- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: Short term capital gain losses from prior tax year fillings

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term capital gain losses from prior tax year fillings

Hi,

I am reposting the question aqgain as i did not get the response after my update.

Previous thread for reference- https://ttlc.intuit.com/community/tax-credits-deductions/discussion/re-short-term-capital-gain-losse...

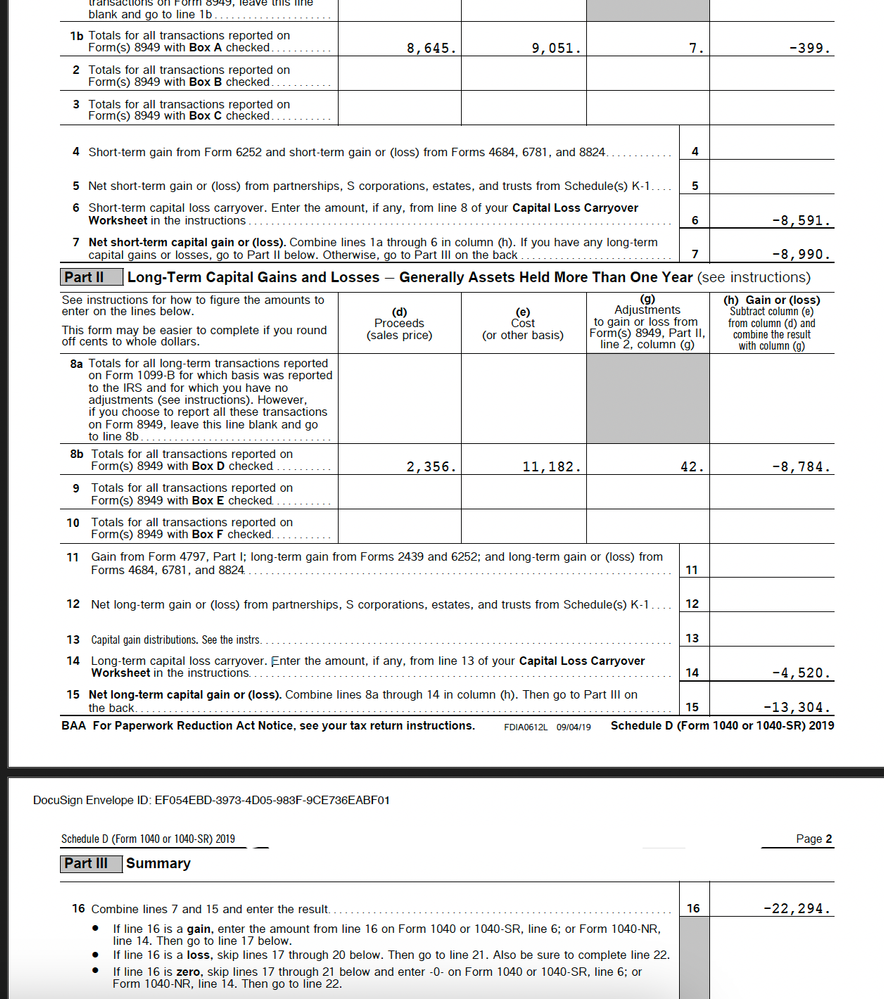

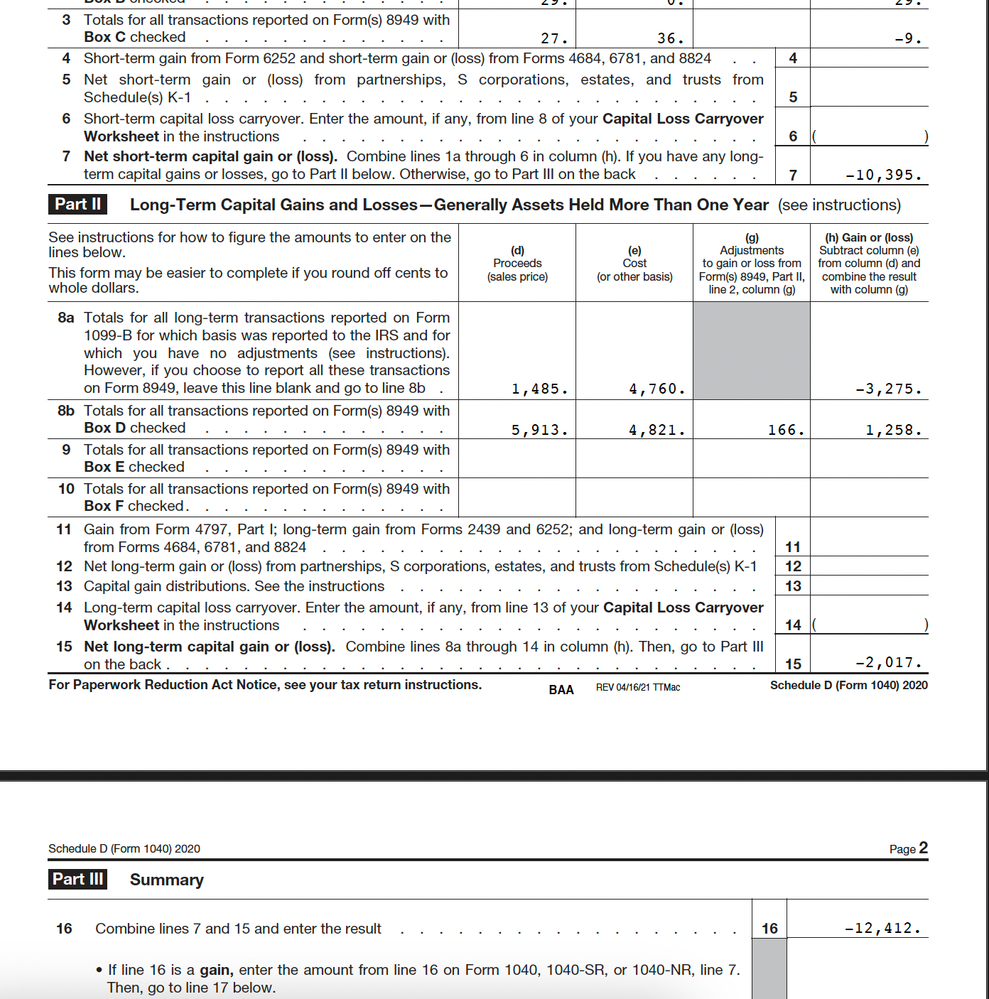

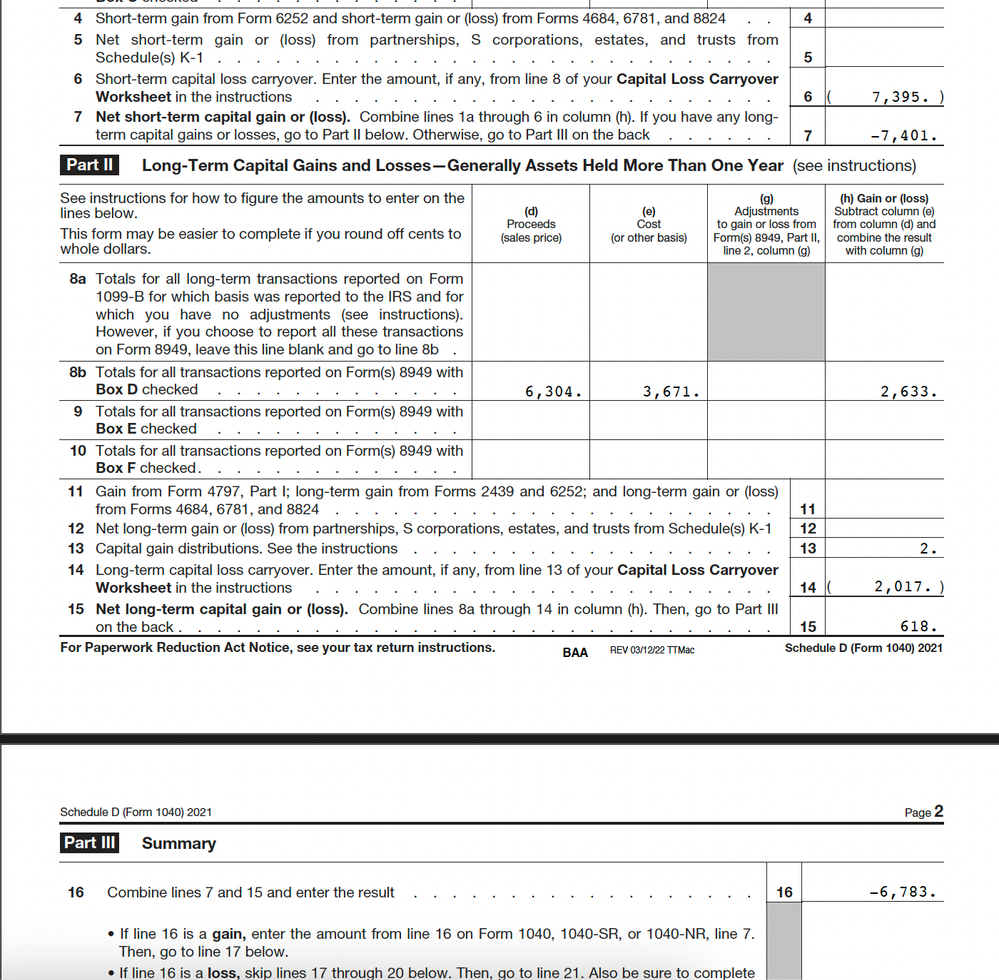

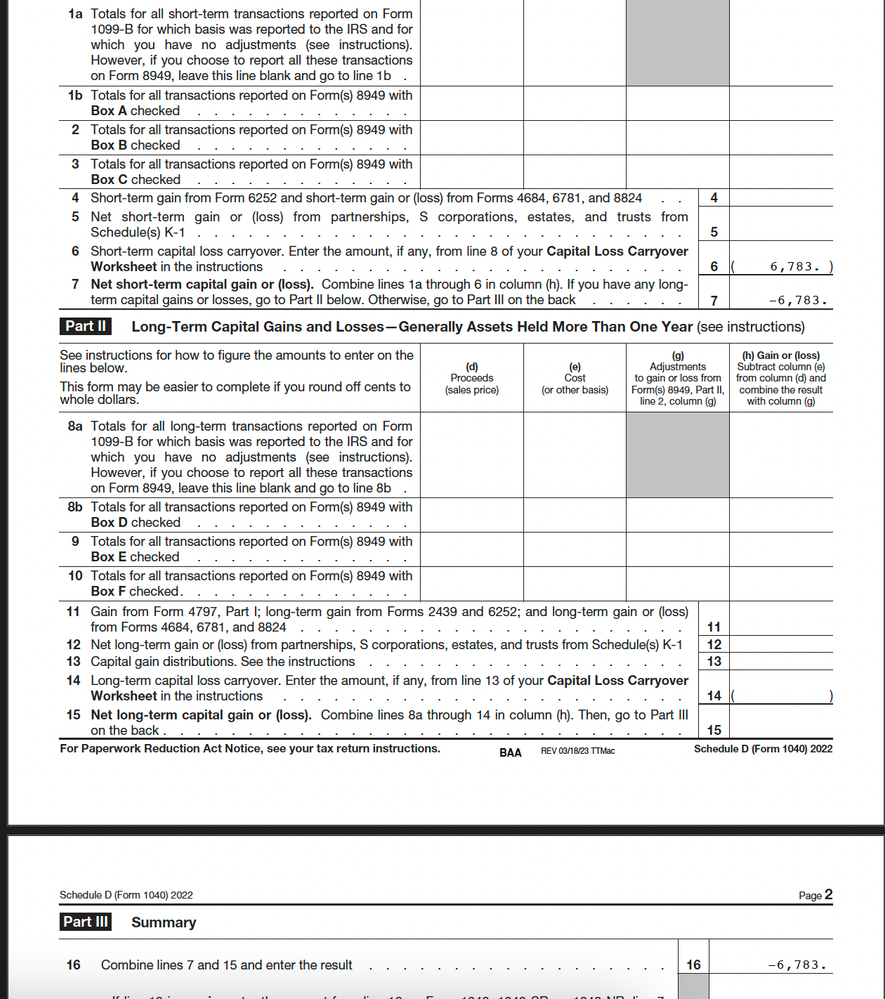

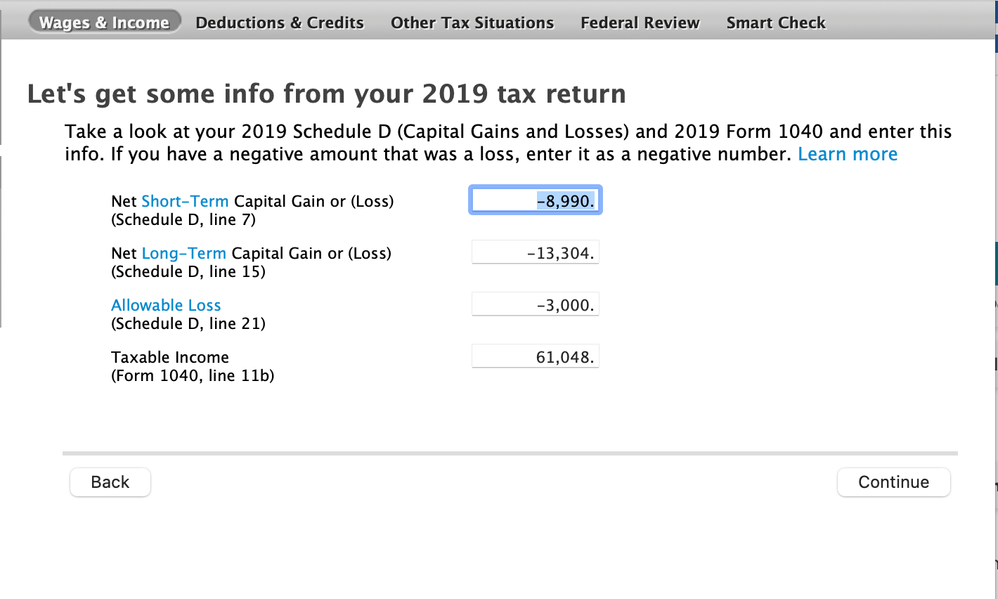

I am attaching my schedule D for 2019, 2020, 2021, 2022 see below

