- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Turbo Tax won't let me e-file because it keeps kicking me back to how our names appear on the...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax won't let me e-file because it keeps kicking me back to how our names appear on the Deductible Home Mortgage Interest Worksheet. How do I fix this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax won't let me e-file because it keeps kicking me back to how our names appear on the Deductible Home Mortgage Interest Worksheet. How do I fix this?

In your saved PDF copy of your return, look at your Home Mortgage Interest Worksheet. Is your name and SSN correct? If Married Filing Jointly, both names may be shown, with the SSN of the Primary Taxpayer.

If not, type '1098' in Search area, then click on 'Jump to 1098'.

EDIT your 1098.

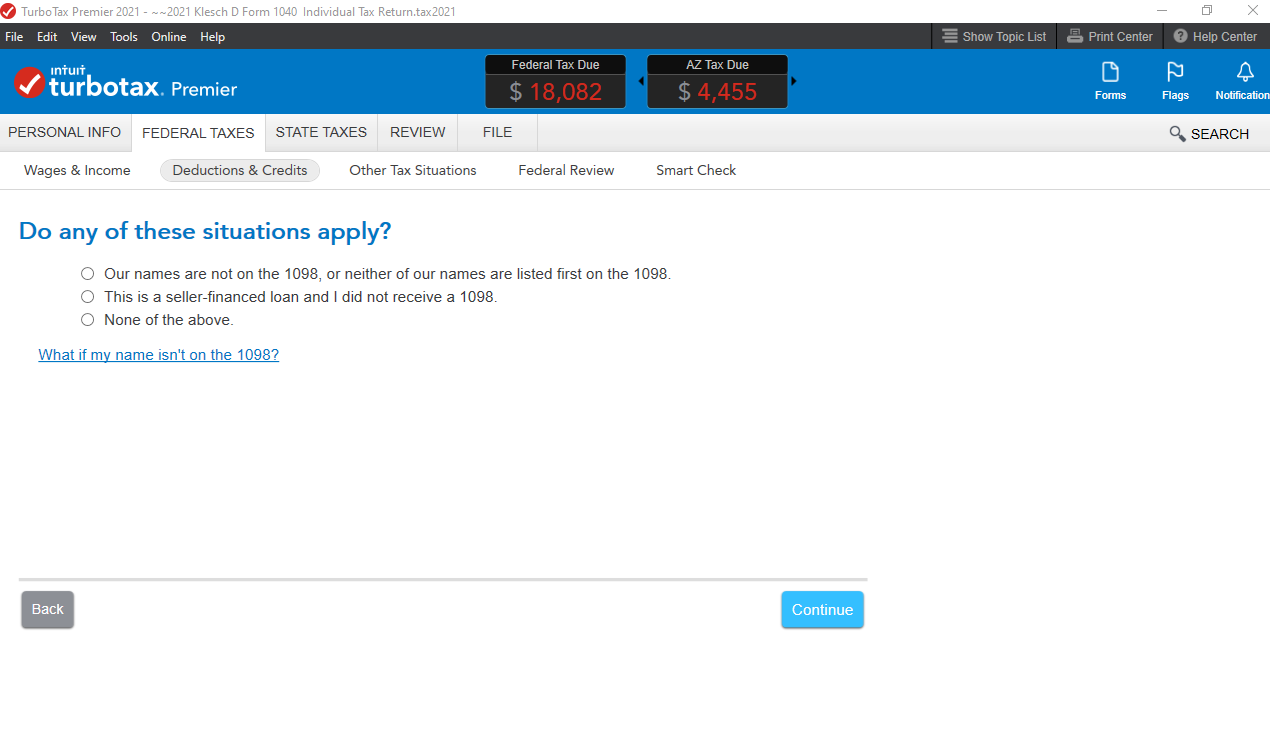

Did you choose an option on the page 'Do any of these situations apply?' if your name(s) are not on the Form 1098 (or not listed first on the 1098).

If everything seems correct, perhaps your error is related to something other than the names? If you can give more info about your error, we'll try to help.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax won't let me e-file because it keeps kicking me back to how our names appear on the Deductible Home Mortgage Interest Worksheet. How do I fix this?

This is a known issue for anyone who sell home and buy a new home with mortgage over 750,000, I have several dozens of friends hitting the same error. however turbo tax doesn't admit this is an error. It happens 3 years in a row now, they said by 2/17 the form will be ready but it's 2/18 now.

I'm not sure if worth waiting tt to fix this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Turbo Tax won't let me e-file because it keeps kicking me back to how our names appear on the Deductible Home Mortgage Interest Worksheet. How do I fix this?

Thank you for sharing this information. Our team has been working to resolve an error message for the form availability of the Deductible Mortgage Interest Worksheet after the original date expected. We apologize for the delay and inconvenience this has caused. This should now be resolved. Please do try the return in Review and see if it will now pass without flags and allow you to file.

- If you have the desktop version of TurboTax, please be sure it updates when you launch the program.

- If you have TurboTax Online and it still gives this error message, please sign out of TurboTax, clear your cache and cookies, or try another browser, then sign back in and take it through Review. Please see this Help article for clearing your cache and cookies. Clearing cache and cookies in your browser

The message:

- "Deductible Home Mortgage Interest Wks: This form has not been finalized for returns with two or more mortgages and limited mortgage interest. We expect this form to be available after February 17th."

Please do not report both homes on one Form 1098; they should each be reported on their own form.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kmjpaj9

New Member

rhub424

New Member

azachary1999

New Member

scattershot001

New Member

just_4me54

New Member