- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: What line shows the sale of a property on a schedule e?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line shows the sale of a property on a schedule e?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line shows the sale of a property on a schedule e?

the sale does not flow to schedule E. most likely it flows to form 4797 page 2 and from there to schedule D line 11 and/or schedule 1 line 4 .

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line shows the sale of a property on a schedule e?

I don't see form 4797 but I do see schedule 1 and line 4 is blank... The most likely means I did not enter the sales price?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line shows the sale of a property on a schedule e?

The sale is reported in the ASSET section of the rental prop entries ... did you ever depreciate the property ? If you did not then RUN to a local tax pro to get this error fixed since depreciation was REQUIRED and not an option.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line shows the sale of a property on a schedule e?

I've had it since 2004 so it was depreciated in prior years taxes. I just don't know why I wasn't promoted to enter a sales price. I will amend when filed. Unless you have a different suggestion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line shows the sale of a property on a schedule e?

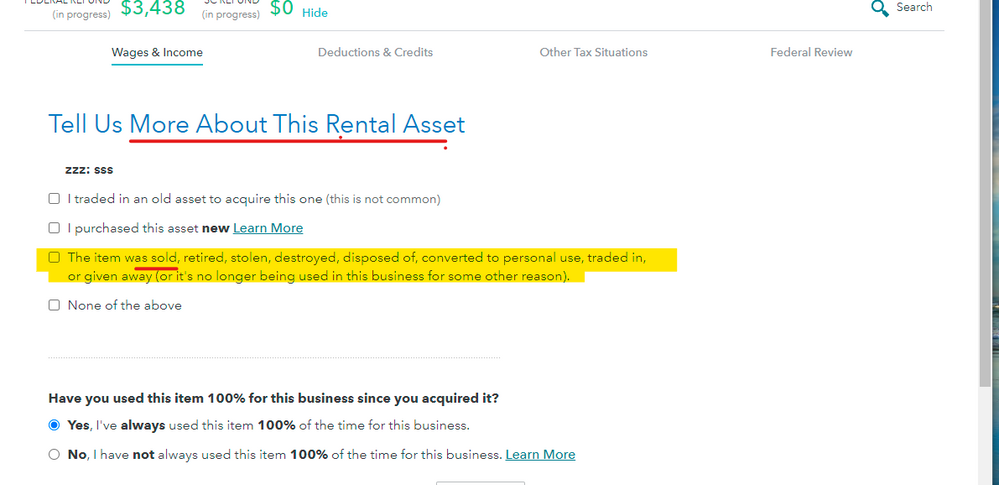

If you have already filed then once the original return has fully processed you can amend it. In the rental section review the assets being depreciated ... that is where you indicate the rental was sold. This would stop the depreciation being taken and prompt you for the sale price & costs of sale. If you have more than one asset for this rental then you need to prorate the costs appropriately.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What line shows the sale of a property on a schedule e?

Thank you! I clicked the box that said I purchased this asset new. Thanks so much...I'm going to amend as soon as it's out of pending status

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scatkins

Level 2

SB2013

Level 2

djpmarconi

Level 1

yingmin

Level 1

realestatedude

Returning Member