- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Report Foreign Dividends does not give me the ability to properly answer

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report Foreign Dividends does not give me the ability to properly answer

How do I resolve this? The amount (blacked out) is the total foreign taxes reported on the imported document from the financial institution. Some of the dividends are from RICs and some are not (Other). TurboTax doesn't provide a way to say both or to separate out how much of each. How am I supposed to complete this part? Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report Foreign Dividends does not give me the ability to properly answer

You can select either one. If you go thru the foreign tax credit interview and there are multiple countries, you can select them as needed which will overrule the 1099-DIV. selection.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report Foreign Dividends does not give me the ability to properly answer

Thanks. I think you are saying there will be additional interaction later in the interview process that will provide the ability to do this correctly, no matter which choice I make here. Is that correct? If that is so, then maybe TurboTax needs to fix this part to say that or maybe provide a "both" option to generate the additional needed interaction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report Foreign Dividends does not give me the ability to properly answer

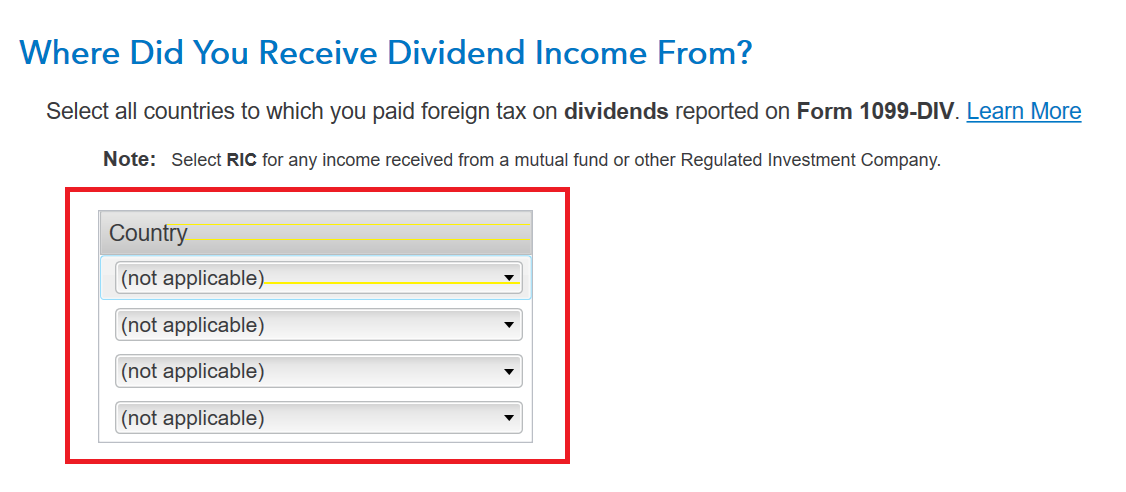

Yes, when you begin to enter your foreign tax credit you will be asked what country the foreign tax was paid to. This will be on the statements that come with your 1099-DIV. See the image below.

- Use the search (upper right) > type foreign tax credit > click the Jump to ... link > Follow the screen prompts

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Report Foreign Dividends does not give me the ability to properly answer

So I jumped to that section and it simply asked me if I wanted to take a credit or deduction and suggested credit. I chose that and it didn't ask me what you posted - it just moved on to the next topic. Was it supposed to ask me what you indicated? Is there some other place I might still need to respond? I'm confused.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

HollyP

Employee Tax Expert

user17611539848

Returning Member

puneetsharma

New Member

userID_204

Level 2

dilsono

Returning Member