- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Short term capital gain losses from prior tax year fillings

Hi,

I am reposting the question aqgain as i did not get the response after my update.

Previous thread for reference- https://ttlc.intuit.com/community/tax-credits-deductions/discussion/re-short-term-capital-gain-losse...

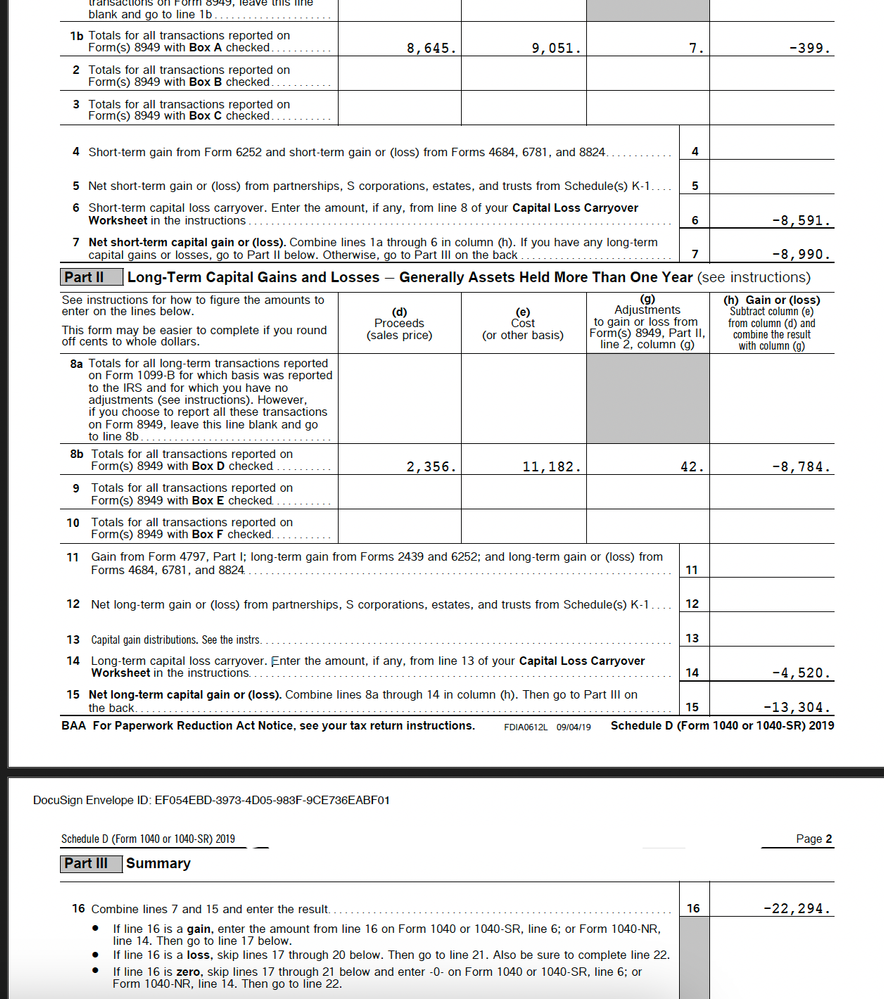

