- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, min...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

How do I do that process using the disk version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

@l405585 wrote:

How do I do that process using the disk version?

To remove the error I went into Forms mode and deleted the Charitable Organization Worksheet. Then on the Form 1040 Worksheet for Line 12b removed the $300 amount so Line 12b is now blank (empty).

Going back to Step-by-Step I completed the Deductions & Credits section without entering anything for a charitable donation and click on Done with Deductions. Continuing through the screens until landing on the screen labeled Charitable Cash Contributions under Cares Act, I entered $600. Continued through Final Review without error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

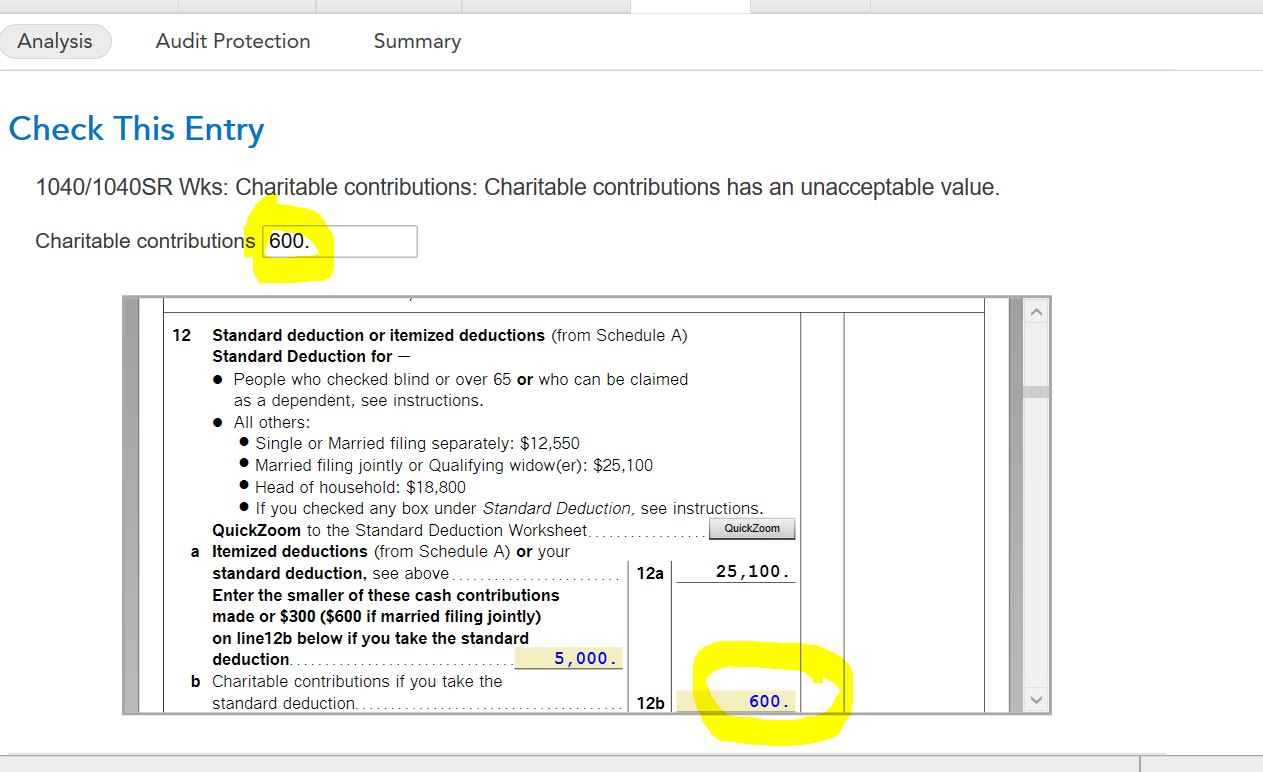

This does not appear to work with Turbo Tax loaded from CD.

Did exactly what you did enter 600 on line 12b.

However when you perform the Federal Tax check for error....software changes it back to $300.00 and you get a error on return !

Hopefully TurbTax can do a update

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

Waiting for update

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

@chinga52 wrote:

This does not appear to work with Turbo Tax loaded from CD.

Did exactly what you did enter 600 on line 12b.

