- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Tax Year 2020 - Put back of RMD taken early in the year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020 - Put back of RMD taken early in the year.

The Stimulus bill passed in late March of 2020 included tax relief for retirees. Required Minimum Distributions (RMDs) were suspended for the year 2020. If you had taken money out of your IRA account earlier in the year, you were allowed to return the money back to the original plan you took the cash from to avoid paying any taxes on it. You had to return the money by 8/31/20.

That is my situation. I took $10,000 out in January of 2020 and then put the $10,000 back into the same account in early August of 2020. Fidelity handled the transaction to ensure the put back of the cash was coded correctly. They said the return of funds would be shown as a “IRA contribution” on Form 5498 and would be a deduction to taxable income since the original withdrawal of the $10,000 would show up as taxable income on Form 1099-R. And that agrees to the tax forms I recently received from Fidelity. The $10,000 is part of the taxable income shown on 1099-R and Form 5498 shows rollover contributions of $10,000 on line 1 of that form.

Here is my problem with entering this into TurboTax. First some information on me. I’m 74 and have income from pensions and social security. And, in a normal year, take my RMD as required. I do not have any “earned income”. Also, the $10,000 was taken out of and put back into an IRA Rollover account, not a Traditional IRA account.

So, in TurboTax, I go to “Retirement and Investments” and then into “Traditional and Roth IRA Contributions”. The first page has you indicate if this is a contribution to a “Traditional IRA”, a “ROTH IRA” or “None of the Above”. Since, in my case, this is a contribution to an IRA Rollover account, I check “None of the Above”. No luck. Doing that immediately backs you out of the input screens.

Since that didn’t work, I thought I would try to fool the system and indicate the $10,000 was a contribution to a Traditional IRA. Many screens later, TurboTax finally tells me that my IRA contribution is not permitted because I do not have any earned income. In fact, TurboTax tells me I have made an “Excess Contribution” and will owe a 6% penalty of $600 on it.

So how and where do I enter this $10,000 contribution to an IRA rollover account in TurboTax?

Thanks for your help.

Tom

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020 - Put back of RMD taken early in the year.

OK, this is Thomas S.

TurboTax has informed me that this situation is going to be handled on IRS Tax Form 8915. That form will not be available until 02/18/21 at the earliest. The IRS must be revising the form to handle the special situations that occurred in 2020 due to suspension and, in some cases, repayment of RMDs. Hope this information helps others in this situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020 - Put back of RMD taken early in the year.

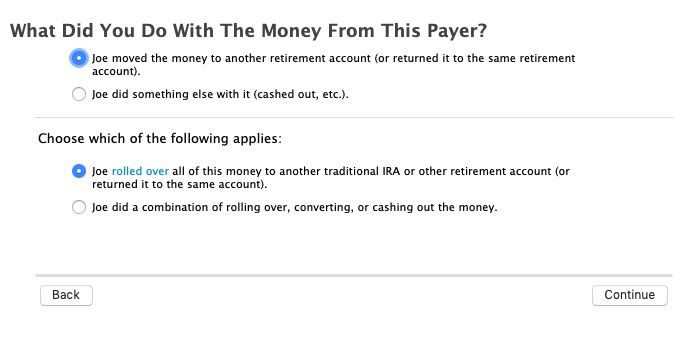

First, a return of the RMD is a *rollover* and NOT an IRA contribution. Nothing goes in the IRA contribution section at all.

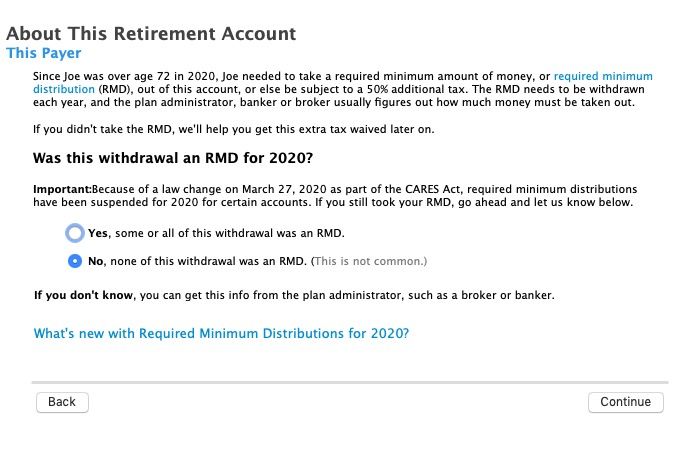

Second, you enter the 1099-R and if the RMD question comes up, you MUST check the box that says "No, none of this withdrawal was a RMD" which it wasn't since there was no RMD inn 2020.

