- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Spouse Traditional IRA Contribution

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse Traditional IRA Contribution

Hi, my spouse and I are filing jointly this year. I have earned income and my spouse does not. Both of us contributed $6000 each to traditional IRA and then converted to Roth IRA (total we contributed $12000).

Since my income exceeds the limit for tax-deduction, all of our contributions are not tax-deductible. I am assuming all of the $12000 contributions are not taxable as well since we are using post-tax dollars to contribute. However, the turbo tax shows that $6000 out of $12000 contribution is taxable.

Can someone help me navigate this issue? Thanks a lot.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse Traditional IRA Contribution

After investigated a bit, I found that the issue is that I wrongly enter 6000 in "Outstanding Rollovers" ("Enter any outstanding 2020 rollovers and recharactizations that were not completed until 2021") for both of us in "Wages & Income" section. I thought it was about how much we rollover to Roth IRA.

Anyway, problem solved. Thanks for the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse Traditional IRA Contribution

Where do you see the contribution as taxable?

I assume that you have at least $12,000 of taxable compensation in order to make the contributions.

(Taxable compensation is generally wages that you worked for - W-2 or net self-employed income minus the deducible part of the SE tax and any self employment plan contributions, but can include commissions, certain alimony and separate maintenance, and nontaxable combat pay ).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse Traditional IRA Contribution

Yes my AGI income is way above $12000.

Turbotax says it is taxable in both deduction page and Federal Review page.

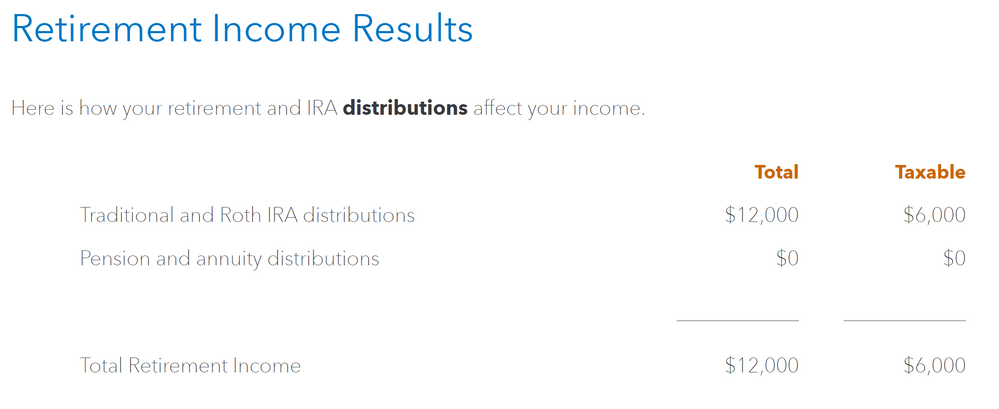

In Deduction Wrap Up step, see image

In Federal Review page, "...your taxable IRA distributions of $6,000..."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse Traditional IRA Contribution

After investigated a bit, I found that the issue is that I wrongly enter 6000 in "Outstanding Rollovers" ("Enter any outstanding 2020 rollovers and recharactizations that were not completed until 2021") for both of us in "Wages & Income" section. I thought it was about how much we rollover to Roth IRA.

Anyway, problem solved. Thanks for the help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Spouse Traditional IRA Contribution

AGI does not matter, Taxable "compensation" does. That is W-2 wages or net self-employed income usually.

However, you screenshot suggests that perhaps when entering the IRA contributions both were entered for the same spouse.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tcondon21

Returning Member

simoneporter

New Member

curlytwotoes

Level 2

VAer

Level 4

VAer

Level 4