However when you perform the Federal Tax check for error....software changes it back to $300.00 and you get a error on return !

Hopefully TurbTax can do a update

Did you see this? It is for the TurboTax desktop CD/Download editions.

To remove the error I went into Forms mode and deleted the Charitable Organization Worksheet. Then on the Form 1040 Worksheet for Line 12b removed the $300 amount so Line 12b is now blank (empty).

Going back to Step-by-Step I completed the Deductions & Credits section without entering anything for a charitable donation and click on Done with Deductions. Continuing through the screens until landing on the screen labeled Charitable Cash Contributions under Cares Act, I entered $600. Continued through Final Review without error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

I went through this very process; the $600 remained but the return still would not transmit. Error reads:

"The Intuit Electronic Filing System is having difficulty recognizing the data in the return you are sending. Make sure your Turbo Tax program is up-to-date: Go to the Online menu and select Check for Updates. If you still can't transmit your return, go to www.support.turbotax.com for a solution or workaround. In some cases, you may need to file this return by mail. -FAILED_VALIDATION - There is an update available for you version of Turbo Tax. Before you can file electronically you'll need to get this update. To do this, go to the online menu and select Check for Updates." Spent 60 minutes with Turbo Tax Help on the phone before they just dropped my call. I have checked for updates about 10 time and each time am told my software is up to date. I even ran a brand new return for which I was charged another $20 for the state e-file (same result) This is obviously a software issue that Turbo Tax needs to fix NOW!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

If you entered any Charitable Donations under "Deduction & Credits" delete those entries.

Next you can go through the Step by Step and change the number to 600

Be sure the picture of the form does not have the number in red, click on the picture of the form if necessary

OR go to Forms, Change Line 12b on the 1040/1040SR Wks

be sure to click on the form after changing so the number is BLUE not RED

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

I have done all of the suggested operations and the error is still present. I'm convinced there is a software issue that needs to be resolved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

In any case, it just shouldn't be this hard. What good is it to make tax returns easier if it's just replaced by software that's nearly as cumbersome?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

Just installed the 2/2/22 update and both the Federal and State returns were transmitted successfully! Finally.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

Now I've deleted all of my charitable contributions as suggested here and I'm not getting the $300 or $600 - should get $600 as MFJ GRRRRRRRRR

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

I just updated my desktop sw and the bug is there, even worse than before. Everything was ok, ran final review, and had an error - incorrect value - back to $300 in red. I went to forms, edited the 1040 worksheet, 1040 was correct, ran final review and it jumped back to the red $300.

Hello! Is anybody at home at Intuit?????

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

Yup! I'm ready to file and can't because of this bug. Is this being worked on?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

Changing the number to $600 alters my State return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Should charitable deduction for Standard Deduction Form 1040 Line 12 accept $600 for MFJ, mine only shows $300?

I'm getting the same error, I think and I've updated the desktop software (Deluxe plus State) as of 2/7/22. What a mess!!!

Originally I entered two different lines containing cash donations totaling over $4K. Completed both the Fed and my state (KS) program. Notice when I went to up to the top left corner and selected Forms that the "Errors" stop sign lit up with a red asterisk next to 1040/1040SR Wks. Scrolling down revealed the issue was on line 12b. Line 12a shows the standard deduction of 27,800. The next line appearing in the center between lines 12a and 12b defaults to my contribution total. Line 12b automatically populates with 300 in red with a yellow highlight. I am filling Married Filling Jointly. The directions on Line 12a declare that if MFJ then enter $600. If I manually change Line 12b from the red colored "300" to "600" it will stick until I run the final Analysis after the FED and State portions. (It will be okay after just running the FED Review portion alone). Then it changes back to 300 and the error is logged.

There is a difference in the tax I pay for both the FED and State based upon the answer to Line 12b is "300" or "600".

I can not get around this error manually.

I've read all of the pertinent posts I can find.

So maybe the error lies in the final "REVIEW" section where "Analysis" if found. That runs a check on both FED and State and causes the error again

Turbotax needs to fix this or explain to me how to get around it Please.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

teewilly1962

New Member

jwicklin

New Member

djpmarconi

Level 1

user17550205713

New Member

rtoler

Returning Member