- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Where is box 4 on the 2023 mortgage interest form 1098?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

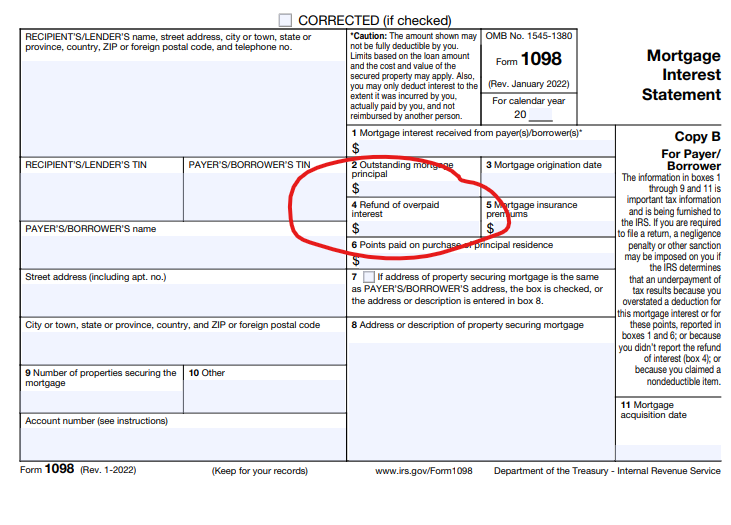

Where is box 4 on the 2023 mortgage interest form 1098?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is box 4 on the 2023 mortgage interest form 1098?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where is box 4 on the 2023 mortgage interest form 1098?

From TurboTax - On Demand Tax Guidance

What if my 1098 has value in Box 4 (Refund of Overpaid Interest)?

Refund of Overpaid Interest in same Calendar Year

If overpaid interest was reimbursed in the same calendar year as paid it should be netted in Box 1 (Mortgage interest received). No action is required. Input your 1098 with the amount in Box 1.

For example, if you paid $5,000 in interest and were reimbursed $500 of that amount in the current year. Box 1 should reflect $4,500 as interest paid and nothing should be in Box 4.

Refund of Overpaid Interest in a different year

If you received a reimbursement of interest this year and in prior year you deduct the interest for a tax benefit you would reconcile the reimbursement.

Example: You overpaid $700 of interest last year and included the amount of your deductible interest on Schedule A. The next year you received the $700 back. The Bank sends you a 1098 that reflects $700 in Box 4 and nothing in Box 1. Since you deducted your income in a prior year and received a refund in a different year the $700 is treated as income in the year received. The income is reported under Miscellaneous Income:Reimbursed deductions from a prior year.

If you did not itemize or did not include the interest on your tax return the amount on 1098 Box 4 does not need to be included in your current tax return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scatkins

Level 2

djpmarconi

Level 1

realestatedude

Returning Member

ramseym

New Member

eric6688

Level 2