Tax year 2019

Tax year 2020

Tax year 2021

Tax year 2022

I have used $3000 capital gain losses in 2020, 2021, 2022 and now in 2023.

I am thinking of filing ammendment for tax year 2020 so i can carry forward the losses correctly into 2021, 2022, 2023 and beyond. Please advice if i can do the ammendment for tax year 2019 now to fix this and extension for 2023. Also what should my numbers look like for 2023 tax year filling now. Thanks.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term capital gain losses from prior tax year fillings

In your situation, I would amend only 2022 tax return showing correct carry forward from 2021. resulting in correct carry forward for 2023..

Note that you lose $3,000 of carry forward each year whether you use it or not.

But, your carryforward is going up not down because losses were more than $3,000 per year.

--

get Form 1040-X from IRS website and mail it in with your corrected Schedule D, which you can also get in fillable PDF.

Note: when you are not changing any dollar amounts on your 1040-X, you can leave all the lines 1-23 EMPTY.

Do not include your old 1040 nor your revised 1040 because the Form 1040-X reflects any changes there and becomes your new tax return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term capital gain losses from prior tax year fillings

Hi,

Can i e-file the ammendent since i e-filed for 2022 tax year using my turbo tax? I will go ahead and file the 1040-x ammendement. Should i file extension for tax year 2023 to wait in mean time and give me time and will the tax year 2023 show the corrected capital gain losses after ammendment?

-Swapnil

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term capital gain losses from prior tax year fillings

There are conflicting reports on whether TurboTax will e-File 2022 1040-X.

In any case, if you revise your 2022 tax return with TurboTax amend, then importing that file when starting 2023 return should give the desired result.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

patamelia

Level 2

patamelia

Level 2

Jdconn

New Member

barnabyf

Level 3

nstuhr

Returning Member