- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, min...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

I've updated the desktop software (Deluxe plus State) as of 2/7/22. What a mess!!!

Originally I entered two different lines containing cash donations totaling over $4K. Completed both the Fed and my state (KS) program. Notice when I went to up to the top left corner and selected Forms that the "Errors" stop sign lit up with a red asterisk next to 1040/1040SR Wks. Scrolling down revealed the issue was on line 12b. Line 12a shows the standard deduction of 27,800. The next line appearing in the center between lines 12a and 12b defaults to my contribution total. Line 12b automatically populates with 300 in red with a yellow highlight. I am filling Married Filling Jointly. The directions on Line 12a declare that if MFJ then enter $600. If I manually change Line 12b from the red colored "300" to "600" it will stick until I run the final Analysis after the FED and State portions. (It will be okay after just running the FED Review portion alone). Then it changes back to 300 and the error is logged.

There is a difference in the tax I pay for both the FED and State based upon the answer to Line 12b is "300" or "600".

I can not get around this error manually.

I've read all of the pertinent posts I can find.

So maybe the error lies in the final "REVIEW" section where "Analysis" if found. That runs a check on both FED and State and causes the error again

Turbotax needs to fix this or explain to me how to get around it Please.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

I am having the same problem as above. I still get an error message when I enter 600.

What is the proper amount if MFG standard Deduction?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

For the 2021 tax return using the Married Filing Joint filing status, you are allowed to deduct up to $600 in cash contributions to charity without claiming itemized deductions.

If you are using the Married Filing Joint filing status AND using the standard deduction:

As you go through your Federal return and you have entered your charitable contributions, you will not see any additional questions regarding your inputs. If your state return also allows you to deduct charitable contributions, then the amounts you entered will be taken into account on your state return.

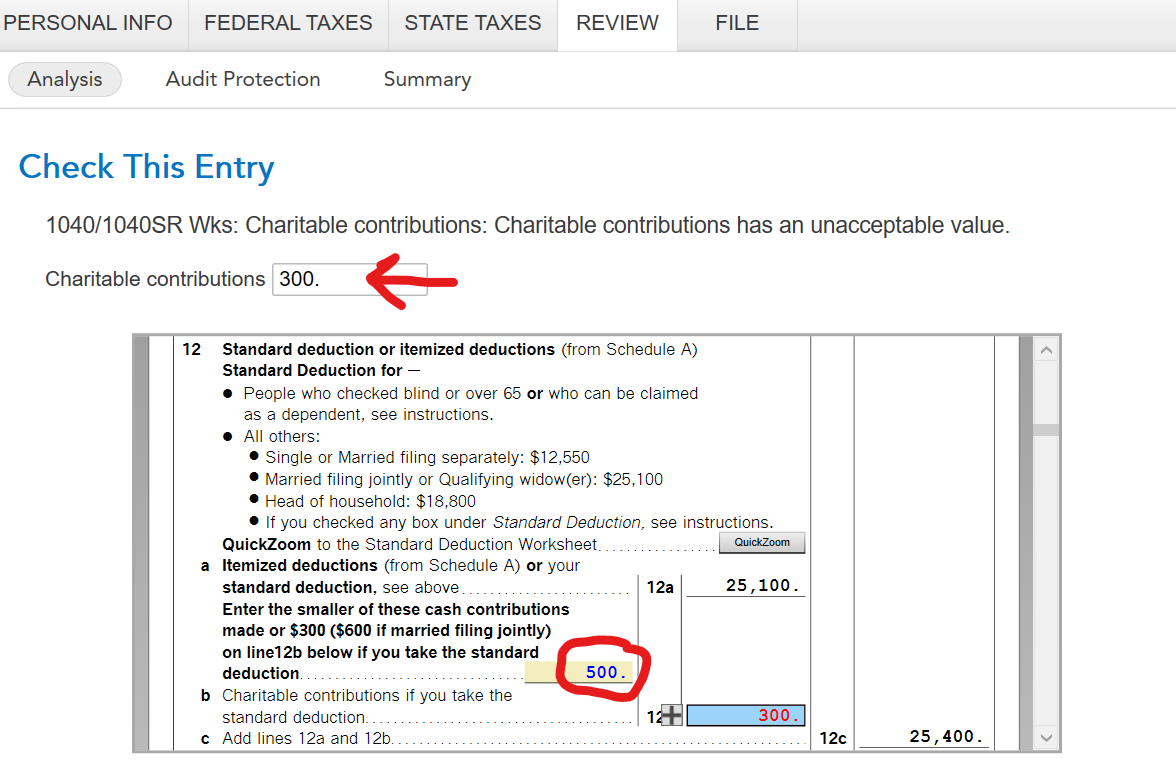

After you have finished your state return and you are getting ready to file, when you run the final Review, you will probably see this message:

1040/1040SR Wks: Charitable Contributions: Charitable contributions has an unacceptable value

You will also see a place at the top of the screen for Charitable contributions with '300' in the box. Below that box, you can see your Form 1040 line 12a which shows the amount of your cash contributions that you already entered.

