- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Unemployment Relief

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Relief

Hi, I have been having a hard time finding a straight answer regarding the $10,200 relief that can applied to my unemployment benefits I received in 2020. For the record I have not filed my taxes yet, I just have everything put into the software. My question is if I already had entered the my received benefits from 1099-G prior to the new unemployment relief being passed, do I have to go back and change the amount I received by deducting $10,200 or I do leave the amount the way it was turbo tax automatically makes the deduction? Thank you for any help

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Relief

The TurboTax program will automatically calculate the exclusion.

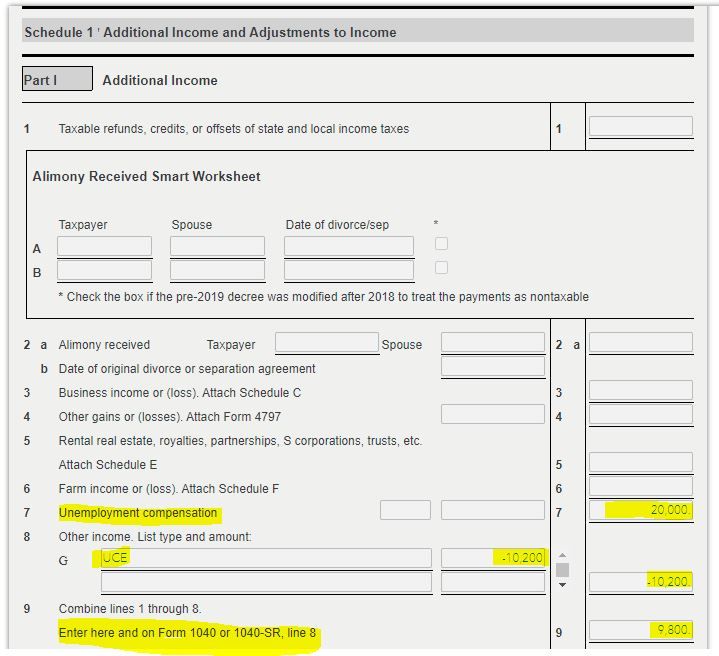

The exclusion is reported on Schedule 1 Line 8 as a negative number. The unemployment compensation received is on Line 7 of Schedule 1. The result flows to Form 1040 Line 8.

Click on Tax Tools on the left side of the screen. Click on Tools. Click on View Tax Summary. Click on Preview my 1040 on the left side of the screen.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Relief

Always enter forms EXACTLY as you receive them....because that is what the IRS is also receiving from the issuer of the document.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Relief

Leave your 1099-G entry alone, as you should have entered the 1099-G exactly as printed. Go to the very end of the "personal income" tab and click DONE, then work it through to your 2020 income summary. On that income summary screen you'll see the amount you reported for unemployment on the 1099-G. Below you'll see "Other Income or Loss" with a negative amount for your unemployment compensation. That negative amount will not exceed $10,200.

As for the forms, you'll see it labeled as "UCE" on line 8 of the SCH 1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Unemployment Relief

thank you for the help

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

NikiB

Level 1

sbschad19

New Member

victoria1957-ve

New Member

lishlou25-5

New Member

ruiz-24

New Member