- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Sale of Inherited Home not lived in or rented.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

To report the sale of your wife's inherited home in TurboTax follow these steps:

- Open or continue your return

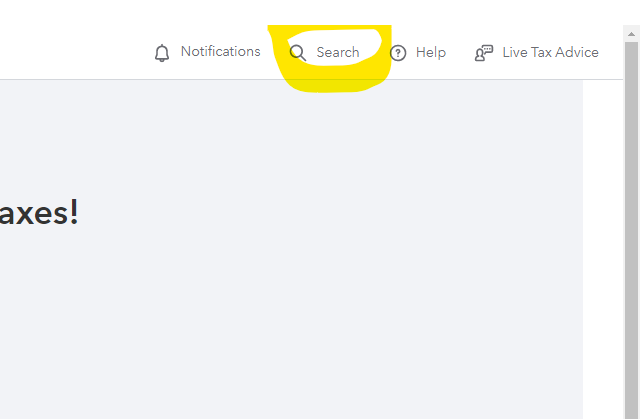

- In the search box, enter sold second home

- Click on Jump to sold second home in the results box

- On the page Did you sell any of these investments in 2021? Answer yes

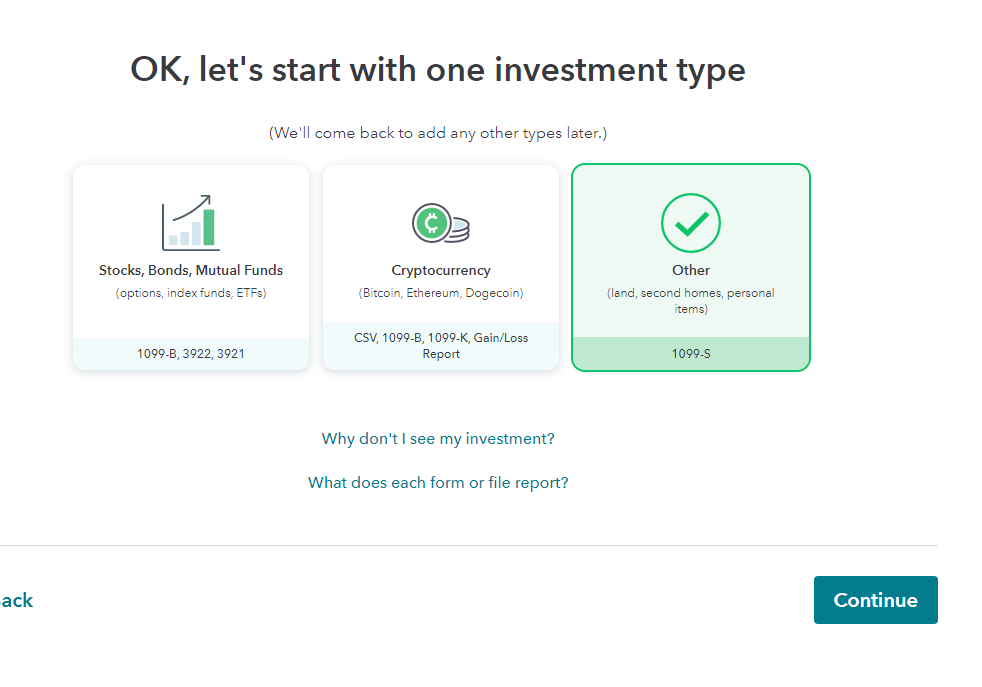

- On the page OK, let's start with one investment type check the Box for other

- On the page Tell us more about this sale enter “sale of inherited home” in the Name box .

- Answer all the questions on the page Now, enter one sale for sale of inherited home Enter your wife's share of the gross proceeds on 1099-S in the Proceeds box and her share of the basis in the Total amount paid box

- On the page Let us know if any of these situations apply to this sale check the box you paid expenses and enter her share of the sale expenses

- Continue to the page Your investment sales summary where you will see her Total gain if any on the sale of your inherited home.

An inherited home not used for investments purposes is personal use of a capital asset. A gain on the sale is reportable income, but a loss is NOT deductible

This link Where do I enter the sale of a second home, an inherited home, or land on my 2021 taxes? has information you may find useful.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

My wife and I inherited her mom's home in Dec 2018 when her mom passed away. My wife was an only child and so we inherited the home. We sold it in May 20, 2021, and financed the deal for up to 12 months. We received a deposit for 31,000 in May of 2021. We recently received the final payoff with interest (2022). How do I claim the $31,000 income in 2021 without being taxed by TURBOTAX for income. It was an inheritance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

my wife

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

which search box do I use?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

which search box? I'm lost

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

In TurboTax Online, the search box is in the upper right corner. Click on this and you will be able to search.

Here is a link that will help you add the sale of an inherited home.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

Have Turbo Tax Premier.

Sold an inherited home. Received 1099 S from title company. How to report? Previous read information said said go to Investment Sale Than go to Stocks Mutual Bonds other. Upgrade. Add more sales pops up.

Other does not pop up. Very very confused on how to report sale. There is no profit or loss on this sale.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

Clarification...

Why is there no profit? Was the FMV more or less than what you sold it for on the date of the decedents death?

After you click Add more sales, you should see Ok, lets start with one investment type and below that the third option is other if you are using the online version.

If you are using the desktop version, you would enter it as an individual sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

We received a 1099 for the sale of inherited property from sale of my wife's dad, how do i report this on return?

The sale was in CA and we live in Texas. Her value in estate was less than $100,000

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

My wife's Dad had died in 1998 and his wife continued living in it until 2022, upon her death the house was sold by the beneficiaries sold the house in 2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

My wife's Dad had died in 1998 and his wife continued living in it until 2022, upon her death the house was sold by the beneficiaries sold the house in 2022

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

You would report that in the Federal section of TurboTax, under Wages and Income and then Investment Income. Look for Stocks, Mutual Funds, Bonds, Other. Indicate that you did not receive a form 1099-B. Choose the option that indicates that a loss on the sale is not deductible, or that the sale is not from investment property. Your menu options will vary depending on which version of TurboTax you are using. The cost of the property would be its fair market value when you inherited it.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

War forms did you use to file and did you have to pay any taxes on the money? {Name removed}

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

In the scenario being discussed on February 7th, a parent's home was inherited by the children. The cost basis is determined on the date of death (either the father or the wife depending on the estate records). This means that whatever the cost basis is would be used against the selling price and any gain would be taxable income. The holding period for all inherited property is long term which provides the most favorable capital gains tax treatment,

Example of property received through inheritance: If a beneficiary inherited a home and sold it close in time then the gain or loss would be minimal because it's likely the value on the date of death would be very close if not exactly the same as the selling price.

Please update if you need additional assistance.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Question on 1099-S Inherited property sale

I have an appointment with H&R Block tomorrow.

Shufee

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Mango-muncher

Level 2

user17519972176

New Member

user17519972176

New Member

hellolami

New Member

beetsfam5

New Member