Then answer the rollover questions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020 - Put back of RMD taken early in the year.

Champ,

I think you have put me on the right track. Mine return is a bit more complicated though since the taxable income shown on the my 1099-R is made up of two components. One component is the return of the $10,000 IRA withdrawal I had taken earlier in the year and the other piece is the amount of ROTH conversions I chose to do in 2020. When I try to input all this on the TurboTax screens you have so kindly shown in your reply, the TurboTax software says I need two 1099-Rs to report all these transactions. It recommends that I manually split my original 1099-R from Fidelity into two 1099-Rs for input purposes. I can easily do this. Just hope the IRS follows what I'm doing. And I really wonder why TurboTax support said this would have to be reported on Form 8915.

Anyway I want to thank you for your informative reply. I think your answer points people in the proper direction for reporting this kind of transaction.

Tom

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020 - Put back of RMD taken early in the year.

@Thomas S wrote:

Champ,

I think you have put me on the right track. Mine return is a bit more complicated though since the taxable income shown on the my 1099-R is made up of two components. One component is the return of the $10,000 IRA withdrawal I had taken earlier in the year and the other piece is the amount of ROTH conversions I chose to do in 2020. When I try to input all this on the TurboTax screens you have so kindly shown in your reply, the TurboTax software says I need two 1099-Rs to report all these transactions. It recommends that I manually split my original 1099-R from Fidelity into two 1099-Rs for input purposes. I can easily do this.

Anyway I want to thank you for your informative reply. I think your answer points people in the proper direction for reporting this kind of transaction.

Tom

You are correct. TurboTax cannot do two destinations on a single 1099-R.

Make two 1099-R's exactally the same except for the box 1 and 2a amounts for the rollover and conversion.

If there was any box 4 withholding then apply that to the taxable conversion.

Be sure that if the RMD question is asked you check that "none of this was a RMD".

For the rollover say that it was all moved to another account of the Roth conversion in the bottom box.

For the conversion say that you did a combination of things and enter the Roth conversion amount into the bottom box.

Unless there was box 4 withholding the IRS only receives the numbers from the 1040 form lines 4a & 4b.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020 - Put back of RMD taken early in the year.

Thanks Champ for your help as I have the same situation.

However, this adds another problem. I drew funds from a second account to pay the IRA back from previous withdrawals. Now I have 1099-B showing a significant capital gain. Can I avoid paying tax on that capital gain since it was all rolled into the IRA account?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year 2020 - Put back of RMD taken early in the year.

@David501 wrote:

Thanks Champ for your help as I have the same situation.

However, this adds another problem. I drew funds from a second account to pay the IRA back from previous withdrawals. Now I have 1099-B showing a significant capital gain. Can I avoid paying tax on that capital gain since it was all rolled into the IRA account?

Since money is fungible (meaning one dollar is the same any any other dollar and it does not matter which pocket you take it form) - if you took a RMD and then paid the same amount of money back because it is COVID related, then where the dollars came form is irrelevant.

It is the retirement amount RMD dollars that were put back - how you obtained the dollars to put back is a separate transaction totally unrelated to the RMD rollover. You simply enter in the TurboTax 1099-R section that non of the distribution was a RMD because it was not and you rolled it over.

Your separate transaction to obtain the money must be reported as a separate unrelated transaction that might have it's own tax consequences.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

mharwood021

New Member

bk1999

Level 1

42Chunga

New Member

user26879

Level 1

tinajcksn

New Member