- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Sale of Vacant Land

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant Land

Where do we report the sale of vacant land? I read through posts from 2020 filings and my screen does not look like or behave the way past posts describe.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant Land

- Once you are in your tax return, click on the “Federal Taxes” tab ("Personal" tab in TurboTax Home & Business)

- Next click on “Wages & Income” ("Personal Income" in TurboTax Home & Business)

- Next click on “I’ll choose what I work on” (jump to full list)

- Scroll down the screen until to come to the section “Investment Income”

- Choose “Stocks, Mutual Funds, Bonds, Other” and select “start’ (or “update” is you have already worked on this section)

- The first screen will ask if you sold any investments during the current tax year (This includes any sale of real property held as an investment property so answer “yes” to this question)

- Since you did not receive a 1099-B, answer “no” to the 1099-B question

Choose type of investment you sold.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant Land

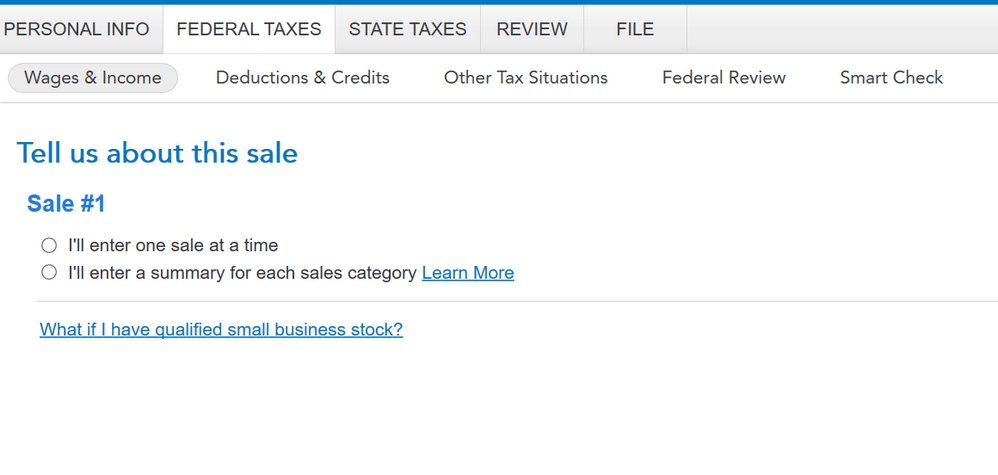

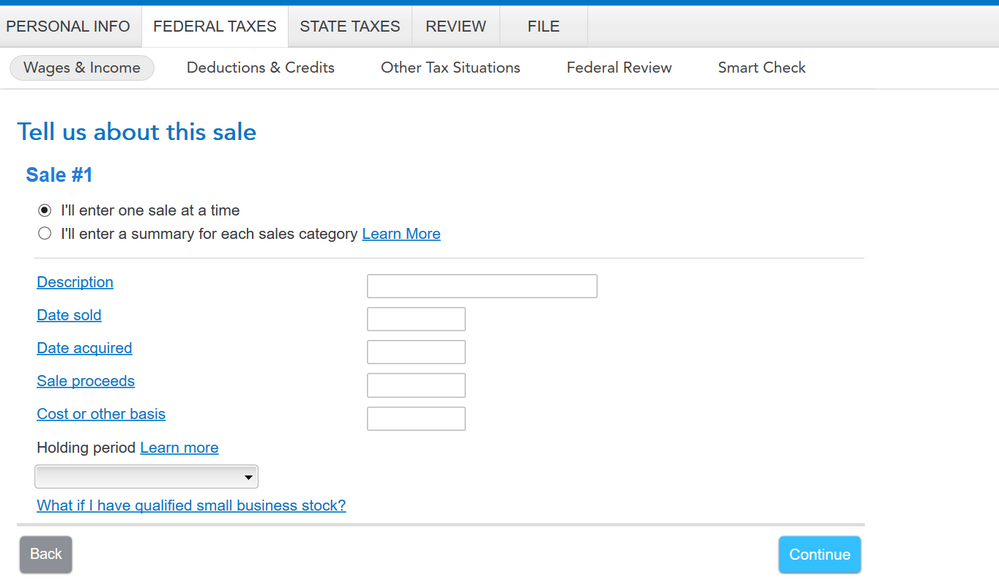

It doesn't bring up the list of choices. From what I've read in old posts that was last in 2020 version. I didn't find a solution. The screen gives me a choice to enter one at a time or a summary.

If I select one at a time this is what I see:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant Land

Yes ... you need to enter the sale. Fill in all the boxes ... what did you sell, for how much, when, etc....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant Land

Even though I tell the system I don't have a form, the screen for informaion about the sale asks for a a holding period, which seams to refer back to a form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant Land

seems silly that it's asking about a holding period if you enter complete dates. and worse if you make the wrong selection you can get the wrong results. say you sold on 10/15/2021 and bought on 4/12/2005. that would be long-term but if you select short-term it will report it as a short-term sale showing the dates you entered (form 8949). of course, the forms are not final so maybe Turbotax will correct this issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant Land

@Mike9241 wrote:

.....the forms are not final so maybe Turbotax will correct this issue.

This issue was actually raised quite some time ago and no action has yet been taken; it appears to be by design programmatically.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant Land

Does this happen in Premer too? I haven't been willing to upgrade when I don't know if it will fix the problem. When I purchased the rep told me Deluxe CD would do what I needed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant Land

@thefenderbender wrote:

Does this happen in Premer too? I haven't been willing to upgrade......

I am seeing the same behavior in Home & Business so I doubt upgrading will resolve the issue at this point in time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sale of Vacant Land

Thank you! I'll hold off on spending the extra $30 then. I may have to figure out the forms and edit on that side. Little frustrating.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

William--Riley

New Member

cm-jagow

New Member

oaosym

New Member

PGW1

Returning Member

user17525279893

Level 1

in [Event] Ask the Experts: Investments: Stocks, Crypto, & More