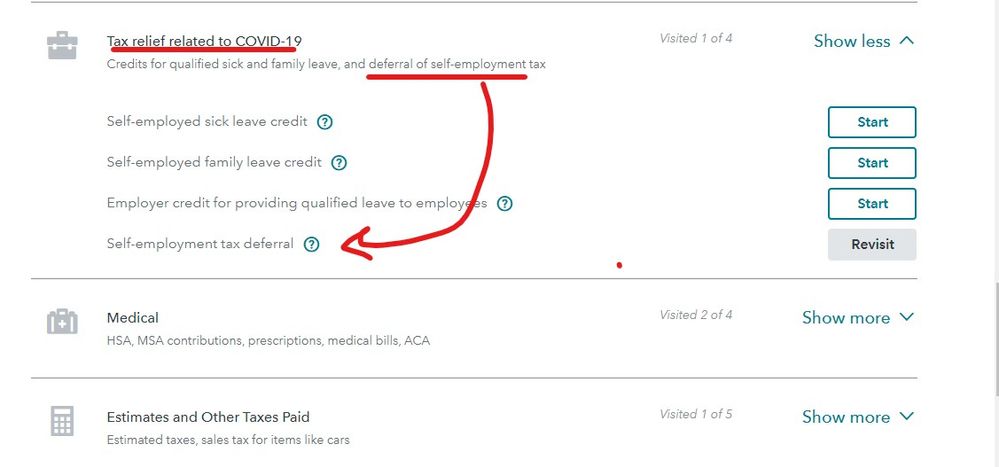

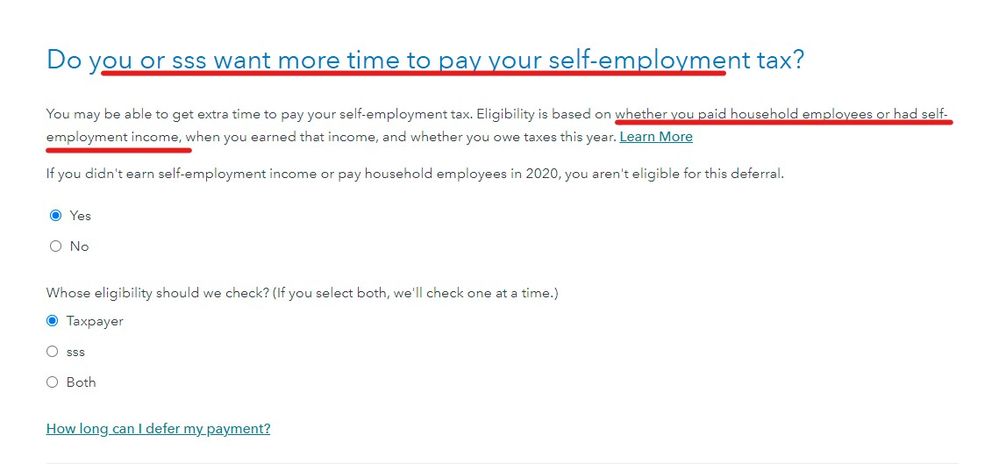

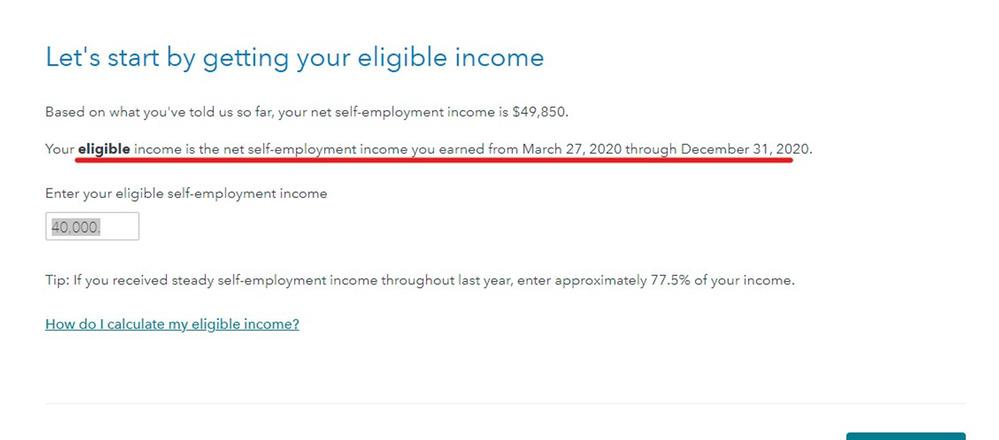

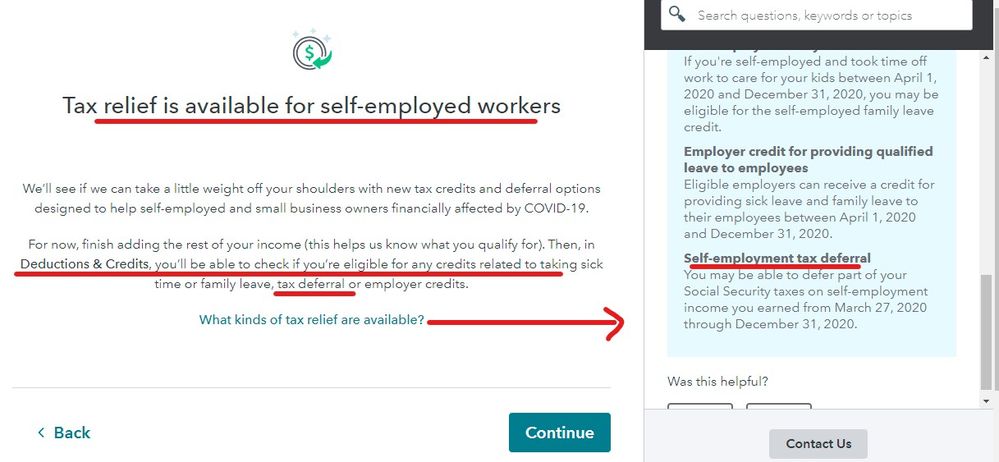

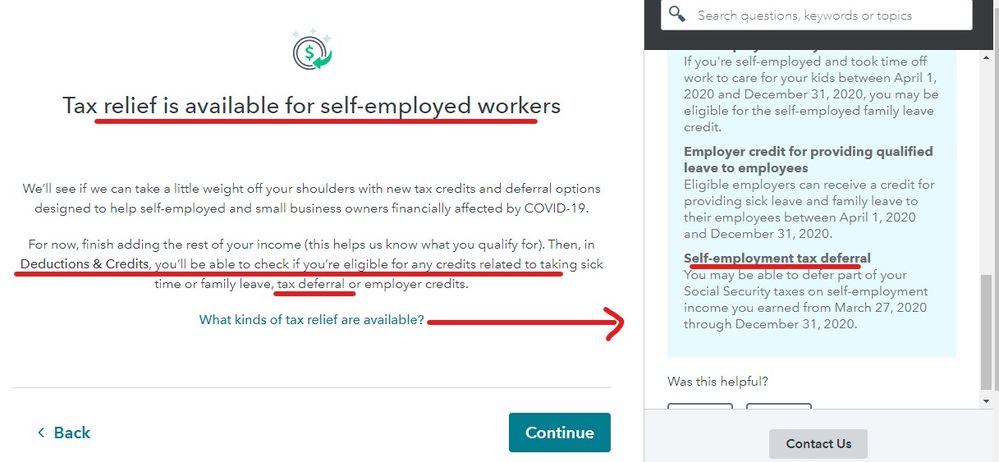

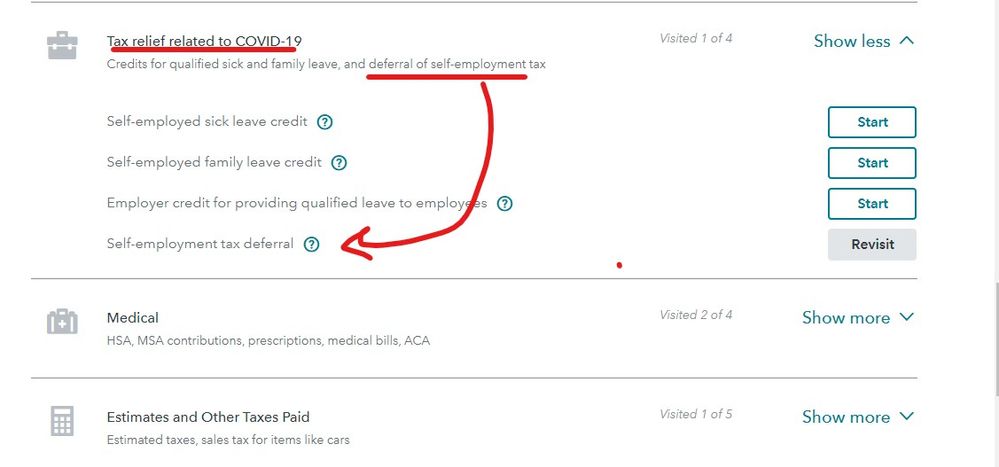

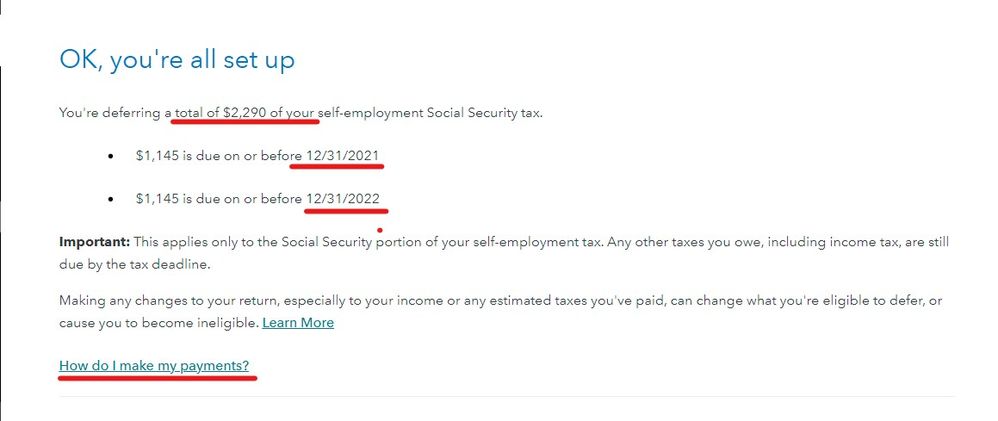

Ok ... the program never does anything automatically ... you needed to choose this new one time option to defer the SS taxes and pay 1/2 by 12/31/2021 & the other 1/2 by 12/31/2022 ... these are the screens in the Deductions & Credits tab ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

Never saw those screens...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

I have the same problem and never saw those screens either. Never put in an amount for a deferral. How did TT screw this up???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

@jimswinder Whether you intended it or not, the tax has been deferred, so you have to pay it. And you have to pay it separately from your estimated tax payments. Here is a link to the IRS instructions for how to pay the deferred tax.

How self-employed individuals and household employers repay deferred Social Security tax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

Here's a recent thread with 2 other users who didn't see it either and claim they were deferred by surprise:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

@mesquitebean you know users tend to skip over informational pages ... this is the one at the end of the Sch C interview. It warns you of the screens to come in the Deductions & Credits section where once again the program has screens that needed to be read and properly answered ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

And those letters just went out last week so if this was a large program issue I am sure that more than 4 users would have posted a question on this thread.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

If there are questions that need to be "properly answered" the TT should take you there and explain!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

It does ... as you complete the interview (in order and don't skip sections) all the correct screens are presented in the correct order ... at the end of the Sch C interview you are told to expect the extra section coming up in the Deductions & Credits section ... Here are those screens :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule H Deferral

Those never came up for me.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

NotHappyWithT-Tax

Level 2

jyeh74

Level 3

FlyFisher99

Level 2

user17701661924

New Member

alina-m-wong

New Member