- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Re: retirement & Investment contribution credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

retirement & Investment contribution credit

My retirement contribution credit last year was 612.00 for the amount of 1224.00. This year my credit is 138.00 for the amount of 1380.00. Why is the credit so much less this year?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

retirement & Investment contribution credit

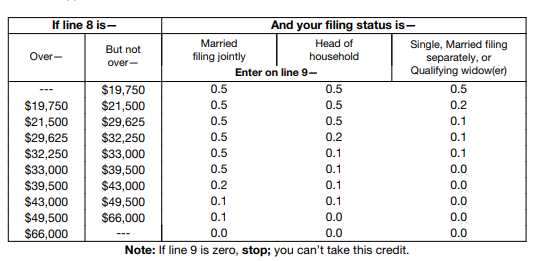

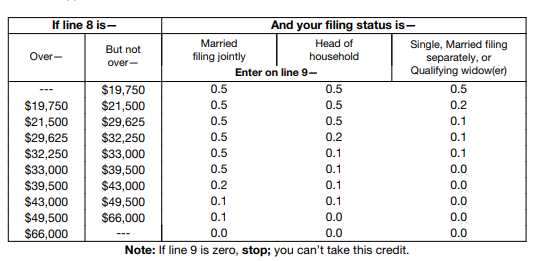

Your credit amount depends on your adjusted gross income that is reported on your Form 1040- the amount of the credit is 50%, 20% or 10%. This could explain the difference- as last year you qualified for the 50% credit and this year you had the 10%. See below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

retirement & Investment contribution credit

Your credit amount depends on your adjusted gross income that is reported on your Form 1040- the amount of the credit is 50%, 20% or 10%. This could explain the difference- as last year you qualified for the 50% credit and this year you had the 10%. See below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

retirement & Investment contribution credit

Thank you.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

shani20902tt

New Member

taxdean

Level 4

user17664993119

Returning Member

techynld

New Member

godspropy

New Member