- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Recovery Rebate Tax Credit

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

I filled out my return already, but the recovery amount, at this point in time (1-5-21), is only the amount of the 1st stimulus

The threshold is not the full amount of of the first and the second stimulus.

Is turbotax going to adjust the allotted recovery amount amount based on:

A. 2019 taxes?

B. Total amount of 1st and 2nd stimulus?

Right now, it's only the amount of what I received on the 1st stimulus.

Any information turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

Good answer! I imagine so too.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

I don't think the total amount from 1 and 2 are there. It's just the total from the 1st as of now.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

@scottmfoil wrote:

I don't think the total amount from 1 and 2 are there. It's just the total from the 1st as of now.

The TurboTax online editions have been updated to include EIP1 and EIP2

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

@scottmfoil - you may have to log out and then log back in - they just updated it this afternoon

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

Thanks for the suggestion. The changes are still not included. I'll keep trying

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

@jenkinstl wrote:

Thanks for the suggestion. The changes are still not included. I'll keep trying

You may have to clear cache and cookies on your web browser so that the updated pages will be available on the online editions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

It's updated. I did mine a couple hours ago, and I got the full $1800. You just have to go back and re-do that section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

Thanks for the suggestion. I don't use the online version. I have the software on my PC. I did get an update today but it didn't include the changes I'm looking for. I was curious if anyone know the latest ECD for these changes

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

@jenkinstl - interesting - I have Deluxe (desktop) and the two boxes for the two payments are there. if the two boxes are they, you have the updated software to correctly calculate the recovery credit for Line 30.

and what you are looking for is the stimulus update or something else?????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

@jenkinstl On Windows or Mac? I have Windows Desktop program and it's updated today.

See IRS 1040 instructions for line 30 and the Recovery Rebate Credit Worksheet on page 59 here,

https://www.irs.gov/pub/irs-pdf/i1040gi.pdf

Good post with screen shots of both Desktop and Online

https://ttlc.intuit.com/community/tax-credits-deductions/discussion/re-turbo-tax-stimulus-question/0...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

I did my step daughters return for 2020 on turbo tax yesterday. From what I can tell yes. If you are filing 2020 return and not being claimed as a dependent in 2020 it will issue you a rebate credit. In my example she is young and for 2019 her father claimed her. She had a child in 2019 but had no earnings. The father of the child filed by himself with the child for 2019. He claimed and got the stimulus payments. When she filed her return for 2020 as head of household claiming her child, it determined on TurboTax that she was eligible for herself for the stimulus since she did not get it. It does not asked if she was a dependent in past years only if she got one or not. Since she did not, it determines her eligible for 2020 based on her 2020 circumstances.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

I did a return yesterday and it calculated the rebate at 1200, 500 and then 600, 600. The total was right for one adult and one child

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

I’ve filled out my federal/state taxes all the way to submit, but I didn’t see any question/prompts about how much stimulus money I received in the first stimulus or anything about the Recovery Rebate Credit. Where can I insert my information on that topic and see if I am owed a refund? I have two dependents, but only received $380 and I think IRS didn’t know about my second dependent back then.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Recovery Rebate Tax Credit

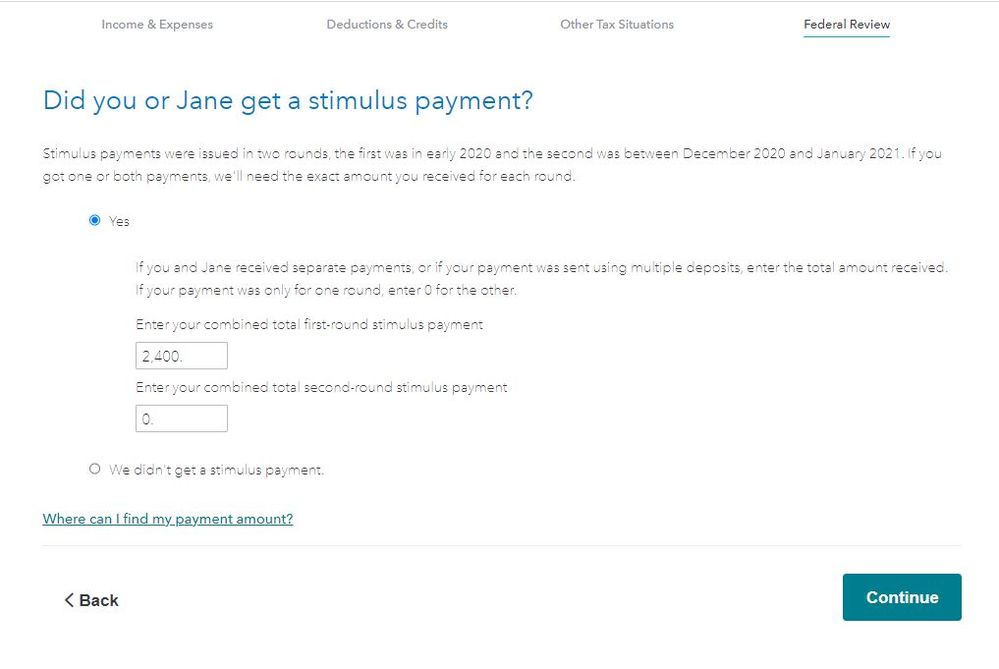

There will be a screen with 2 boxes for each round. If you didn't get one enter a 0 in the box.

When you go through the federal review tab it will ask how much you got if any. Or to enter your stimulus payment in TurboTax, type "stimulus" (without the quotes) in the Search box, then click the link that says "Jump to stimulus."

After you have entered your tax information and are ready for the Federal Review, it will be the first question.

If you are trying to trigger it, you can go to Other Situations, answer any questions and click Done. The next automatic selection is Federal Review and it will ask about payments received.

The Recovery rebate credit is on 1040 line 30. It either adds to your refund or reduced a tax due.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

elliottulik

New Member

Garyb3262

New Member

nalee5

New Member

johnpickle306

New Member

theresavanhoose

New Member