If your line 12a is greater or equal to $600, enter '600' in the box at the top of the screen.

If your line 12a is less than $600, enter your line 12a amount in the box at the top of the screen.

After changing the input at the top of the screen to the correct value, proceed through any other errors that may pop up and then move forward to file your return. It is very important that you do not revisit any other section of your return before you file or the change may not be retained or able to be changed a second time.

See the screenshot below for reference:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

I have tried everything but deleting my charitable contributions. if I delete them, I dont have documentation for the state taxes that give a tax credit for certain donations.

I suppose i will have to force the 600 in the forms as someone else noted. Turbo-tax needs to fix this.

LE

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

Yes, you may also use the following procedure if you are getting an error message:

Please return to the Deductions & Credits section, scroll down to "Charitable Donations" and DELETE any cash entries you made there.

(NOTE: Some states allow you to Itemize Deductions when taking the Standard Deduction on the Federal Return. To include cash charitable donations as an Itemized Deduction on your STATE return, you can enter the donations as "Items" select "I'll value them, select "Other intangible property" enter the description as CASH, since it was and the amount as the value.)

Go back through the review. The program will ask you for your charity donation again although it may not be until after the state return is finished, at the END of the FINAL REVIEW. (After the "Tax Summary for 2021" screen)

Enter the amount up to 600 Married Filing Joint.

Unless your cash donations are limited by your income, this procedure (listing cash as items) will give you the same result on your state return as entering under cash donations.

The Tax law allows a Taxpayer to claim Charity Donations on their Schedule A or, if using the Standard Deduction, on their 1040 line 12b as an addition to their Standard Deduction amount.

This amount can be up to 600 for Married Filing Joint, or 300 for all others.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

yes, this will work. However, it is still a kludge. When will you really fix the bug?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

Thank you, AnnetteB6, but this is still a kludge. When will Intuit fix the bug? Also, as I commented before, Intuit used to give the details on the updates so we could see exactly what changed and whether or not there was something that affected us. My career in engineering management and my MBA finance courses are showing!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

Did exactly what TT keep saying to get around their "glich"

1. Deleting to Charitable deduction - will allow you to claim the $600 for " married couples taking Standard deduction). Wen you "Set charitable Deduction done" and claim the amount $600 under the Cares Act prompt. This will only work for Federal Tax return. You will notice on your State Return Charitable will be $0

2. However, when you do your State Tax TT will show $0.00.

What I did was under Forms Look for the State itemize deduction form" . Add your state charitable deduction amount. This seem to work....

I have not filed yet...hoping TT will do the proper software change

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

TT MUST FIX THIS GLITCH! Nearly all customers are having this issue. I have the same issue. Married filing jointly. Cash charitable contributions with receipts greater than $600. Standard deduction taken. Easy calculation: my Line 12b deductible amount is clearly $600. But TT figures $300. Clearly a programming error that needs to be fixed. Same rule in 2020, except maximum deduction was $300. Seemed to work fine for 2020. Why the huge problem for 2021? I cannot file an accurate 2021 return using TT. That should concern TT.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

I got a TT download on Tuesday and it looks like issue was resolved. Reenter charitable deduction (mainly for State Tax); did TT check - passed.

Verified by doing a TT Preview: On Fed Tax Got Standard Deduction + $600.00

Try see if you got the download!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

PS the difference from Tax 2020, Has to do with the Cares Act that increased deduction for Married/Standard deduction/with charitable over $600.

Earlier this year, TT program was flagging this deduction and changing it back to $300 for those taking Standard Deduction.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

Thank you for the update. I am waiting until the 4th of March for my next attempt, since the 2116 form is supposed to be available on the 3rd. Ron

- « Previous

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

teewilly1962

New Member

jwicklin

Level 1

djpmarconi

Level 1

user17550205713

New Member

rtoler

Returning Member