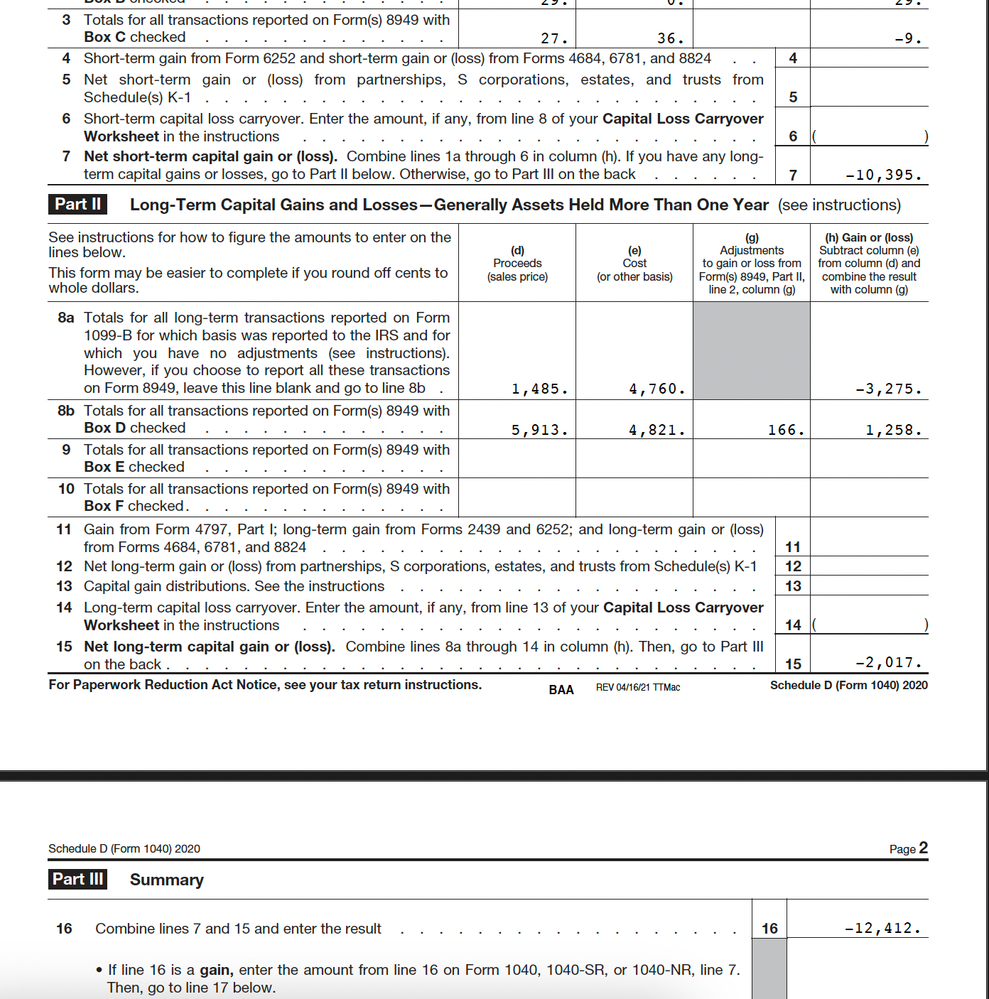

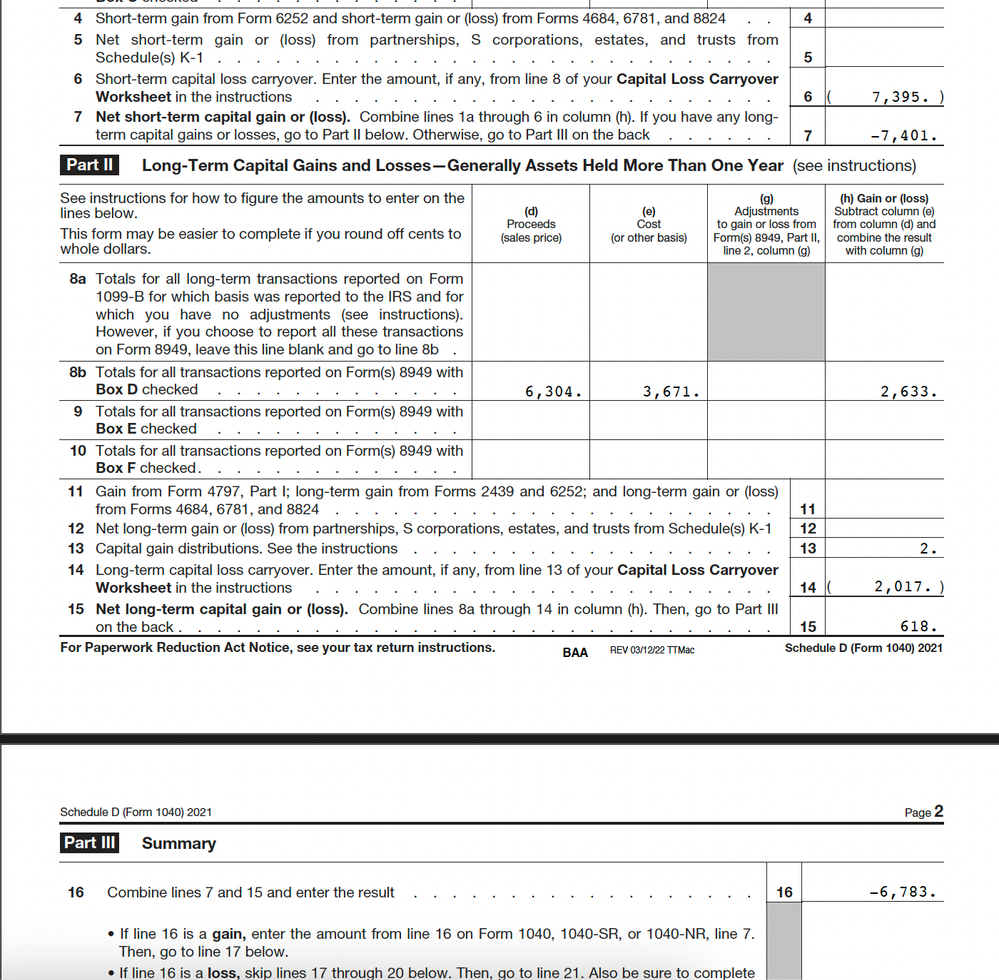

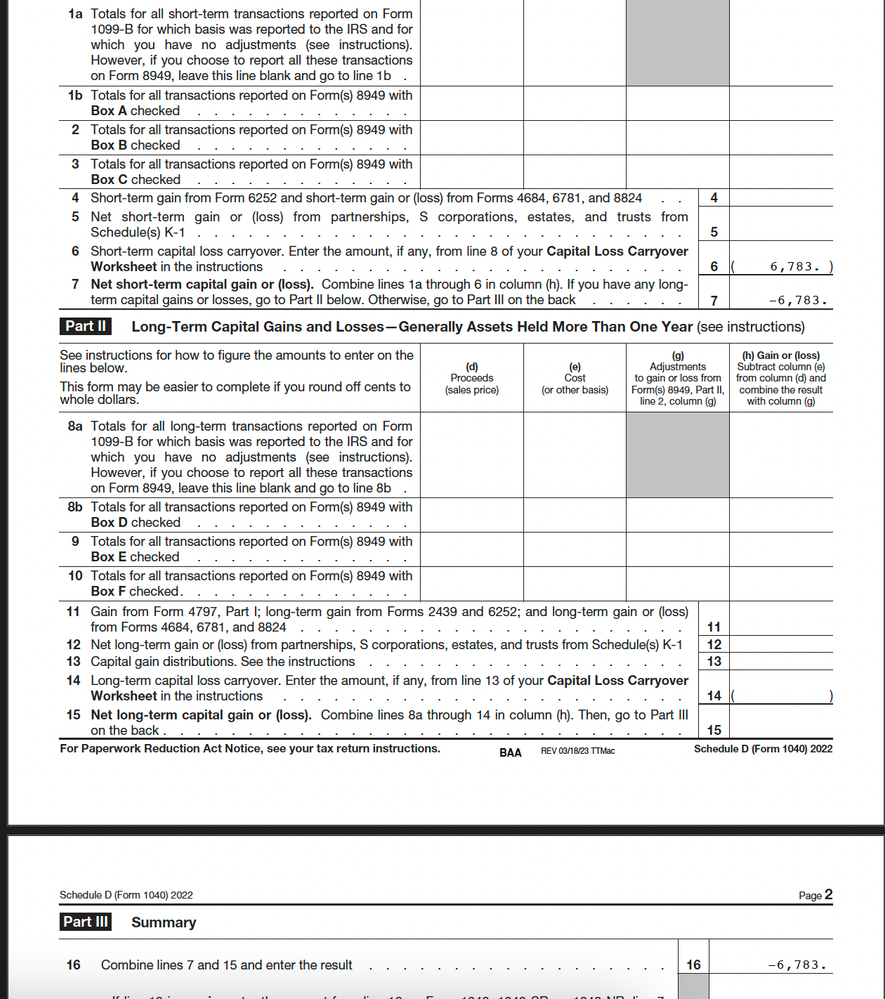

I am attaching my schedule D for 2019, 2020, 2021, 2022 see below

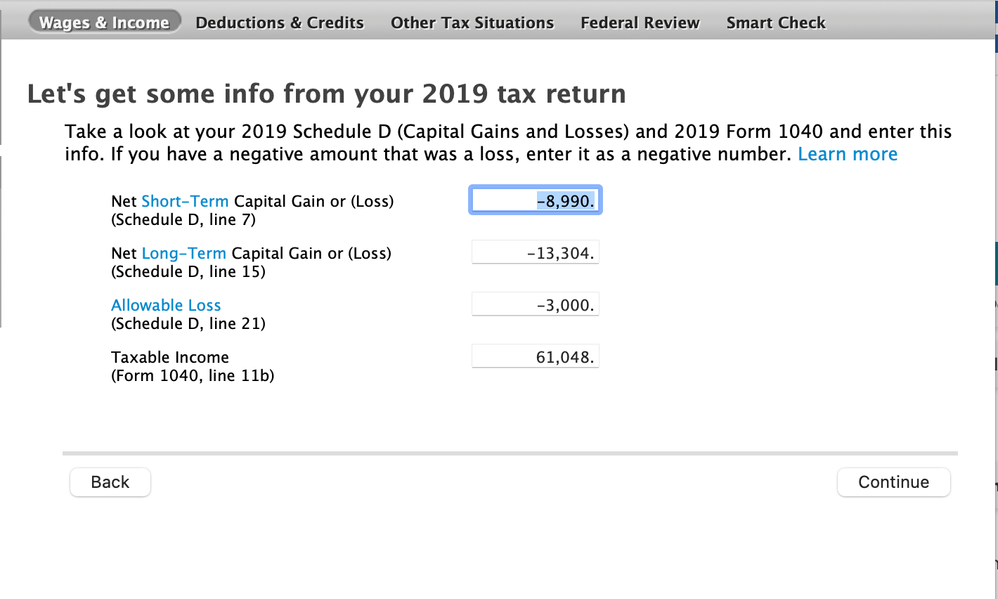

Tax year 2019

Tax year 2020

Tax year 2021

Tax year 2022

I have used $3000 capital gain losses in 2020, 2021, 2022 and now in 2023.

I am thinking of filing ammendment for tax year 2020 so i can carry forward the losses correctly into 2021, 2022, 2023 and beyond. Please advice if i can do the ammendment for tax year 2019 now to fix this and extension for 2023. Also what should my numbers look like for 2023 tax year filling now. Thanks.

March 24, 2024

10:16 AM